Zinger Key Points

- The Accumulation Trend Score (ATS) reached its highest value, indicating substantial Bitcoin accumulation activity in recent weeks.

- Long-Term Holders are waiting for higher prices, with the LTH Sell-Side Risk Ratio remaining low compared to previous cycles.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Bitcoin BTC investors are demonstrating a renewed commitment to holding their assets for the long term, despite recent market turbulence, a new report by blockchain analytics firm Glassnode shows.

What Happened: The report reveals a significant shift in investor behavior, with large wallet holders, often associated with ETFs, leading the charge in accumulation.

“We’re seeing early signs of a reversal in the distribution trend, particularly among the largest wallet sizes,” stated the Glassnode analysts.

This sentiment is further reinforced by the Accumulation Trend Score (ATS), a metric used to assess the overall market balance.

The ATS has reached its maximum value of 1.0, indicating “significant accumulation throughout the last month,” according to the report.

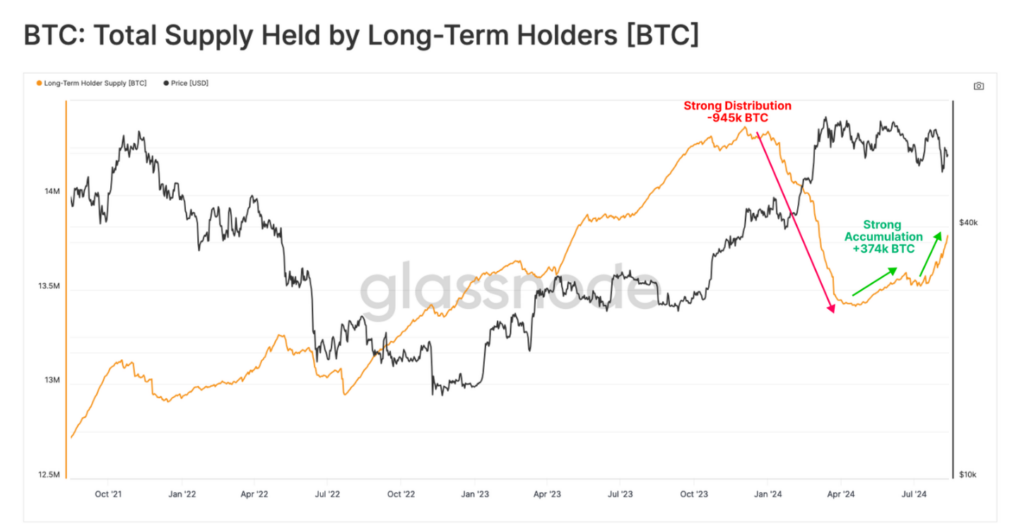

Long-Term Holders (LTH), a cohort that had been divesting during the run-up to the all-time high earlier this year, have now pivoted back to a holding strategy.

“This cohort have now returned to a preference for HODLing, with a total volume of +374k BTC migrating into LTH status over the last 3-months,” the report notes.

Despite the market’s recent downturn, the spot price has managed to maintain levels above the Active Investor Cost Basis, which represents the average acquisition price of active coins.

Glassnode analysts interpret this as a sign of “underlying strength, suggesting investors are generally still anticipating positive market momentum in the short-to-medium-term.”

Also Read: A Donald Trump Win Could Be Seen As Bullish, Harris Victory As Bearish For Crypto: Bernstein

Why It Matters: However, the report also highlights ongoing challenges in the spot market.

The Cumulative Volume Delta (CVD) metric indicates a persistent sell-side pressure since the formation of the new all-time high.

“When we analyze the yearly median value of Spot CVD, we can see that the median value has fluctuated between -$22m and -$50m over the last 2 years, suggesting the presence of a net-sell side bias,” the report states.

Perhaps most notably, the percentage of network wealth held by long-term holders remains at historically elevated levels compared to previous all-time high breakouts.

This suggests that “even though prices have traded sideways, to downwards of late, these investors are increasingly unwilling to part ways with their coins at lower prices,” according to Glassnode.

The Long-Term Holder Sell-Side Risk Ratio, which gauges the profit and loss realized by investors relative to the size of the asset, remains comparatively low.

This implies that “the magnitude of profit taken by the LTH cohort is comparatively small relative to previous market cycles,” indicating that this group may be waiting for higher prices before increasing their selling pressure.

Industry experts and enthusiasts alike will have the opportunity to discuss these trends and their implications at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.