Zinger Key Points

- Options trading and increased sentiment data, the new additions on the Stocktwits platform.

- CEO Rishi Khanna believes its platform is not only for experienced traders but also for novice traders in options trading.

- Wall Street veteran Chris Capre is going live April 9 at 6 PM ET to reveal a short-term strategy that just returned 195%—in the middle of a crashing market.

Stocktwits, a social media service for investors and traders, added options trading to its platform.

The company provides trading options across all asset classes including stocks, crypto, and other emerging investments.

The news comes on the heels of a record-high relationship between sentiment and options trading.

Find out more on crypto trading from the experts themselves! Meet and engage with transformative Digital Asset and Crypto business leaders and investors at Benzinga's exclusive event — Future of Digital Assets. Tickets are flying — get yours!

Options trading will be carried out through their wholly owned subsidiary and SEC-registered broker-dealer, ST Invest, LLC. The Stocktwits platform boasts more than 8 million registered users and expects to widen its user base with the addition of execution functions to even more asset classes.

“Whether you're an experienced trader or just starting out, our Options Trading platform offers an accessible and engaging experience to explore Call and Put Options,” CEO Rishi Khanna commented.

Initially, the platform was created only to encourage discussions about stocks and crypto. However, with rising interest in retail investors for trading the social platform enhanced its features with time.

Meet and engage with transformative Fintech business leaders and investors at Benzinga's exclusive event — Fintech Deal Day. Tickets are going fast — get yours!

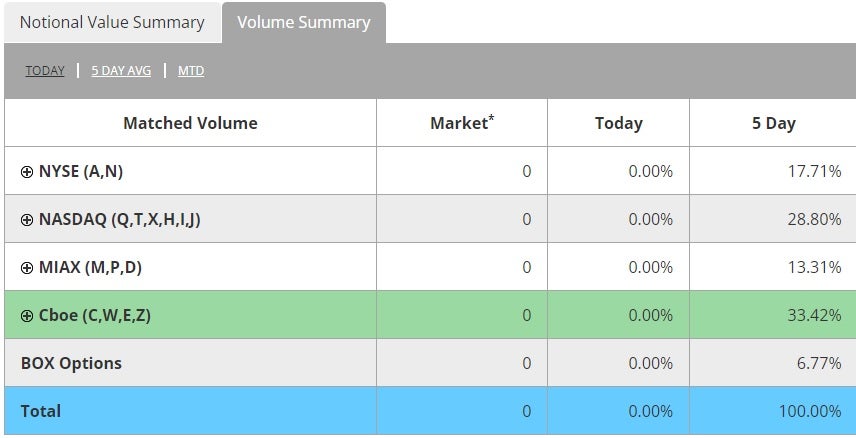

Cboe CBOE is the operator of the largest platform for U.S. equity options, among other businesses. Led by stock market volatility, options trading has attracted investors significantly. The operators reported profit in the most recent quarter, led by a surge in options trading volume. Sifma trade group data indicates an average of 41 million equity options contracts traded daily in 2022 compared to only 20 million per day in most of the years prior to the pandemic.

The below depicts the U.S. Options Market Volume Summary (updated today) as per Cboe data:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.