Cathie Wood-led hedge fund Ark Invest has bet big on two cryptocurrency-focused stocks across its portfolio and one of these stocks has returned the firm banger returns.

Wood’s Portfolio: Both Coinbase Inc. COIN and Block Inc. SQ are among the top holdings in Ark’s flagship ETF, the Ark Innovation ETF ARKK alongside the ARK Next Generation Internet ETF ARKW and the ARK Fintech Innovation ETF ARKF.

Coinbase stake accounts for 8.8% weight in ARKK ETF, next only to Tesla’s 8.9%, with the latest market valuation of $545 million.

Will The SEC Finally Approve Long-Awaited Bitcoin Spot ETF? Ask industry experts directly at Benzinga’s Future of Digital Assets event happening in NYC on Nov. 14, 2023. Be a part of the discussions where you won’t just be a passive spectator. Don’t let this chance slip away – secure early bird discounted tickets now!

Block accounts for 5.16% of the fund at a valuation of $319.4 million. Via ARKW, Wood holds about $106 million worth of COIN and $64.3 million worth of SQ.

In ARKF, Coinbase is the top holding with a 10.86% weight and $84.1 million valuation and Block is the fourth largest holding with a 7.09% share and $54.9 million valuation.

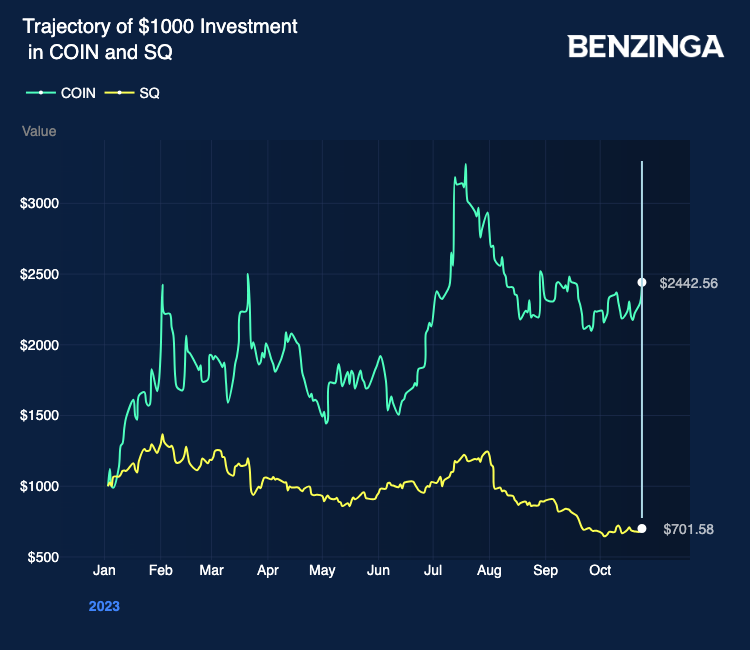

How COIN Vs. SQ Returns Compare This Year: While both Coinbase and Square are significantly down from their 2021 all-time highs, there is one stock that is returning Wood handsome returns with a recovery this year.

A $1000 investment in Square at the start of the year would have slumped to $701.58, according to Benzinga calculations, while the same investment in Coinbase would have fetched a whopping 144.2% returns, fetching $2442.56.

While Coinbase is seen as more of a pure crypto play, Bitcoin BTC/USD bull Jack Dorsey-led Square is a wider fintech player that is increasing betting on crypto.

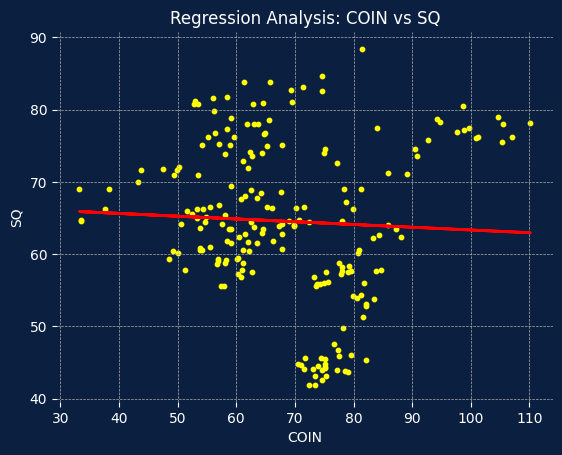

COIN Vs. SQ Correlation: The two stocks, despite having a common ground in the sector in which they function, have not been moving in tandem this year. The price actions of Coinbase and Square relation have a coefficient of determination (R2) of 0.00249, implying extremely low co-relation.

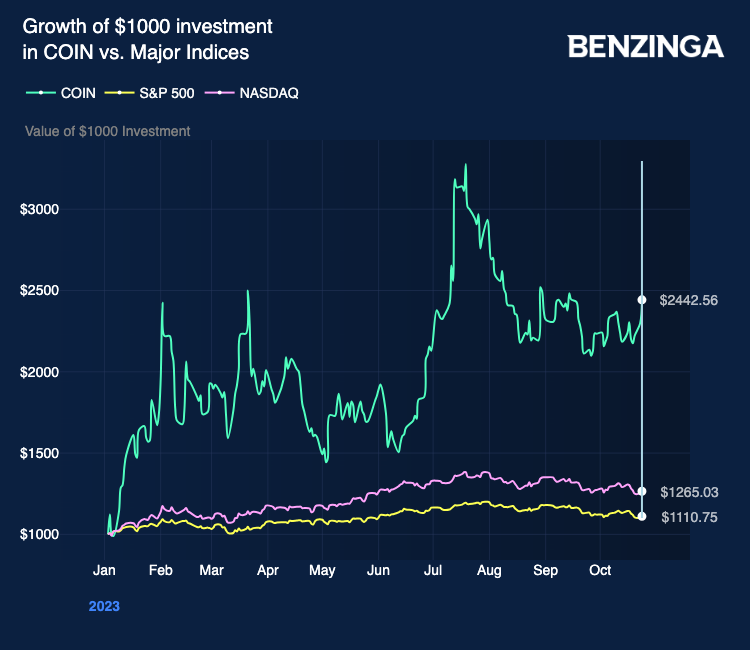

Coinbase In Review: It is not just Square that Coinbase is outperforming this year, the crypto exchange is doing significantly better than the major indices this year, including the S&P 500 and the tech-heavy Nasdaq.

$1000 in S&P 500 have grown to $1,110.75 while in Nasdaq to $1,265.03 compared to Coinbase’s return of $2,442.56.

Coinbase last reported earnings for the quarter ending June for revenue of $707.9 million, 10% above analyst estimates and a diluted EPS of -$0.42 against an estimated loss of $1.36 per share, according to data from Benzinga Pro.

The crypto company is next set to report its earnings next week on Nov. 2. Analysts are expecting it to report a loss per share of 53 cents with a revenue of $654 million, Benzinga Pro data shows.

Photo via Ark Invest.

This story is brought as part of the BZ Data Project, check out similar stories here, or give suggestions or feedback at labs@benzinga.com.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.