Zinger Key Points

- Is Bitcoin headed for a major correction? Expert weighs in.

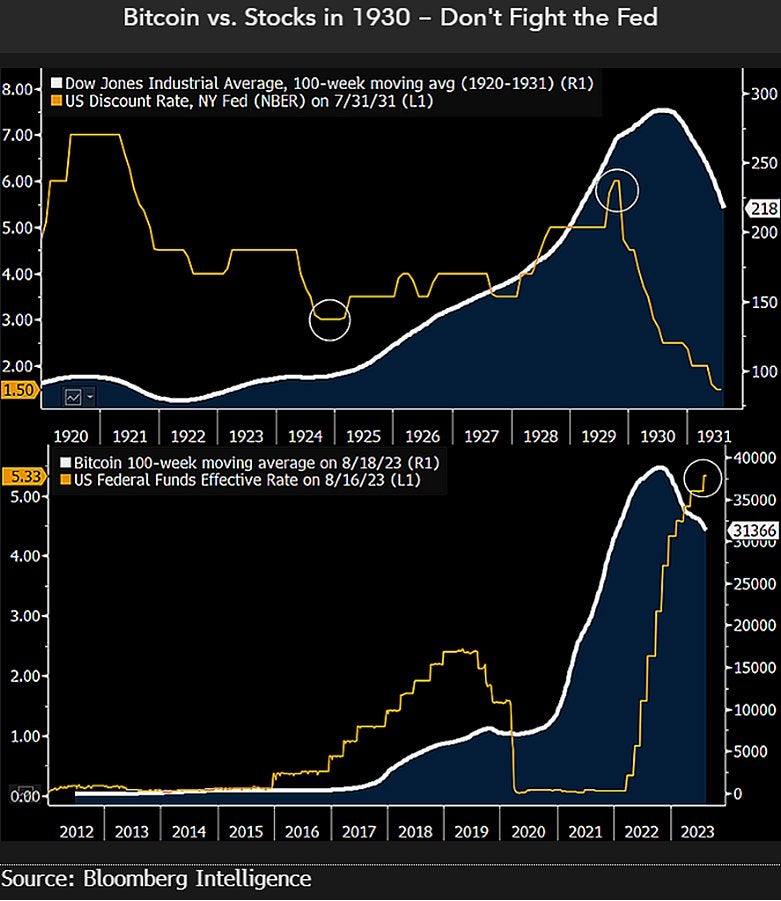

- Bitcoin's price action mirrors 1930 Stock market crash.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Bloomberg analyst Mike McGlone drew parallels between Bitcoin's BTC/USD current trajectory and the stock market crash of 1930.

In a series of tweets, McGlone highlighted the similarities between the two, suggesting that Bitcoin's performance might be echoing the patterns of one of the most significant financial downturns in history.

McGlone referenced statistician and entrepreneur Roger Babson, who had cautioned about soaring equity prices well before economist Irving Fisher's infamous 1929 declaration of a "permanently high plateau."

Also Read: Bitcoin Fractal Repeats: Prepare For A Rally To $60,000, Says Analyst

McGlone's analysis suggests that the Federal Reserve's current stance aligns more with Babson's warnings.

The Bullish Side: Technological Advancements And The Federal Reserve's Role

Despite the cautionary tone, McGlone also highlighted some bullish aspects.

He drew attention to the revolutionary technologies of the era, parabolic price movements, and rampant speculation, all of which Bitcoin shares with the stock market as it approaches its 1929 zenith.

However, a notable distinction exists: the Federal Reserve Bank of New York began slashing rates in the fourth quarter of 1929 in response to plummeting equity prices, a move contrasting with today's scenario.

Read Next: The Altcoin All-Star: Which Coin Will Make You Richest Before Bitcoin Halving?

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.