DeFi, or decentralized finance, is a term that refers to the use of blockchain technology and smart contracts to create financial services that are transparent, permissionless, and interoperable. DeFi has been one of the most innovative and disruptive trends in the crypto space, offering new ways to lend, borrow, trade, save, and invest in digital assets. As this innovative phenomenon meshes into the mainstream world of finance and investment, ordinary investors will experience its impact.

DeFi: The Bigger Picture

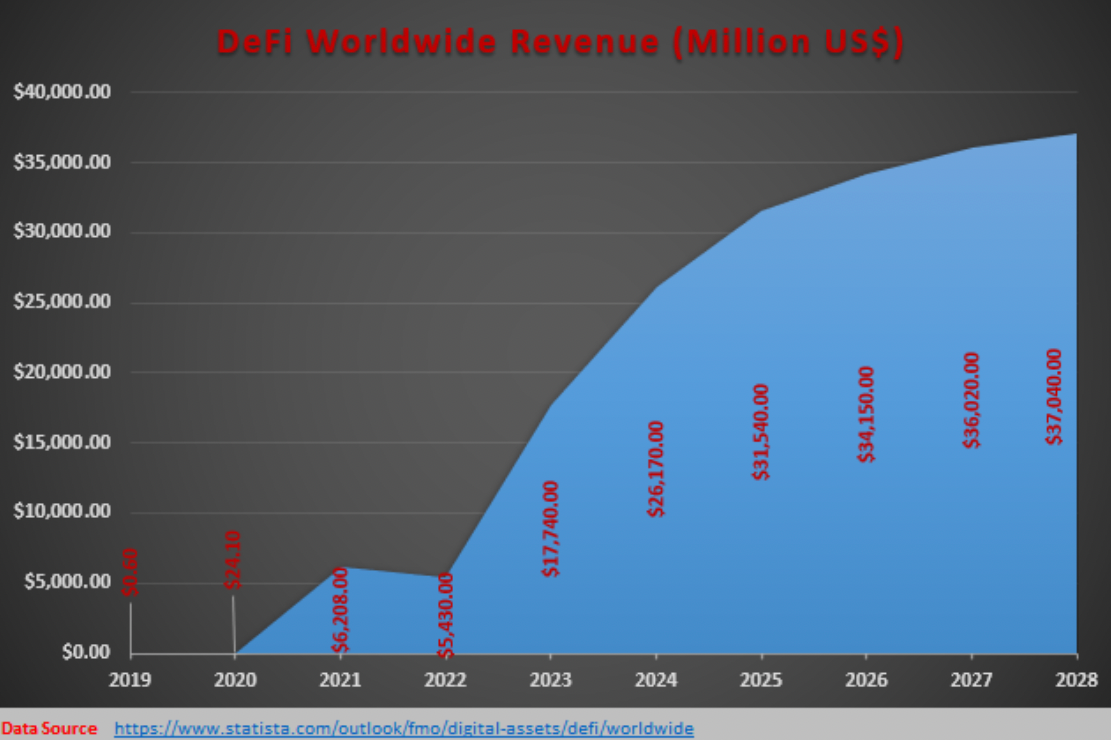

According to data available at Statista, the worldwide decentralized finance (DeFi) sector is set for substantial expansion, projecting a revenue of US$17,740.0 million in 2023, with an anticipated 15.86% annual growth rate leading to a total of US$37,040.0 million by 2028.

It’s projected that the sector will produce an expected average revenue per user (ARPU) of US$1,064.0 in 2023, reflecting the thriving economic activity in the DeFi space. As the sector evolves, the user base will reach 22.09 million by 2028, underscoring the widespread adoption of decentralized financial solutions and its transformative impact on traditional financial paradigms.

What is DeFi and why it matters

DeFi is a movement that aims to create a more open, inclusive, and efficient financial system, not controlled by any central authority or intermediary. DeFi leverages the power of blockchain technology, which is a distributed ledger that records transactions in a secure and verifiable way; and smart contracts, which are self-executing agreements that enforce the rules and terms of a transaction.

By using blockchain and smart contracts, DeFi enables anyone with an internet connection and a compatible wallet to access a variety of financial services without having to rely on traditional intermediaries such as banks, brokers, or exchanges. This means that users can have more control over their own funds, data, and identity, as well as benefit from lower fees, faster transactions, and greater transparency.

Advantages of DeFi to the World of Finance and Investing

DeFi has emerged as a groundbreaking paradigm shift in the financial landscape, revolutionizing how individuals engage with the global financial system. This innovative approach leverages a range of technologies to offer a myriad of benefits, transforming the traditional financial sector. Some of the key advantages that distinguish DeFi from conventional financial models include:

1. Accessibility: One of the significant advantages of DeFi lies in its commitment to inclusivity. Whether it’s about applying for online student loans, or looking for a crypto investment opportunity, by eliminating traditional entry barriers, DeFi opens the doors for anyone, irrespective of geographical location, income level, or credit history, to actively participate in the global financial ecosystem. This democratization of finance empowers previously excluded populations, thereby fostering a more inclusive and equitable financial environment.

