Leading chip manufacturer Intel Corp. INTC entered the Bitcoin BTC/USD mining hardware market with its Blockscale chip line but ended it after only a year of operation.

What Happened: In April 2022, Intel launched Blockscale, a set of application-specific integrated circuits designed for cryptocurrency mining in proof-of-work networks. The semiconductor giant initially aimed to supply these chips to companies like Argo Blockchain and Block, Inc. XYZ

But despite initial optimism, Intel discontinued the line in April 2023. The form stopped taking new orders for the chips and stopped shipping in April 2024.

The decision could have been motivated by the prolonged downturn in the cryptocurrency industry, with Bitcoin trading 55% down from its 2021 highs.

However, things have changed remarkably since then.

| Entity | Price (Recorded on April 18) | Price (Recorded at 2:10 a.m. ET) | Gains +/- |

| Bitcoin | $29,449.09 | $84,307.89 | +186% |

| Intel Stock | $32.43 | $19.74 | -39% |

See Also: Another Crypto Firm Set To Go Public: Galaxy Digital Foresees Nasdaq Listing Soon After SEC Approves Delaware Move

Cut to April 2025, and Bitcoin was worth $84,307.89 a piece, marking an impressive 186% since Intel ended its mining chips. But that's not all.

The mining sector has also grown by leaps and bounds, with the total Bitcoin hash rate surging by more than 163%, according to Coinwarz data.

Typically, an increase in hash rate implies an increase in computational power needed to perform mining, which, in turn, suggests the entry of more miners into the network.

Interestingly, Intel shares moved in the opposite direction, plummeting 39%, according to the last closed price of $19.74.

Price Action: At the time of writing, Bitcoin was exchanging hands at $84,539.42, down 0.25% in the last 24 hours, according to data from Benzinga Pro.

Shares of Intel closed 0.70% lower at $19.74 during Friday’s regular session. Year-to-date, the stock has lost 1.55%.

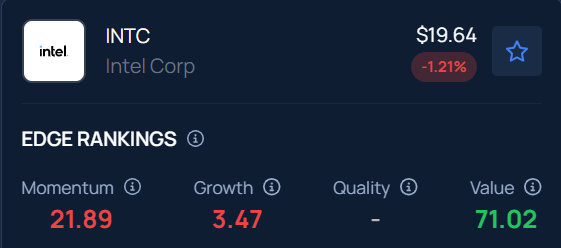

Intel stock had a low momentum and growth score as of this writing. Visit Benzinga Edge Stock Rankings to compare how its rival, Advanced Micro Devices Inc. AMD, performs on these parameters.

Photo Courtesy: Tada Images On Shutterstock.com

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.