The adoption of renewable energy is accelerating, particularly wind and solar power, as governments and corporations ramp up decarbonization efforts to minimize the impacts of climate change. We forecast global non-hydro renewables electricity capacity could increase threefold from 2023 to 2032.1 By 2032, non-hydro renewables could account for nearly one-third of the world’s total power generation.2 In this report, we explore the factors supporting our robust growth outlook and the significant investment opportunities that could emerge as a result.

Key Takeaways

- The non-hydro renewables sector is likely to grow significantly over the coming decade amid an increasingly supportive government policy landscape.

- Corporate sustainability efforts, continued technology advancements, and renewable energy systems’ cost competitiveness also support the strong growth outlook.

- The wind and solar power segments are likely to remain the renewable energy technologies of choice, presenting opportunities for companies across the wind and solar power value chains.

Supportive Policy, Superior Tech Bolster Renewables’ Growth Outlook

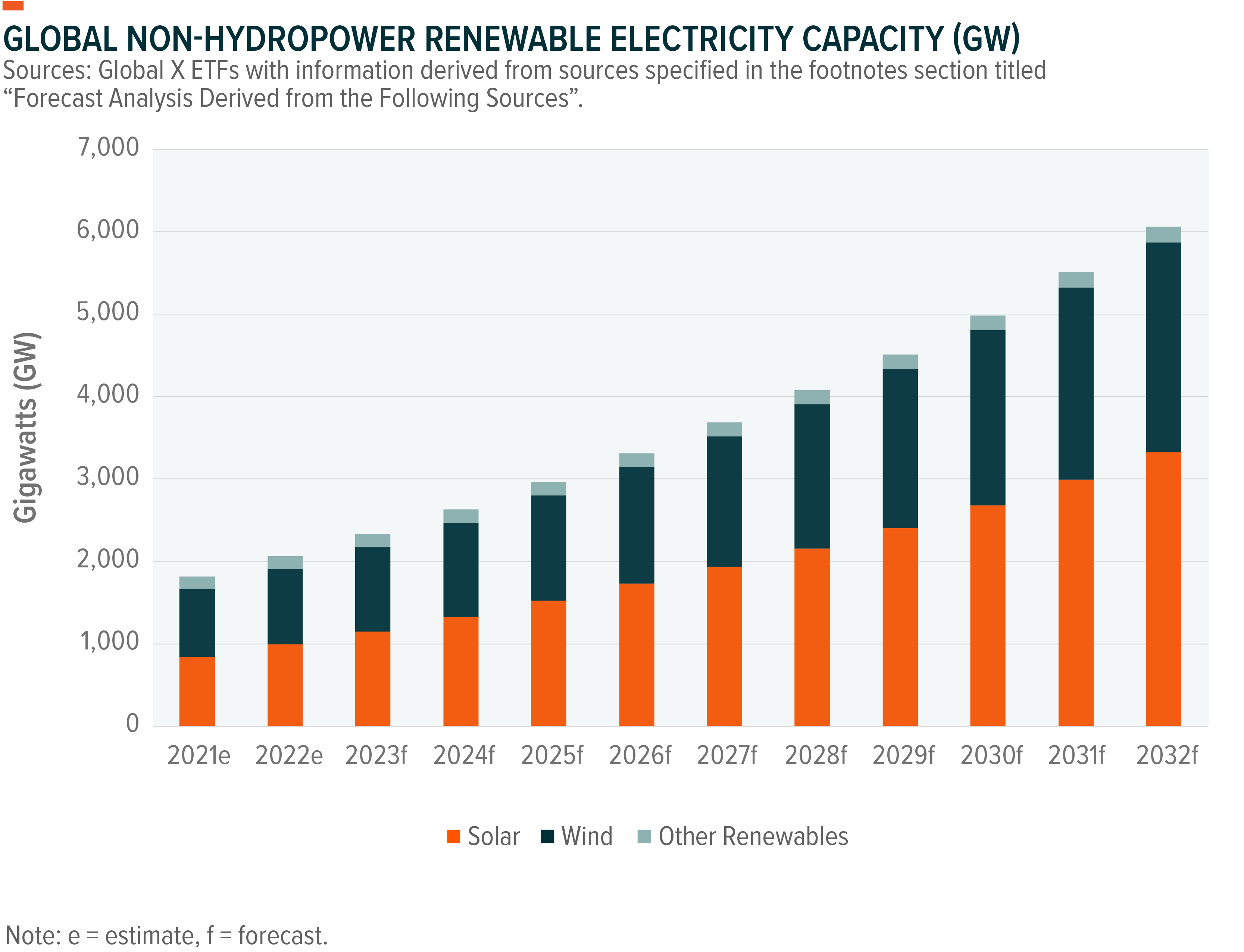

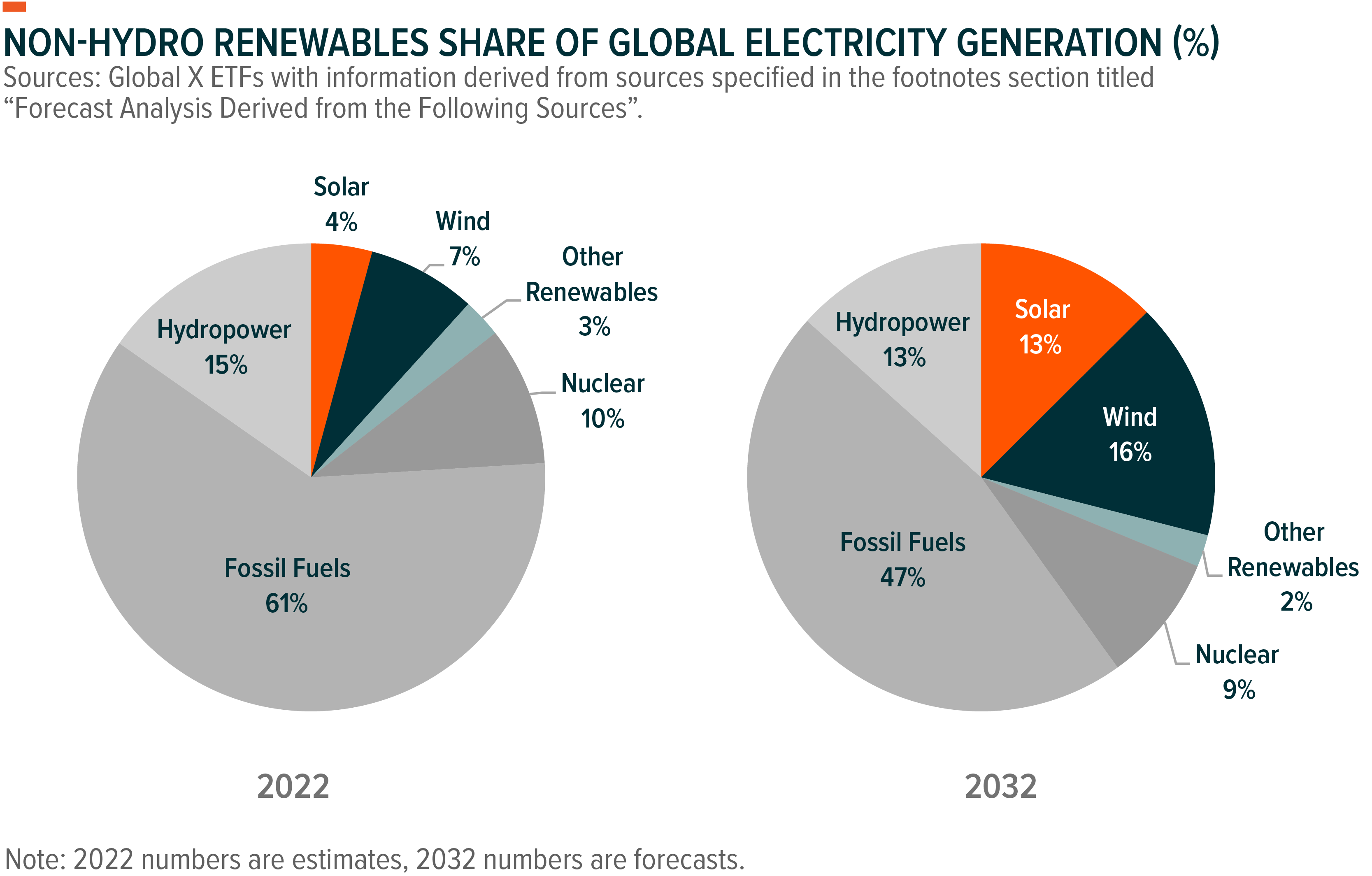

We forecast global non-hydropower renewable electricity capacity could grow 195% over the coming decade, increasing from an estimated 2,064 gigawatts (GW) at year-end 2022 to 6,060GW in 2032.3 Subsequently, non-hydro renewables’ share of global electricity generation could increase from an estimated 14% share in 2022 to a notable 31% share in 2032.4

