Zinger Key Points

- Bitcoin's rally accelerated in late 2023 on hopes of spot Bitcoin approval coming through.

- Although the rally hit a pause immediately after the catalyst materialized, the upward momentum has reaccelerated in February.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

The ongoing cryptocurrency bull market run has included both major plays like Bitcoin BTC/USD and alternative coins. The increased appetite for risk since early January has also boosted other risky investments, such as stocks related to artificial intelligence, leading the way.

So, what has caused this increased appetite for risk?

What Happened: Most cryptocurrencies peaked in November 2021 and endured a prolonged downtrend throughout 2022, marking a dismal year for most financial assets. Inflationary pressures prompted global central banks to raise interest rates, keeping investor sentiment cautious.

Scandals like the FTX fiasco, the collapse of Three Arrows Capital, and Voyager Digital‘s bankruptcy further fueled investor fear and drove them toward safe-haven assets. Regulatory concerns also loomed large.

Crypto’s Comeback: In 2023, cryptocurrency investors emerged from the crypto winter with renewed optimism. After a volatile first nine months, Bitcoin experienced a sharp upward trend in late 2023, ultimately becoming one of the year’s best-performing assets with a gain exceeding 155%. This late-year surge was largely attributed to the anticipation of a spot Bitcoin ETF launch.

Regulators approved spot Bitcoin ETFs in early January. While the immediate impact was muted, possibly due to the “buy-the-rumor, sell-the-news” phenomenon, the crypto market gradually gained momentum throughout February.

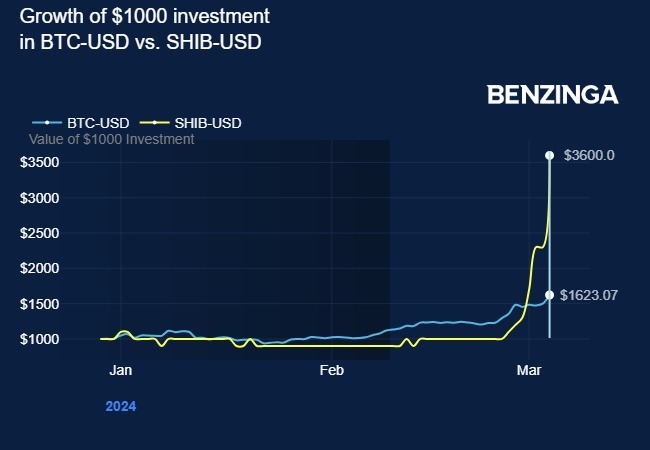

Source: Benzinga Pro

Meme Coin Performance: Shiba Inu SHIB/USD underperformed in 2023, remaining relatively stagnant until mid-February when it finally broke free from its trading slump.

See Also: How To Buy Bitcoin (BTC)

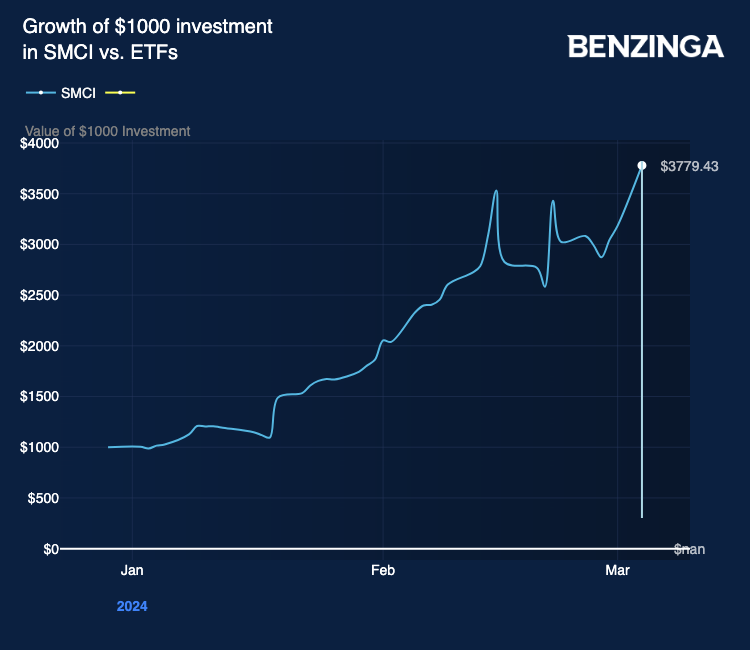

Investment Returns: With various financial assets experiencing significant growth, let’s compare the returns from a hypothetical $1,000 investment in a few high-performing options at the end of 2023:

- Bitcoin: A $1,000 investment at the end of 2023 would have yielded 0.024 bitcoins. This translates to $1,617 (based on Monday’s closing price) – a 61.7% return in two months.

- SHIB: A $1,000 investment in SHIB at the end of 2023 would have secured 100 million SHIB tokens, currently worth $3,600 (based on Monday’s closing price) – a 260% return.

- Super Micro Computer SMCI: A $1,000 investment in SMCI on Dec. 29, 2023, would have purchased 3.52 shares, currently valued at $3,780 (based on Monday’s closing price) – a 278% return.

Interestingly, Super Micro Computer, a high-flying AI stock, surpassed both cryptos in terms of returns during this two-month period.

Current Market Snapshot (as of Benzinga Pro data):

- Bitcoin: Up 5.97% at $67,457.26

- SHIB: Soared 49.63% to $0.000041

- Super Micro Computer: Rallied 18.65% to $1,074.34, driven by the news of its S&P 500 inclusion.

Image via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.