The Grayscale Bitcoin Trust GBTC/USD, managed by Grayscale, is claiming bragging rights for being the first of the newly approved spot Bitcoin BTC/USD exchange-traded fund (ETF).

What Happened: CoinDesk reported on Thursday that GBTC began pre-market trading at 4 am EST, as confirmed by Jennifer Rosenthal to the publication, the head of communications at Grayscale.

This development follows the historic approval by the Securities and Exchange Commission (SEC) of the applications for spot Bitcoin (BTC/USD) ETFs. The decision, announced on Wednesday, is poised to transform the crypto and conventional finance industries.

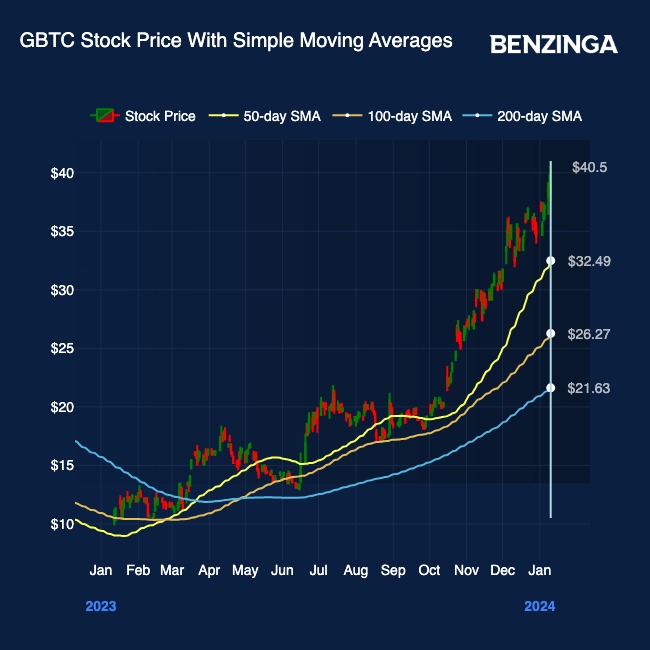

At the time of writing this article, GBTC was trading at $42.20, according to Benzinga Pro.

Among the ETFs approved were those managed by Grayscale, Bitwise, Hashdex, iShares, Valkyrie, ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity Wise Origin, and Franklin.

Why It Matters: GBTC’s early entry into the market could give it a competitive edge over the other approved ETFs. The approval of the ETFs marks a significant shift in the regulatory environment around cryptocurrencies, potentially heralding a new era of institutional investment in the crypto space.

This development is expected to momentarily impact the broader crypto market, potentially increasing Bitcoin’s adoption and mainstream acceptance.

Engineered by Benzinga Neuro, Edited by Pooja Rajkumari

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.