Zinger Key Points

- Ethereum ETFs are gradually attracting institutional interest, yet still trail far behind Bitcoin in overall market penetration.

- Despite recent market turbulence, institutional investors appear committed to holding or increasing their Bitcoin ETF allocations.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

One month after the Ethereum ETF launches, institutional investors have continued to hold and even increase their exposure to cryptocurrency via ETFs.

What Happened: According to new data, while Bitcoin BTC/USD struggles to regain momentum, Ethereum ETH/USD is beginning to gain traction in the ETF space.

However, the emerging comparison between Bitcoin and Ethereum ETFs reveals an intricate dynamic in the broader crypto market.

One month into trading, Ethereum ETFs have amassed approximately $7.293 billion in Assets Under Management (AUM), while Bitcoin ETFs boast a substantially larger $49.108 billion AUM.

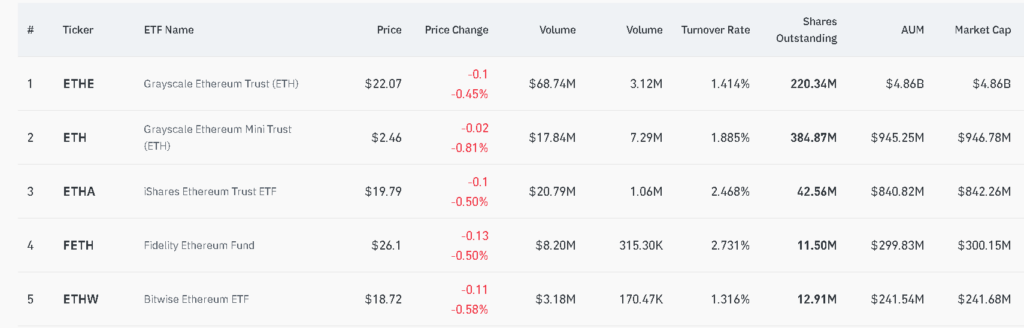

The Grayscale Ethereum Trust ETHE leads the Ethereum ETF pack with $4.86 billion AUM, followed by the Grayscale Ethereum Mini Trust ETH at $945.25 million, according to Coinglass data.

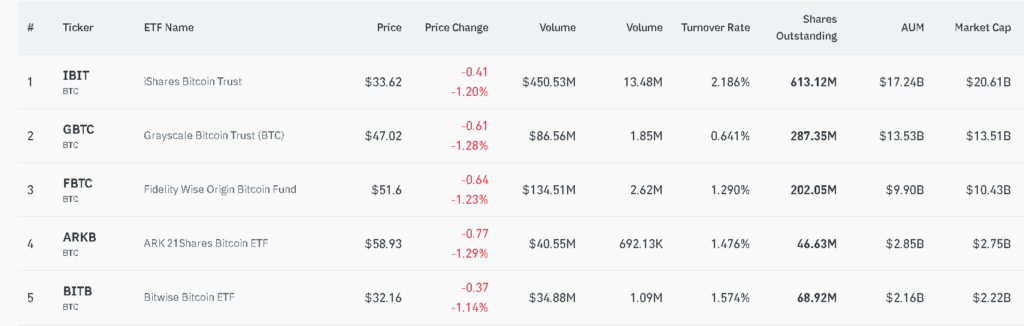

In contrast, the Bitcoin ETF landscape is dominated by the iShares Bitcoin Trust IBIT with $17.24 billion AUM, closely followed by the Grayscale Bitcoin Trust GBTC at $13.53 billion, according to data.

This stark difference in inflows highlights the continued preference for Bitcoin among institutional investors, despite recent market volatility.

The total AUM for Bitcoin ETFs is nearly seven times that of Ethereum ETFs, indicating a more cautious approach to Ethereum exposure through these new investment vehicles.

Why It Matters: Market analysts attribute the disparity to several factors, including the broader economic context and investor sentiment.

Aurelie Barthere, Principal Research Analyst at Nansen, points to a general trend of risk aversion in the market.

“To me, it is still unclear if we are just taking a consolidation pause or if crypto prices have peaked,” Barthere told Benzinga, emphasizing the uncertainty surrounding both crypto and traditional risk assets.

Also Read: How Much Has Donald Trump Made From NFT Sales? It’s More Than You Might Think

The sluggish performance of Ethereum ETFs is further underscored by the weakening Ethereum/Bitcoin (ETH/BTC) trading pair.

Bitfinex analysts suggest that this underperformance indicates deeper market forces at play, beyond the mere availability of institutional investment products.

Despite these challenges, there are signs that institutional interest in cryptocurrencies remains robust.

Matt Hougan, Chief Investment Officer at Bitwise Invest, reported a 30% increase in the number of institution-ETF pairs from Q1 to Q2, stating, “The Institutions Are Still Coming.”

The contrasting fortunes of Bitcoin and Ethereum ETFs reflect the complex dynamics of the crypto market.

While Bitcoin continues to attract significant institutional capital through ETFs, Ethereum’s slower start suggests a more cautious approach from investors.

As the market evolves, industry stakeholders will be closely watching to see if Ethereum ETFs can close the gap with their Bitcoin counterparts.

Investors and experts alike will have the opportunity to delve deeper into these trends at the upcoming Benzinga Future of Digital Assets event on Nov. 19, where the evolving landscape of digital assets will be a central topic of discussion.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.