Zinger Key Points

- Coinbase anticipates Q4 earnings with strong technical signals, including a bullish trend and positive momentum.

- The technically bullish scenario is marked by consistent stock price strength above key moving averages.

- Wall Street veteran Chris Capre is going live April 9 at 6 PM ET to reveal a short-term strategy that just returned 195%—in the middle of a crashing market.

Coinbase Global Inc COIN, will be reporting its fourth-quarter earnings on Feb. 15. Wall Street expects 2 cents in EPS and $823.85 million in revenues.

The company is known for being one of the leading cryptocurrency exchanges in the world. It provides a user-friendly platform that allows individuals to buy, sell, and trade a variety of cryptocurrencies, including popular ones like Bitcoin BTC/USD, Ethereum ETH/USD, and Litecoin LITE/USD.

Coinbase Stock Technical Setup

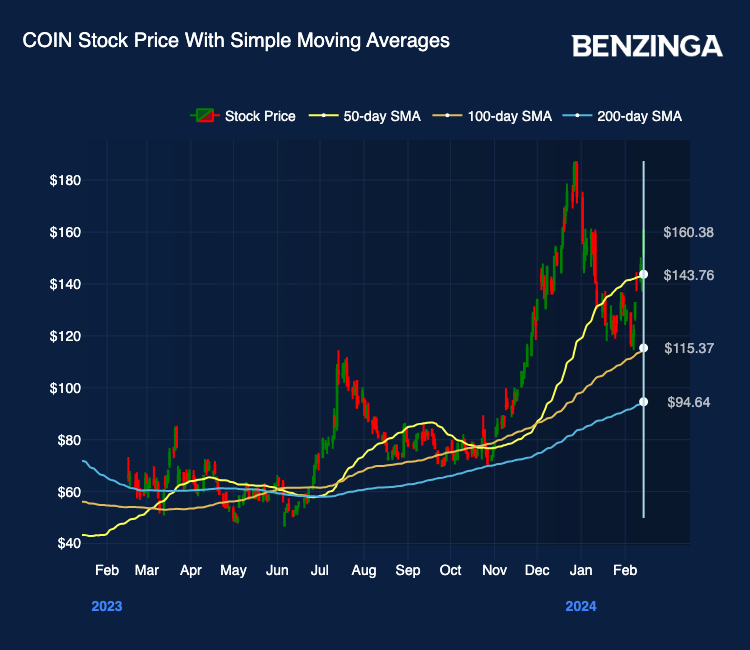

The technical setup for Coinbase stock suggests a strongly bullish trend and positive momentum.

The share price is consistently above its 5, 20, and 50-day exponential moving averages, indicating robust buying pressure and favoring future bullish movements.

Additionally, the eight-day simple moving average, 20-day simple moving average, 50-day simple moving average, and 200-day simple moving average all suggest a “Buy” signal as the stock price ($160.38) exceeds these averages.

Similarly, the eight-day exponential moving average, 20-day exponential moving average, and 50-day exponential moving average all indicate a “Buy” signal.

However, it’s worth noting that the Moving Average Convergence Divergence (MACD) is -0.73, suggesting a “Sell” signal. The Relative Strength Index (RSI) is 72.81, indicating that Coinbase Global is currently overbought.

On the other hand, the Bollinger Bands ($25) and Bollinger Bands ($100) both suggest a “Buy” signal. Investors may want to consider these mixed signals and monitor the stock closely for potential shifts in momentum.

Ratings & Consensus Estimates: Consensus analyst ratings on Coinbase stock stand at a Buy currently with a price target of $98.56.

Price Action: Coinbase stock was trading at $160.38 at the close of trading day on Feb. 14.

Read Next: Why Coinbase Shares Are On A Tear Ahead Of Earnings

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.