Zinger Key Points

- Fed's Bank Term Funding Program, a post-Silicon Valley Bank failure safety net, ends this week.

- BFTP's $164 billion boost to banking system helped avert a crisis, supporting risk asset gains amid tight Fed policies.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

A safety net implemented by the Fed in the wake of the Silicon Valley Bank and Signature Bank failures in March 2023 has ceased operations this week.

The Federal Reserve’s Bank Term Funding Program (BFTP) was designed as an emergency bulwark against the looming threat of a regional banking crisis, offering an additional, affordable liquidity source to eligible depository institutions.

The cessation of this program may now raise significant concerns about the future of liquidity in financial markets, potentially altering the landscape of bullish risk sentiment that has buoyed investors in the recent past.

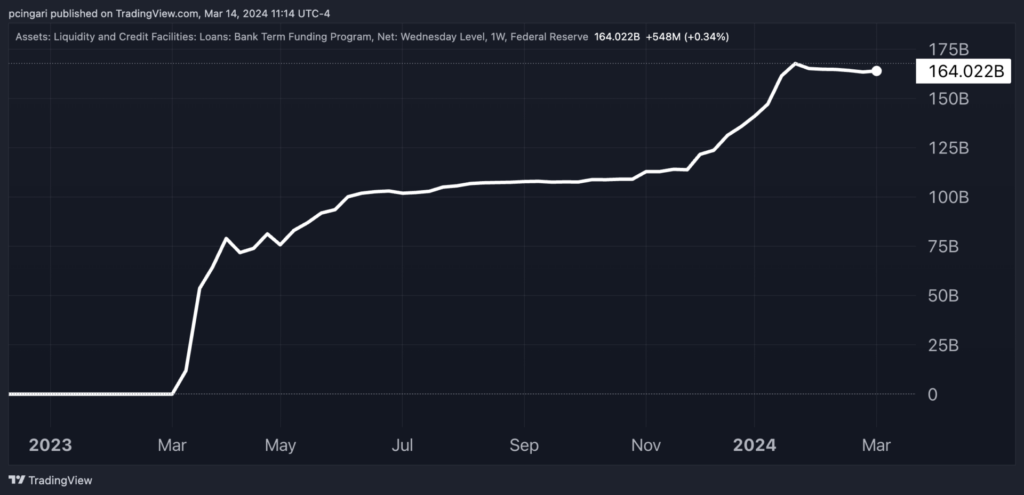

Chart: BFTP Funneled $164 Billion Into The U.S. Banking System

Market Performance Under BFTP’s Umbrella

The Fed promptly unleashed the BFTP last year in response to financial collapses to ensure that banks remained equipped to fulfill depositor demands and business loan requests.

The initiative successfully funneled $164 billion into the banking system, staving off a bank run and credit crunch risks.

For investors, the program has represented a much-needed infusion of liquidity that partially cushioned the negative effect of the Fed’s balance sheet tightening.

Among other factors, the Fed’s emergency umbrella has been a useful aid in driving asset gains over the past year, with riskier assets notably outperforming their more defensive, higher-quality counterparts.

The SPDR S&P Regional Banking ETF KRE surged 8% since a year ago and nearly 40% since hitting a low point in May 2023. The S&P 500 Index has climbed 33% from its previous lows during the regional banking crisis, while the Dow Jones Industrial Average has seen a 22% increase.

Moving up the risk ladder, tech stocks, represented by the Invesco QQQ Trust QQQ, have soared by 51%, while Bitcoin BTC/USD has witnessed an astonishing 218% surge.

Chart: Stocks And Bitcoin Performance Since March 2023

What Happens After The BFTP Expiration

According to Bank of America analyst Mark Cabana, borrowers who rely on the BFTP may face three options: renewing their loans ahead of expiration, securing alternative funding or allowing loans to expire without seeking replacement financing.

Data revealing whether banks tapped into the liquidity window in the last week ahead of expiration has not yet been published by the Fed.

Cabana expects that the cessation of the BFTP could lead to a drain on reserve balances held at the Fed if banks opt not to replace this funding source.

Thus far, this situation hasn’t materialized, indicating banks’ reluctance to reduce their cash levels.

The liquidity landscape remains in evolution as the Federal Reserve presses forward with quantitative tightening and with the risk of keeping elevated interest rates for longer in light of recent surge in inflationary pressures.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.