Zinger Key Points

- Nearly 1 million new crypto tokens were created in May, leading to unprecedented market dilution.

- Token unlocks are adding around $200 million in sell pressure per day, suppressing the market.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Bitcoin‘s BTC/USD recent run-up close to all-time highs has failed to spur an equivalent rally in altcoins—a sign that the market is far from an altcoin bull run, according to a renowned crypto analyst.

What Happened: In a detailed series of tweets, Miles Deutscher highlighted the significant underperformance in altcoins and the apparent contradiction in market sentiment.

"At first glance, you’d think crypto sentiment would be euphoric right now," he tweeted, pointing out that while Bitcoin is nearing its all-time highs, and meme coins are gaining traction, the reality is different.

“Most retail doesn’t hold large amounts of Bitcoin – they’re in alts. And alts have been significantly underperforming thus far this cycle.”

Supporting his claim, Deutscher presented data showing that the OTHERS/BTC ratio, which excludes the top 10 coins, is lower than it was eight months ago.

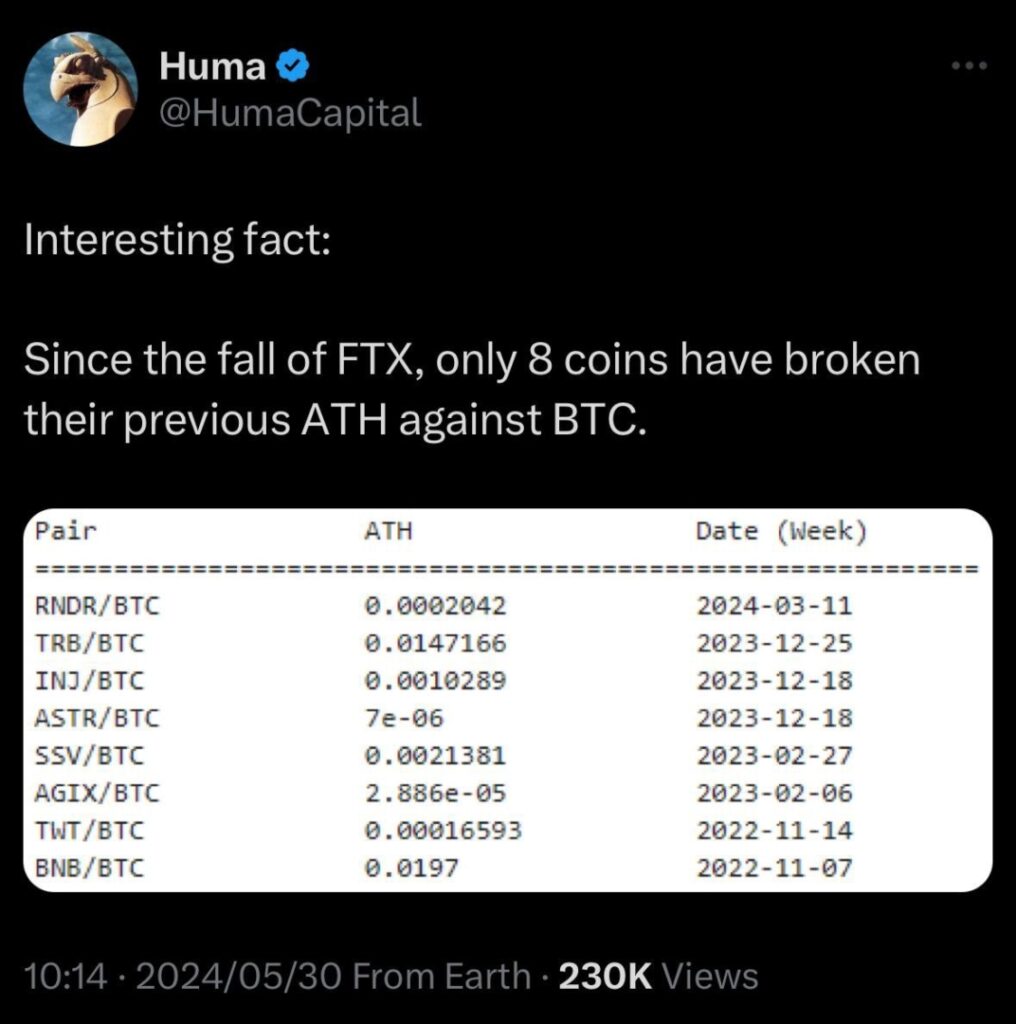

Another trader pointed out that since the bankruptcy of FTX, only eight coins have made a new all-time high against Bitcoin. Notably, the list does not feature major altcoins like Solana SOL/USD, Ripple XRP/USD, Cardano ADA/USD, Polkadot DOT/USD or even Ethereum ETH/USD

This underperformance is further evidenced by the fact that crypto YouTube views have significantly lagged behind Bitcoin prices, with views dropping from 4 million per day in 2021 to just 800,000 per day in 2024.

Deutscher highlighted that altcoins are still 70% away from their previous highs compared to Bitcoin, pointing out that alts “haven’t had a sustained rally” since Bitcoin’s thrust upwards starting in October 2023.

Also Read: Bitcoin Plummets To $67K And ‘This Move Isn’t Over,’ Warns Analyst

Why It Matters: Deutscher attributes the current market dynamics to several factors.

- He describes the cycle as Bitcoin-narrative led, driven by the spot ETF narrative and strong inflows.

- Specific sectors such as memes, AI, and real-world assets (RWA) have outperformed, while major altcoins lag.

- Market dilution is at an all-time high, with nearly 1 million new crypto tokens created in May alone.

- Lastly, token unlocks are adding continuous sell pressure, with around $200 million worth of unlocks per day.

Addressing the future of the market, Deutscher speculated on a potential turnaround. He noted that in previous cycles, altcoins peaked 546 days post-halving, suggesting a possible peak in October 2025 for this cycle.

However, he also acknowledged the possibility of an earlier peak due to various factors such as cycle acceleration and macroeconomic conditions.

"During the 1st half of the cycle it's natural for Bitcoin to take the lead. In fact, this is HEALTHY for market structure," he stated, emphasizing that altcoins typically outperform in the latter stages of the run.

Crypto trader Cred also chimed in with an analysis of the uneven distribution of returns this cycle. He pointed out that traditional risk curves and market behaviors have been less profitable, with meme coins on blockchains like Solana taking the lead instead.

“The rising tide has not lifted all boats and there are very clear winners vs losers,” Cred noted, highlighting the challenges faced by traders with differing strategies and risk appetites.

Eugene Ng Ah Sio, another crypto analyst, summarized the cycle’s progression, noting significant price movements in late 2023, followed by a reset in early 2024, and a large deleveraging event in the second quarter of 2024.

He emphasized the mental strain on market participants and suggested a possible interim cycle bottom in June, with a better outlook for the second half of the year.

What’s Next: As the crypto community navigates these turbulent times, upcoming events such as Benzinga’s Future of Digital Assets on Nov. 19 will be crucial.

Industry leaders will gather to discuss market trends, regulatory impacts, and future predictions, offering valuable insights into the evolving landscape of digital assets.

Read Next: Crypto Adoption Is Coming ‘Slow And Steady,’ Research Report Says

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.