Zinger Key Points

- Bitcoin's current 114% year-to-date gain may climb further, spurred by ETF optimism and Federal Reserve policy shifts.

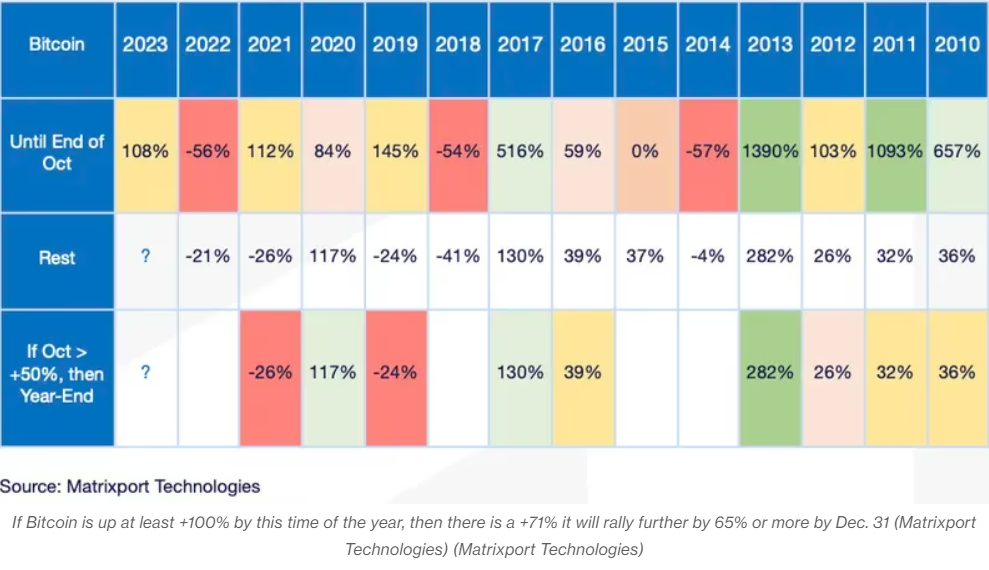

- The past 12 years show Bitcoin often rallies in the last two months after a strong performance by October.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Cryptocurrency services firm Matrixport suggests that Bitcoin BTC/USD may soar to $56,000 by year's end, as it drew parallels to its historical performance and potential future outcomes.

"If Bitcoin is up at least +100% by this time of the year, then there is a +71% chance or five in seven that Bitcoin would finish the year higher with average year-end rallies of +65%," Matrixport's Head of Research and Strategy, Markus Thielen outlined, suggesting the potential for a so-called "Santa Claus Rally" in the crypto sector during the weeks from early November to mid-December.

At the time of this report, Bitcoin's trading value has crossed the $35,000 threshold, marking a 114% increase since the beginning of the year, spurred by ETF optimism and Federal Reserve policy shifts.

Thielen projects a 65% increase by the end of the year, which would place Bitcoin's value above $65,000.

Join the conversation at Benzinga's Future of Digital Assets conference, beginning Nov. 14.

"Based on these statistics, Bitcoin continues to offer upside potential, and a +65% year-end rally would lift prices back to $56,000," Thielen says.

"Based on these statistics, Bitcoin continues to offer upside potential, and a +65% year-end rally would lift prices back to $56,000," Thielen says.

The chart above depicts Bitcoin's performance in the first 10 months compared to the last two months of the year, spanning from 2010 to 2022.

In seven of the last 12 years, Bitcoin has seen at least a 100% increase in the first ten months, with the following final eight weeks averaging a 65% rally.

“When Bitcoin is up at least +50% by the end of October, there is, on average, a 78% chance that Bitcoin will advance even more into year-end," Thielen said. "Bitcoin rallied another +68% until year-end on seven of nine previous occasions."

This analysis is based on 13 years of Bitcoin history, he added.

Read Next: SEC Charges SafeMoon Team With Orchestrating Crypto Grand Fraud

Industry titans BlackRock, DTCC, OCC, State Street, Société Générale, Hedera, Citi, BMO, Northern Trust, Citibank, Amazon, S&P Global, Google, Invesco, and Moody’s will join our Nov. 13 Fintech Deal Day and Nov. 14 Future of Digital Assets. Secure a spot here to join them

Image: Pixabay

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.