Bitcoin, Ethereum, and Dogecoin were all in the green at the time of publication with the global cryptocurrency market cap rising 0.47% to $1.25 trillion.

What Happened: The major cryptocurrencies carried over the positive momentum from a rally fueled by expectations surrounding Bitcoin Spot ETFs.

| Cryptocurrency | Gains +/- | Price (Recorded at 10:03 p.m. EDT) |

| Bitcoin BTC/USD | +1.95% | $34,305.63 |

| Ethereum ETH/USD | +1.77% | $1,804.04 |

| Dogecoin DOGE/USD | +0.00% | $0.07 |

Meet and engage with transformative Digital Asset and Crypto business leaders and investors at Benzinga's exclusive event – Future of Digital Assets. Tickets are flying- get yours!

Analyst Takes: Bitcoin's momentum on Tuesday was driven by the listing of iShares Bitcoin Trust on the Depository Trust & Clearing Corporation, according to Edward Moya, a senior market analyst at OANDA.

Top Gainer (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 10:03 p.m. EDT) |

| Mina (MINA) | +52.16% | $0.72 |

| Conflux (CFX) | +23.85% | $0.16 |

| Chainlink (LINK) | +9.2% | $11.32 |

"The bull case for Bitcoin is being built on hope that it might take a couple more months before we get an official spot Bitcoin ETF approval and along with next year's halving event in April."

Meanwhile, it should be noted that the iShares Bitcoin ETF was seen once again on DTCC's website after vanishing from it earlier on Tuesday, reported Blockworks.

After the disappearance of IBTC from the website some had speculated that the Securities and Exchange Commission had intervened, according to that report.

Bloomberg Senior ETF Analyst Eric Balchunas said that he wouldn't read "much into" the report that BlackRock is seeding the iShares ETF in October.

He said on X, formerly Twitter, "Seeding is typically not a lot of money just enough to get ETF going. So I wouldn’t read this as ‘omg Blackrock is buying a ton of bitcoin’ at all but more the fact they doing it and disclosing it shows another step in the process of launching."

Cryptocurrency trader Michaël van de Poppe noted that Bitcoin is "currently in an upwards trend." The Amsterdam-based analyst said on X, "Bitcoin at $31,100-31,800 is a must-hold and probably 4-8% dips are entries towards $38K."

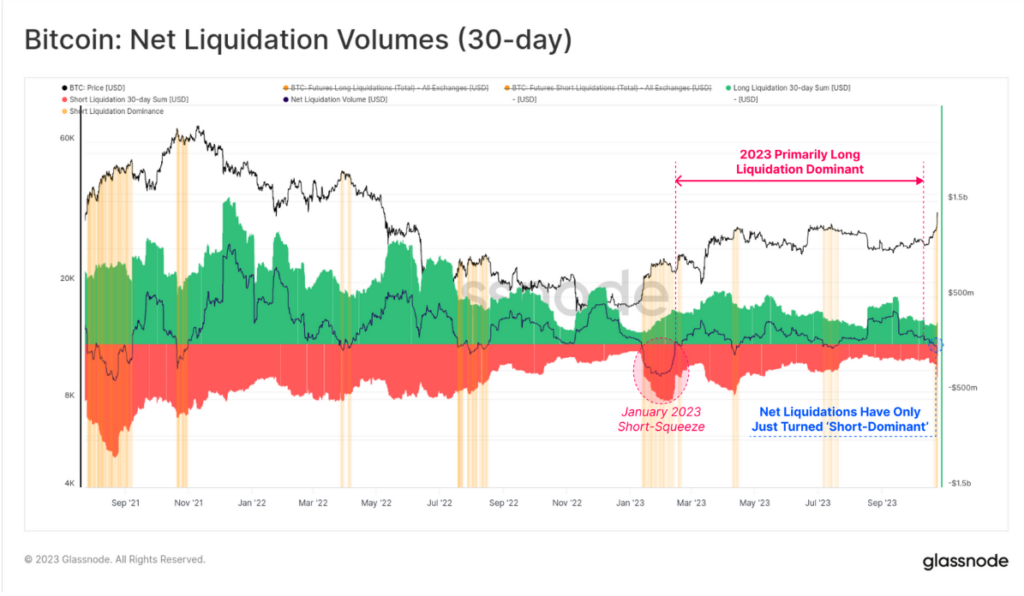

On-Chain intelligence platform Glassnode said in a newsletter that the upcoming weeks are "important to keep an eye on" as the apex cryptocurrency has found "sufficient strength" to break above several important psychological pricing levels.

Bitcoin: Net Liquidation Volumes Over 30 Days, Courtesy Glassnode

On whether the recent rally was driven by liquidations, Glassnote observed, "Whilst funding rates have spiked during the short squeezes this week, is has remained relatively low, suggesting the rally may be only partially driven leveraged speculation."

Photo by FellowNeko on Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.