Zinger Key Points

- MicroStrategy announces it bought more Bitcoin.

- The company continues to add Bitcoin to its balance sheet, something co-founder Michael Saylor told Benzinga will continue to happen.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Software company MicroStrategy Inc MSTR has purchased more Bitcoin BTC/USD, continuing the company's strategy of buying the leading cryptocurrency asset.

What Happened: MicroStrategy announced Friday it acquired 18,300 Bitcoin between Aug. 6 and Sept. 12. The announcement comes days after MicroStrategy Executive Chairman Michael Saylor highlighted the company's outperformance compared to all the S&P 500 companies.

The software company co-founded by Saylor said the 18,300 Bitcoin were acquired for around $1.11 billion in cash at an average price of $60,408 per bitcoin. The purchases were done with proceeds from a recent share issuance.

The software company co-founded by Saylor said the 18,300 Bitcoin were acquired for around $1.11 billion in cash at an average price of $60,408 per Bitcoin, using proceeds from a recent share issuance. This sale is part of a broader $2 billion offering the company previously announced.

As of Sept. 12, 2024, MicroStrategy has around 244,800 bitcoins. The company has paid around $9.45 billion to acquire the Bitcoin with an average purchase price of $38,585.

The company said its Bitcoin Yield was 4.4% from July 1 to Sept. 2024. Year-to-date, the company's BTC Yield was 17.0%. Bitcoin Yield is a key performance indicator for the company.

Read Also: Missed Out On Nvidia? Michael Saylor Says ‘Get On The Bitcoin Standard’ For Even Better Returns

Why It's Important: Buying Bitcoin is nothing new for MicroStrategy with the company first adding the leading cryptocurrency to its balance sheet back in August 2020.

"If you look out over four years or six year or eight years, then simply acquiring high-quality property with free cash flow is generally a really good investment strategy," Saylor previously told Benzinga on the company's Bitcoin purchases.

MicroStrategy has grown to be one of the largest Bitcoin holders globally and a key way for investors to get exposure to the leading cryptocurrency.

"We have a simple strategy and our strategy is we just acquire Bitcoin, and we hold the Bitcoin."

Saylor said that investors want to own scarce, desirable, high-quality property that other investors will want to buy down the road.

“And of course we happen to think that Bitcoin is the highest-quality scarce desirable property,” he said.

The company's Bitcoin strategy has helped MicroStrategy become one of the top-performing stocks since August 2020, outperforming the S&P 500 stocks and top companies like NVIDIA and others.

“We think that the highest-quality, best asset in the world is Bitcoin. Everything else in the world is inferior to Bitcoin. So, if you gave me $1 million and said what do you want to buy, I don’t want to buy a sports team, I don’t want to buy a building, I don’t want to buy a company … all I want to buy is Bitcoin,” Saylor said.

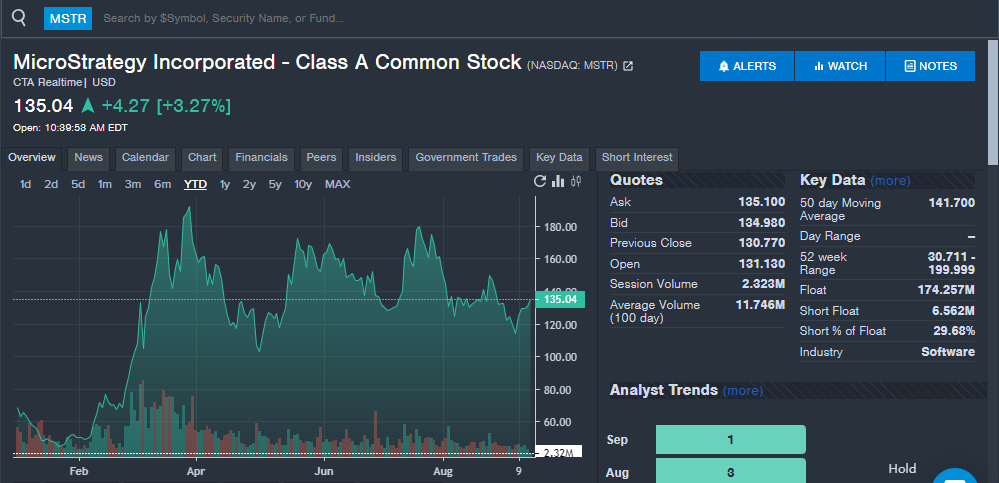

MSTR Price Action: MicroStrategy stock is up 6.6% to $139.66 on Friday, versus a 52-week trading range of $30.71 to $200.00.

The stock is up over 90% year-to-date, as seen on the Benzinga Pro chart below.

Read Next:

Photo: Wikimedia

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.