Zinger Key Points

- Mike Novogratz thinks a confluence of multiple factors has set up cryptocurrency king Bitcoin for a “wonderful story”.

- He thinks Bitcoin prices will be “significantly higher” and that the cryptocurrency could scale its old highs once again.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Galaxy Digital Holdings (OTC BRPHF) CEO Mike Novogratz thinks that multiple events are setting Bitcoin BTC/USD up for a "wonderful story," joining others who are bullish on the king of cryptocurrency.

What Happened: Novogratz thinks that the confluence of multiple events like the expectations of spot Bitcoin exchange-traded fund (ETF) approval, the U.S. Federal Reserve's rate action, and the upcoming halving event are the next three major catalysts that could drive up the prices of the cryptocurrency.

"There's a bunch of good things happening for Bitcoin. We are going to get an ETF, there's a lot of anticipation, some of that is built into the price," Novogratz told Bloomberg Television.

While multiple analysts believe the Bitcoin bull run still has legs, Novogratz says that a lot depends on his company, and BlackRock, Ark, Invesco, Fidelity and others to convince people to buy into Bitcoin ETFs once they are approved by the U.S. Securities and Exchange Commission (SEC).

Experts increasingly believe the approval could come as soon as Jan. 2024.

"The price is going to be significantly higher, especially at a time when the Fed is probably cutting rates. And so, could we go to old highs by this time next year? Of course, we could, and we could go higher," Novogratz added, underlining his bullish outlook for Bitcoin.

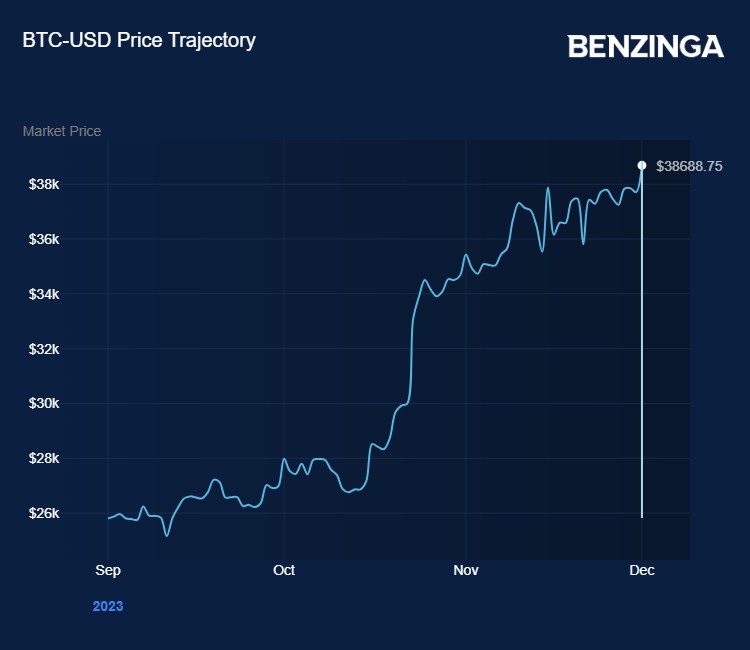

Macroeconomic factors and the anticipation of a Bitcoin ETF have driven Bitcoin prices to a year-to-date high of $38,742. Since the beginning of Sept. till Dec. 2, Bitcoin prices have surged by almost 50%.

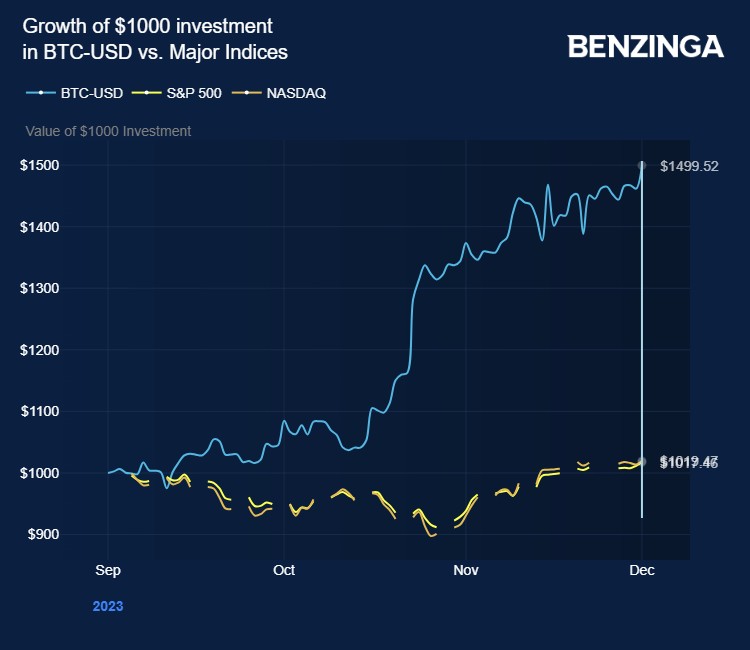

In this period, an investment of $1,000 in Bitcoin at the beginning of Sept. would now be worth $1,500.

On the other hand, a similar investment in the S&P 500 or NASDAQ indices would be worth a little under $1,020.

"We're going to have the halving next year, which means that the daily supply or inflation rate gets cut in half and so you really are setting up for a wonderful story," Novogratz added.

Bitcoin. Image by Leonid studio on Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.