Robust government policies underpin the strong growth outlook. Nearly 135 countries have economy-wide net zero emissions targets.5 Many national and sub-national governments also have specific renewable energy targets. To incentivize renewable energy growth and to meet these targets, governments are offering a range of subsidies, grants, feed-in-tariffs, renewables auctions, and project tenders.

The Inflation Reduction Act is a prime example, as it extends and expands clean energy tax credits, which are expected to provide significant tailwinds for renewable energy growth in the U.S.6 Additional evidence of supportive policy’s positive effects is the nascent U.S. offshore wind industry, which is beginning to take off due to a range of recent policy efforts at the state and federal levels.

In the private sector, some corporations even want their own renewable energy supply to meet sustainability targets, including onsite. For example, Ikea has rooftop solar systems on nearly all its buildings.7 However, the most common procurement avenue for corporations is through power purchase agreements (PPAs) with a renewable energy generator that owns and operates the renewable energy project.8 PPAs provide corporations an avenue for reducing emissions without directly building clean power facilities. The United States has the most active PPA market, where over 300 corporations contracted a record-high 20GW of renewable energy capacity in 2022.9 Technology companies, including Amazon, Google, and Meta, have contracted the largest cumulative PPA capacities over the past decade.10

Further supporting the robust growth outlook are expectations for continued advancements in clean energy technologies. Improvements to renewable energy system components such as solar modules and wind turbines are likely to expand the suitability range and performance of systems. Importantly, more powerful solar modules and wind turbines can reduce the amount of equipment needed for a project, potentially cutting land, labor, and construction costs.

Also, advancements in floating solar panel systems and floating offshore wind power technologies are likely to expand the areas where projects can be built, which could be particularly beneficial in land-scarce countries. At the same time, advancements and growth in energy storage should allow for the proliferation of high shares of renewable energy on electrical grids.

Wind and Solar Power Economics Create Growth Opportunities

Wind and solar power are likely to remain the renewable technologies of choice given their scalability, improving technology, and increasing affordability. In particular, cost competitiveness of renewable energy systems contributes to the significant interest by governments, corporations, and residential energy users.

