Bitcoin BTC/USD, the world's first and largest cryptocurrency, has outpaced every other asset class – by a lot. Bitcoin is up a mind-boggling 17,355.7% while the S&P 500 Index ETF SPY is up 223.3%. Though the run may seem long in the tooth to amateur investors, the data points to much higher prices.

Bitcoin's Supply & Demand: The Perfect Storm

The Halving (Supply)

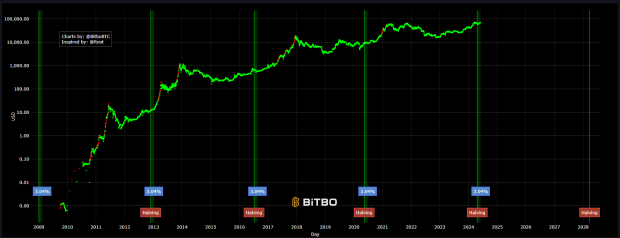

Earlier this year, the highly-anticipated Bitcoin halving event occurred. This is built into Bitcoin's monetary policy, increasing scarcity (supply) by reducing the number of new Bitcoin entering the market and reducing the reward for Bitcoin miners like Riot Platforms RIOT and Marathon Digital MARA. Historically, Bitcoin investors reap rewards post halving. Halving events occurred in November 2012, July 2016, and May 2020. One year later, Bitcoin's price more than doubled each time (and much more).

Image Source: BitBO/TradingView

Bitcoin ETFs Spur Demand

While supply will be more constrained, demand for Bitcoin is near-insatiable after the launch of several spot Bitcoin ETFs in the U.S. BlackRock BLK, the world's largest asset manager, achieved $10 billion in assets under management in it's iSHares Bitcoin ETF IBIT far faster than any ETF launch in history – a sign of immense demand.(crypto exchange giant Coinbase COIN is the custodial exchange)

Governments, Companies Adopt Bitcoin

Governments, States Move Toward Bitcoin Holdings

Nayil Bukele, the young president of the Latin American nation El Salvador took the bold step of buying Bitcoin for his country and making it legal tender. After some early turbulence, the bold step is paying dividends for Bukele. El Salvador has an average price ~$40,000 on its Bitcoin holdings (Bitcoin is currently trading near $70,000). As a result, Bukele was victorious in attaining another presidential term.

El Salvador's success is influencing asset allocators in the U.S. Last month, the State of Wisconsin Investment Board purchased $99 million worth of the IBIT ETF.

Public Companies Move to "Bitcoin Standard"

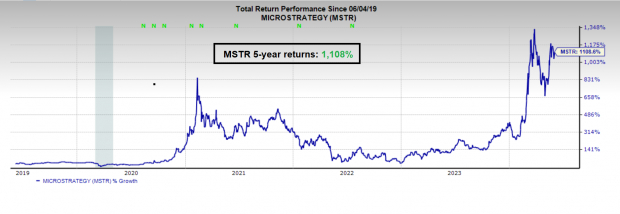

In late 2020, software firm MicroStrategy MSTR became the first publicly traded company to adopt Bitcoin as a reserve asset. Though the strategy was controversial at first, the results are tough to argue with. MSTR shares are up more than 1,000% over the past five years.

Image Source: Zacks Investment Research

Bitcoin: Hedge on Reckless Government Spending

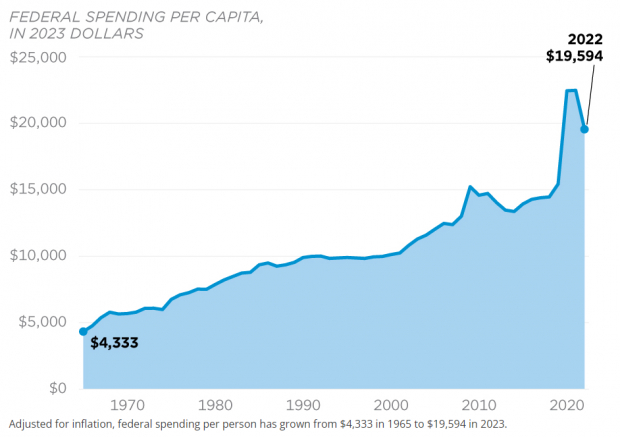

Amid the COVID-19 pandemic and the support for foreign wars like the War in Ukraine, government spending has exploded over the past decade. Why is increased government spending bullish for Bitcoin? Many investors see Bitcoin as a hedge against reckless spending and inflation because of its fixed supply and built-in monetary policy.

Image Source: U.S. Treasure

Bitcoin's Big Base

Bitcoin is emerging from a multi-year base structure. Earlier this year, the Gold ETF GLD emerged from a similar base structure and trended strongly to the upside. As the Old Wall Street adage goes, "the longer the base, the higher in space."

Image Source: TradingView

Trump & Biden Court Crypto Voters

Joe Biden and Donald Trump, the leading candidates to be the next president of the United States, have not always been pro crypto. However, each candidate has pivoted their message to a more pro crypto stance in an effort to court young crypto enthusiasts. Friendlier regulation and a more open-minded view toward the crypto industry should be a bullish catalyst.

Bottom Line

Bitcoin is the top performing asset over that past decade and has gone on a meteoric run. Nevertheless, several data points suggest Bitcoin will eclipse $100,000 by year-end.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.