Zinger Key Points

- Bitcoin miner shares fell after short seller issued negative report about the company.

- Hut 8 accuses J Capital of profiting from misinformation.

- Markets are swinging wildly, but for Matt Maley, it's just another opportunity to trade. His clear, simple trade alerts have helped members lock in gains as high as 100% and 450%. Now, you can get his next trade signal—completely free.

Bitcoin miner Hut 8 HUT hit out on Wednesday against what it called “false and misleading” claims by an activist short seller regarding the company’s merger with mining peer US Bitcoin Corp (USBTC).

J Capital Research unveiled a litany of accusations against the merged companies, including the allegations that USBTC was likely going bankrupt without the merger; Hut 8 paying more than the value of USBTC’s assets; and USBTC’s co-founder and CEO being a “30-year-old used-car salesman whose history is littered with involvement in SEC-defined pump-and-dumps.”

“Ultimately,” J Capital alleged, “We strongly believe that shareholders are likely to feel the pain of being on the wrong side of an over-levered pump-and-dump, only to be left holding the most inefficient Bitcoin miner, which is unprofitable even at a Bitcoin price of over $60,000.”

Short Seller’s ‘Own Benefit’ Claim

On Wednesday, Hut 8 hit back saying the J Capital report was filled with inaccuracies, misrepresented data, speculative claims and unfounded character attacks.

Also Read: Let Bears Fret About Tech Valuations: How AI Leaders Microsoft, Nvidia And Google Can Push Higher

“The Company believes that the report was designed for the sole purpose of negatively impacting Hut 8's share price for the short seller’s own benefit, at the expense of Hut 8's shareholders, partners, and employees,” it said.

Addressing the merger, Hut 8 Chairman Bill Tai said the company’s board had “full confidence in its merger of equals, strategic plan and management team.”

And answering J Capital’s claim that it would likely have to raise at least $200 million in the near term to stay in business, Hut 8 said that it currently held 9,195 Bitcoin in reserve, with an approximate value of $390 million.

It added: “In addition to its strong balance sheet, Hut 8 is distinguished from its peers by its diversified business, as approximately 30% of its revenue was generated from fiat revenue streams as of September 30, 2023.”

Hut 8 Shares Tumble On Report

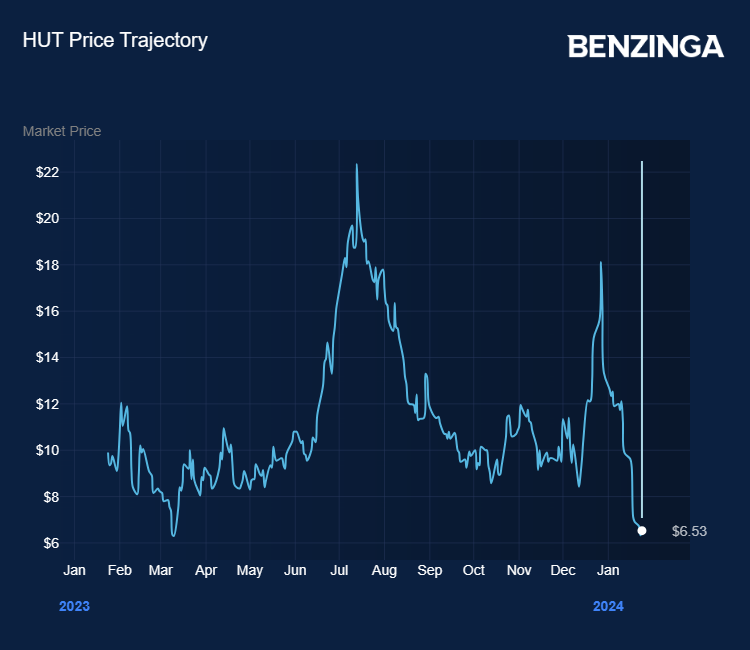

On Jan. 18, the day of J Capital’s report, shares in Hut 8 fell 23.3%. The activist investor declared at the top of the report that it held short positions on Hut 8, meaning it would profit if the shares fell.

In its statement on Wednesday, Hut 8 CEO Jaime Leverton, said: “We will not be derailed by activists who stand to profit from spreading misinformation and making defamatory character attacks.”

The company did not disclose whether it would be taking the matter or commenting further.

Now Read: AI Regulation: Did The EU Just Deliver The Future Of AI Directly Into The Hands Of The US?

Photo: Courtesy Unsplash

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.