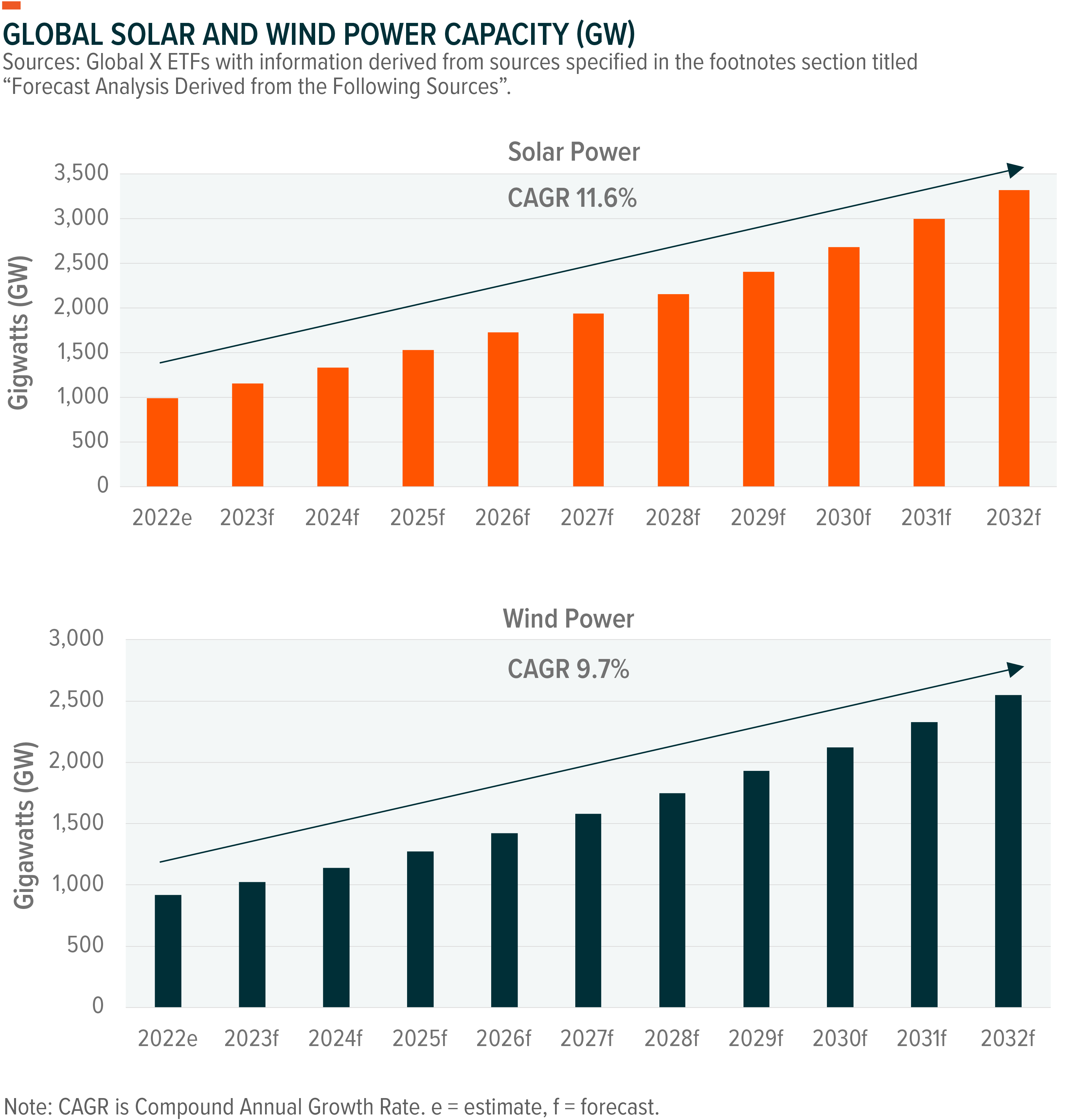

Onshore wind and solar photovoltaic (PV) power costs declined by 68% and 88%, respectively, between 2010 and 2021 due to technology advancements and economies of scale.11 Supply chain challenges increased wind and solar power prices over the past year, but both remain highly cost competitive, given often steeper cost increases to natural gas prices.12

Combined, these attributes position the solar and wind segments for significant capacity growth. We forecast the two sectors could account for nearly 88% of total capacity growth worldwide over the next decade, well in excess of forecasted capacity growth by other sources such as fossil fuels and other renewables.13 Over the next 10 years, solar power capacity could grow at a compound annual growth rate (CAGR) of 11.6% and global wind power capacity could yield a CAGR of 9.7%.14

Conclusion: Renewables Offer Transformative Growth Potential

Global investments into renewable energy reached a new record high of $495 billion in 2022, a 17% increase from 2021.15 We expect renewable energy investments to continue to climb as the energy transition picks up. As investments increase, substantial opportunities are likely to emerge for renewables companies, particularly those across the solar and wind power value chains. Equipment manufacturers of solar power modules, cells, inverters, wafers and tracking systems, wind turbine manufacturers, and wind and solar project developers and asset owners, all have the potential to benefit. Over time, we expect these players to turn the power sector green, and in the process create compelling opportunities for investors to participate.

Related ETFs

RNRG – Global X Renewable Energy Producers ETF

WNDY – Global X Wind Energy ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.