2. Innovation: DeFi's decentralized nature fosters a dynamic culture of experimentation and collaboration. This environment encourages developers and financial experts to work together, leading to the creation of innovative products and solutions. This continuous innovation addresses diverse financial needs and preferences, resulting in a more versatile and adaptive financial system that can swiftly respond to changing market demands.

3. Efficiency: By leveraging blockchain technology and smart contracts, DeFi eliminates the need for traditional intermediaries. This reduction in intermediaries not only minimizes bureaucratic hurdles but also significantly lowers transaction costs. Consequently, participants in DeFi can enjoy higher returns on their investments and a streamlined user experience, making financial interactions more efficient and cost-effective.

4. Resilience: DeFi's foundation on decentralized networks enhances the system's resilience to external threats. Decentralization mitigates the risks associated with censorship, manipulation, and corruption, ensuring the continued functionality and security of the financial ecosystem. In times of crisis, where centralized systems may falter, DeFi's decentralized architecture provides a robust and reliable alternative, instilling confidence in the stability of the financial infrastructure.

It’s clear that DeFi is now a transformative force that transcends the limitations of traditional finance. Its commitment to accessibility, innovation, efficiency, and resilience marks a significant departure from conventional financial models. As DeFi continues to evolve, its impact on global finance continues to grow, offering individuals newfound opportunities and contributing to the development of a more inclusive and resilient financial landscape.

DeFi Unleashed: Transforming Finance and Investments

DeFi has ushered in a transformative era within the financial industry, introducing innovative products and processes that challenge and redefine traditional investment and financial services. By decentralizing key functions, DeFi has disrupted the conventional roles of intermediaries, including banks, credit unions, and savings and loan associations. In this paradigm shift, DeFi not only brings efficiency and accessibility but also offers novel financial instruments that empower users in unprecedented ways.

Some of the pioneering products and processes that highlight DeFi's ingenuity include:

1. Lending and Borrowing Platforms: DeFi lending and borrowing platforms stand out for enabling users to engage in crypto asset transactions with variable interest rates. What sets them apart is the elimination of the need for credit checks or collateral, providing a more inclusive avenue for individuals to access financial resources without traditional barriers.

2. Decentralized Exchanges: Thanks to decentralized exchanges, users can now directly trade crypto assets without relying on brokers or custodians. By cutting out intermediaries, DeFi enhances the speed and efficiency of asset exchanges, fostering a more direct and transparent market environment.

3. Asset Management Platforms: DeFi asset management platforms redefine how users create and manage portfolios of crypto assets. The absence of intermediaries and fees streamlines the process, allowing users to have greater control over their investments while reducing costs associated with traditional asset management services.

4. Derivatives Platforms: DeFi derivatives platforms provide a decentralized avenue for users to trade futures, options, and other contracts based on crypto assets. The absence of clearing houses and margin calls simplifies the trading process, making it more accessible to a broader range of participants.

5. Stablecoins: Stablecoins, a unique facet of DeFi, are cryptocurrencies pegged to fiat currencies or other assets. Offering stability and liquidity in the volatile crypto market, these coins serve as a reliable medium of exchange, mitigating the inherent volatility associated with many other digital assets.

6. Insurance Platforms: DeFi insurance platforms introduce a decentralized marketplace for users to buy and sell insurance policies covering various risks. Whether safeguarding against smart contract failures or hacking attacks, these platforms provide a novel approach to risk management without traditional bureaucratic hurdles.

7. Prediction Markets: DeFi prediction markets empower users to engage in speculative activities, betting on the outcomes of future events such as elections, sports, or weather. This decentralized approach to prediction markets enhances transparency and fairness, offering a novel avenue for users to express and act on their insights.

In essence, DeFi's groundbreaking products and processes underscore a fundamental shift in how financial services are conceptualized and delivered. By removing barriers and intermediaries, DeFi not only enhances efficiency but also fosters a more inclusive and accessible financial ecosystem. As these innovations continue to evolve, the decentralized finance and investment landscape redefines the core principles of traditional finance, offering users unprecedented control and flexibility in their financial endeavors.

Staking a Claim: DeFi's Influence on Finance and Investments

In the highly-fluid world of finance and investments, DeFi has staked its claim as a dynamic force, ushering in new possibilities and challenges for investors. This innovative approach not only harmonizes with the broader investment ecosystem, but also introduces distinctive advantages that reshape traditional investment paradigms.

Let’s talk about some of DeFi’s capabilities, and their value proposition to ordinary investors.

Within the DeFi landscape, investors experience the real possibility of higher returns. DeFi platforms distinguish themselves by offering competitive interest rates and lower fees, a result of eliminating intermediaries and leveraging the network effects inherent in decentralized systems. This creates an environment where returns can surpass those offered by conventional financial institutions.

