Jensen Huang-led Nvidia Corp. NVDA has emerged as one of the top gainers of the AI revolution, with its GPUs being in high demand.

It has also left behind rival Intel Corp. INTC, both in terms of market capitalization as well as stock price gains in 2023, riding the AI wave.

While Nvidia's market capitalization stands at $1.152 trillion, Intel's market capitalization stands at $187.781 billion – and the gulf between the two companies could continue to increase going forward.

Unsurprisingly, Nvidia's stock has delivered far better returns than Intel's in 2023 so far.

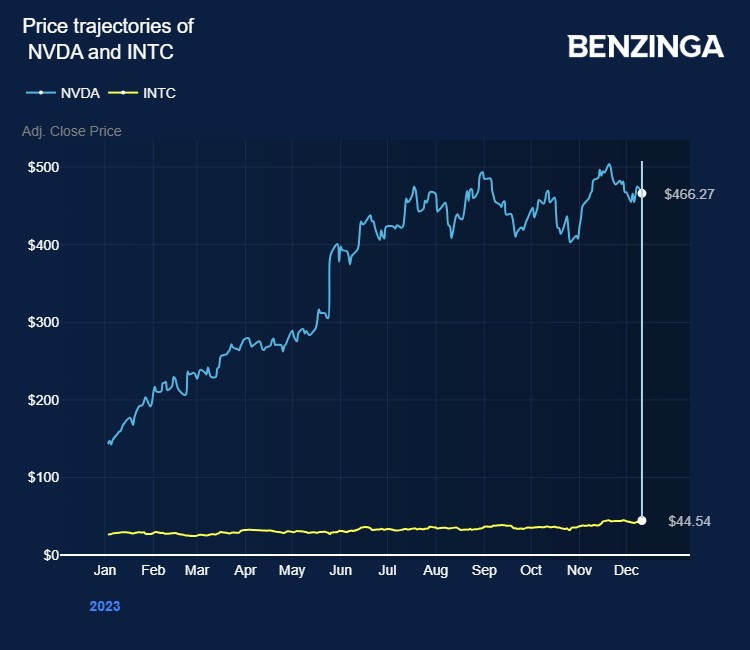

Charting Nvidia And Intel's Stock Price Trajectory From 01-01-2023 To 12-12-2023

Nvidia's shares have surged from $143 at the beginning of the year to $466.27 now, registering an increase of 226% in this period.

On the other hand, Intel's stock price has risen from $26.73 to $44.54 in the same period, which is an increase of 67%.

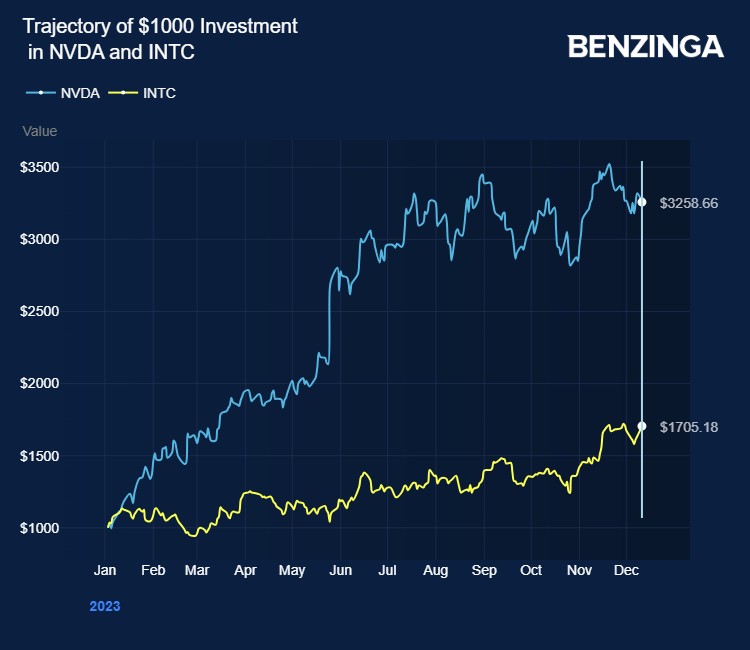

If you had invested $1,000 in the Nvidia stock at the beginning of 2023, you would now have $3,258.66.

In comparison, a $1,000 investment in the Intel stock would now be worth $1,705.18.

See Also: If You Invested $1,000 In Microsoft When Windows 2.0 Was Launched, Here's How Much You'd Have Today

Why Is Intel Lagging Behind Nvidia?

Although Nvidia and Intel don't reveal their AI revenue separately, looking at their data center business gives us a good idea about the takeoff that Nvidia witnessed right when the AI revolution gathered steam.

Data centers use central processing units (CPU), graphic processing units (GPU), and data processing units (DPU) to run their operations. Amongst these, GPUs are better suited for AI-driven applications since they can perform these tasks fastest and most efficiently.

One glance at Nvidia and Intel's data center revenue shows the contrasting performance of both companies.

In the Sept. 2023 quarter, Nvidia reported $14.5 billion in data center revenue, nearly 4 times as much as in the same quarter in 2022.

On the other hand, Intel's data center revenue fell to $3.8 billion from $4.4 billion in the same period.

Nvidia Vs. Intel's Data Center Business' Revenue

| Period | Nvidia | Intel |

| Q1 2022 | $3.8B | $6.1B |

| Q2 2022 | $3.8B | $4.7B |

| Q3 2022 | $3.8B | $4.4B |

| Q4 2022 | $3.6B | $4.6B |

| Q1 2023 | $4.3B | $3.7B |

| Q2 2023 | $10.3B | $4.0B |

| Q3 2023 | $14.5B | $3.8B |

According to an estimate by analyst firm Omdia, Nvidia accounts for over 70% of the total AI chip sales. Its latest AI chip, the H100, is already in high demand. It began shipping in September and Nvidia's ability to meet the demand depends on Taiwan Semiconductor Manufacturing Company TSMC.

Analysts remain gung-ho about Nvidia's prospects in the future – the broad consensus is ‘Buy' with a potential upside of 27.6%. On the other hand, the analyst consensus for Intel is ‘Hold,' with expectations of a potential 22.2% fall in the company's stock.

While Nvidia tries to cope up with demand for the H100 GPU, its successor, H200, is expected to be launched in 2024, restarting the cycle of scarcity again.

Image Credits – Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.