Zinger Key Points

- Bitcoin's surge has helped to pull Coinbase and Cathie Wood-led ARKK higher.

- TARK is an actively managed 2X leveraged ETF aiming to return 200% of the daily performance of ARKK.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

Bitcoin BTC/USD was spiking up over 2% during Wednesday’s 24-hour trading session, attempting to break above Tuesday’s high-of-day amid increased optimism that a spot Bitcoin ETF will gain SEC approval.

The apex crypto’s move higher has helped to pull Coinbase Global, Inc COIN north over the last few days. The crypto exchange has risen over 10% since Oct. 19 and appeared to be consolidating Wednesday on lower-than-average volume.

Combined with a slight rebound in Tesla’s stock, Coinbase’s move higher helped the Cathie Wood-led ARK Innovation ETF ARKK to spike higher on Monday and Tuesday.

If a spot Bitcoin ETF is approved, or leading up to that potential event, Bitcoin could continue to trek higher, which could continue to bolster ARKK.

Traders and investors looking for leveraged long exposure to ARKK can play the AXS 2x Innovation ETF TARK.

TARK is an actively managed 2X leveraged ETF aiming to return 200% of the daily performance of ARKK.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

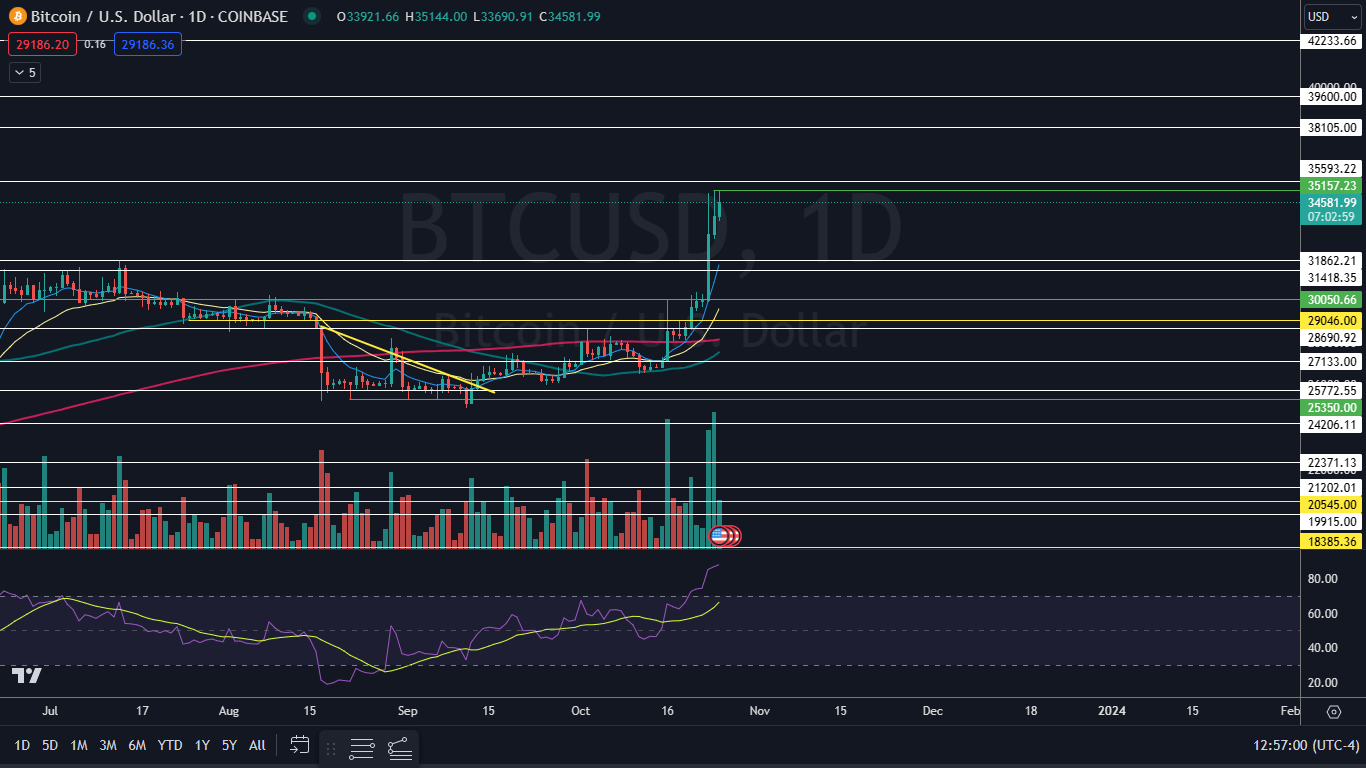

The Bitcoin Chart: Bitcoin is trading in an inside bar pattern, with Wednesday’s price action taking place within Tuesday’s trading range. The formation leans bullish in this case, because Bitcoin surged 10% on Monday, confirming its strong uptrend is intact.

Bitcoin’s most recent higher high within the trend was formed on Tuesday at $35,157 and the most recent higher low was printed at the $28,122 mark on Oct. 19, when the crypto began its ascent from back-testing the 200-day simple moving average. Because Bitcoin hasn’t formed another higher low in six days, an eventual pullback is a likely scenario.

An eventual pullback or at least sideways trading is also likely because Bitcoin’s relative strength index (RSI) is measuring in at about 87%. When a stock’s or crypto’s RSI reaches or exceeds the 70% level, it becomes overbought, which can be a sell signal.

Bitcoin has resistance above at $35,593 and at $38,105 and support below at $31,862 and at $31,418.

Read Next: Sam Bankman-Fried To Testify In Court: Crypto Market Holds Its Breath

Read Next: Sam Bankman-Fried To Testify In Court: Crypto Market Holds Its Breath

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.