Another defining feature of DeFi is its commitment to accessibility and inclusivity. According to the U.S. Federal Deposit Insurance Corporation (FDIC), an estimated 4.5% of U.S. households were “unbanked” in 2021 – meaning, no adult in the household had a checking or savings account at any traditional financial institution. In 2022, according to figures from the U.S. Federal Reserve (the Fed), that population rose to 6%. That trend may reverse as DeFi gains traction!

These platforms open their doors to anyone with an internet connection and a crypto wallet, transcending geographical barriers, identity constraints, and financial statuses. This democratization of access ensures that investment opportunities move beyond the reach of just specific demographics, fostering a more inclusive and diverse investment landscape.

DeFi platforms also empower users with unprecedented control over their funds and data. By eliminating reliance on third parties or centralized servers, investors gain confidence in managing their assets within a secure and autonomous environment. This autonomy not only enhances transparency but also mitigates the risks associated with traditional financial intermediaries.

Diversity is a hallmark of DeFi platforms, offering a broad spectrum of financial products and services to cater to the diverse needs and preferences of investors. Whether engaging in lending, borrowing, or asset management, DeFi provides a versatile array of opportunities, allowing investors to tailor their strategies according to their unique requirements.

The commitment of DeFi to open-source development and community-driven feedback underpins continuous innovation. These platforms are dynamic and adaptive, evolving in response to the ever-changing needs of the community. This commitment ensures that investors can tap into a landscape of continually improving financial tools and services, marking DeFi as a frontier of innovation in the investment sphere.

DeFi Beyond Theoretical Use Cases

While there's a lot of theory and hypothetical information about what DeFi is, and how it might impact ordinary investors, its capabilities are real and applicable in the real world today. Here are four scenarios illustrating how DeFi products and services impact and benefit ordinary investors:

- Yield Farming for Passive Income

SCENARIO

Sarah, an ordinary investor, decides to participate in a DeFi protocol offering yield farming opportunities. She locks $10,000 worth of stablecoins in a liquidity pool. The protocol rewards her with a 10% annual percentage yield (APY) in additional tokens.

OUTCOME

After a year, Sarah earns $1,000 in additional tokens as a reward for providing liquidity. This showcases how ordinary investors can leverage DeFi protocols to generate passive income beyond traditional savings accounts or bonds.

- Decentralized Lending and Borrowing

SCENARIO

John needs funds for a home improvement project but doesn't want to go through the lengthy process of applying for a bank loan. He turns to a DeFi lending platform, where he locks $5,000 worth of Ethereum as collateral and borrows $2,500 in stablecoins with an interest rate of 5%.

OUTCOME

John completes his home improvement project, and after repaying the loan with interest, he regains his Ethereum collateral. This demonstrates how DeFi allows ordinary investors to access capital quickly without the need for traditional financial intermediaries.

- Participating in a Decentralized Autonomous Organization (DAO)

SCENARIO

Emily is passionate about a new DeFi project and wants to actively contribute to its development. She buys $1,000 worth of the project's governance tokens, giving her voting rights in the associated DAO. The community proposes a new feature, and Emily participates in the voting process.

OUTCOME

The proposal passes, and Emily's active involvement in the DAO influences the project's direction. This showcases how ordinary investors can actively shape the development of DeFi projects they believe in, participating in decision-making processes traditionally reserved only for larger stakeholders.

- Trading on a Decentralized Exchange (DEX)

SCENARIO

Mark wants to trade his Bitcoin for a lesser-known Altcoin. Instead of using a centralized exchange, he opted for a DeFi decentralized exchange. He swaps $3,000 worth of Bitcoin for Altcoin, saving on traditional exchange fees.

OUTCOME

Mark completes the trade with minimal fees, as decentralized exchanges often have lower transaction costs compared to centralized counterparts. This highlights how ordinary investors can benefit from cost-effective and efficient trading within the decentralized financial ecosystem.

In these examples, DeFi demonstrates its potential to provide ordinary investors with new avenues for investing, income generation, access to capital, active participation in project development, and cost-effective trading. While the examples showcase the potential benefits, it's crucial for investors to conduct thorough research, understand the associated risks, and adopt a cautious approach when navigating the dynamic landscape of decentralized finance.

DeFi: A Lot Delivered…and Much More to Come!

Decentralized Finance (DeFi) demonstrates the transformative power of blockchain technology, offering tangible solutions that go beyond the conceptual realm. In recent years, DeFi has introduced innovative products and services that are reshaping the landscape of traditional investment and finance. We’ve explored how these capabilities translate into real-world scenarios, providing ordinary investors with opportunities to enhance their financial strategies and actively participate in the decentralized financial revolution.

From earning passive income through yield farming, to shaping the future of projects through decentralized autonomous organizations (DAOs), DeFi is not just a theoretical concept but a game-changer in the way we invest and manage our finances. And with Artificial Intelligence (AI) only now making its entry into mainstream financial products and services, expect DeFi to further empower investors in the months ahead.

This post was authored by an external contributor and does not represent Benzinga's opinions and has not been edited for content. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice. Benzinga does not make any recommendation to buy or sell any security or any representation about the financial condition of any company.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.