Zinger Key Points

- Meta is the second best-performing S&P 500 stock this year and has gained 190% year-to-date.

- Analysts are optimistic of further upside in 2024, as the company reaps the benefits of its cost cuts and its stepped up AI initiatives.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

In the backdrop of a dynamic 2023 for mega-cap stocks, Facebook parent Meta Platforms, Inc. META, part of the esteemed “Magnificent Seven,” emerged as a standout performer, echoing the success of AI-leveraged chipmaker Nvidia.

In fact, the stock is on track for its best year ever. So, what factors contributed to all this?

Stock Trajectory:

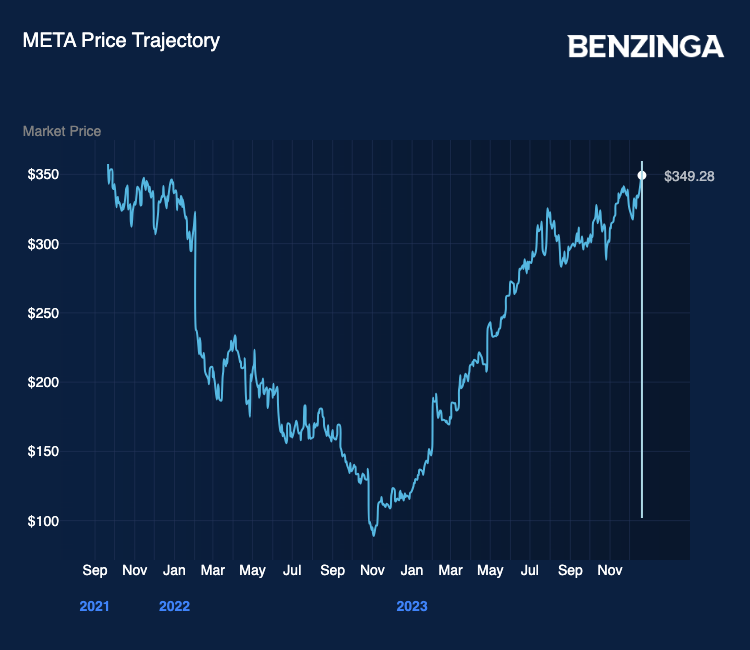

Meta’s stock rally, prevalent during the COVID-19 years, encountered a stall in September 2021, initiating a year-long secular downtrend until early November 2022. The downturn reflected declines in both top and bottom-line figures due to an ad spending slowdown amid challenging economic conditions. Challenges from the loss-making Reality Labs division, Apple‘s privacy initiatives, and the competitive threat from TikTok further impacted the company.

Chart Courtesy of Benzinga

Resuscitation Measures:

Amid these challenges, Meta unveiled strategic plans to streamline operations and navigate through adverse conditions. In November, the company announced a significant workforce reduction, eliminating 11,000 employees as the initial step.

In a letter to employees detailing the layoffs, CEO Mark Zuckerberg outlined additional measures, including desk sharing for remote workers, infrastructure review for spending cuts, and a hiring freeze until the first quarter of 2023. The market responded positively to these resuscitation measures, leading to a rebound in Meta’s stock from its six-year low.

Performance Highlights:

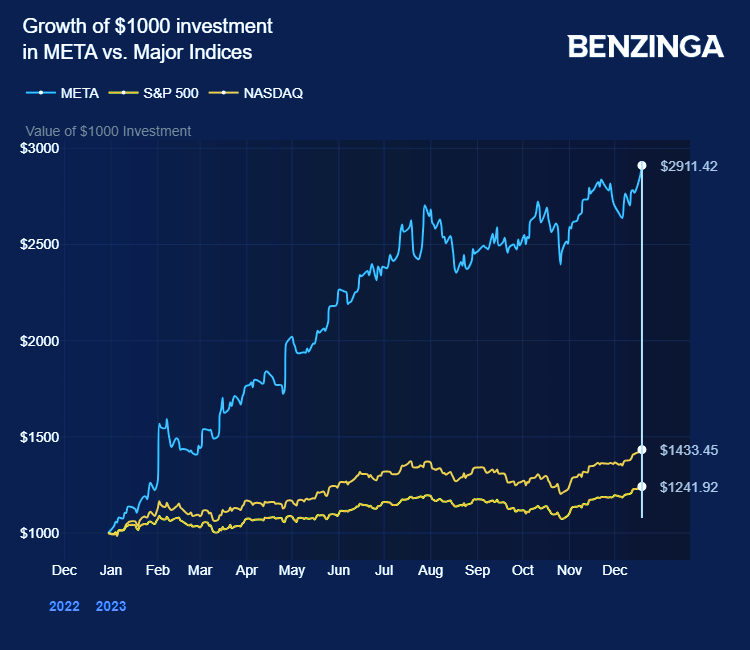

Despite the hurdles, Meta emerged as the second-best-performing S&P 500 stock in 2023, boasting a year-to-date gain of 190%, its best-ever performance. It outperformed both the S&P 500 and the Nasdaq Composite Index during the same period.

Despite the recovery, the stock is trading below its all-time high (intraday) of $383.79.

Chart Courtesy of Benzinga

See Also: How To Buy Meta (Formerly Facebook) Stock

‘Year Of Efficiency’

In the quarterly earnings report for the fourth quarter of 2022, released on Feb. 1, 2023, Zuckerberg emphasized the management theme for 2023 as the “Year of Efficiency,” focusing on building a stronger and more nimble organization.

During this period, Meta’s flagship Facebook platform’s daily active user metric rebounded, reaching the 2-million mark, which the company attributed to its AI discovery engine and Reels, a TikTok clone introduced in late 2021.

A second wave of job cuts in mid-March involved 10,000 positions, along with the closure of 5,000 yet-to-be-filled positions, concluding in late May.

Meta also launched Threads, a potential rival to Elon Musk‘s X, in the U.S. in July 2023, to mixed reviews. “Meta’s new Threads looks sharp to us, both in the direct opportunity and in the return of swagger to Meta’s social media wheelhouse,” said Rosenblatt analyst Barton Crockett, after its launch. It is set to launch in the EU in December.

Financial Performance:

For the nine months ending Sept. 30, 2023, Meta reported revenue of $94.79 billion, reflecting a robust 12% year-over-year growth, mainly thanks to a recovery in ad spending from customers. Efficient cost management contributed to a steeper 35% increase in net income to $25.08 billion.

What’s Next?

Meta anticipates fourth-quarter revenue of $36.5 billion to $40 billion, potentially resulting in full-year revenue of $133.04 billion (using the midpoint of guidance).

The company foresees increased capital expenditures and spending in 2024, attributed to heightened infrastructure spending and payroll expenses. Wider operating losses are expected for its Reality Labs business due to ongoing efforts in augmented reality/virtual reality product development and ecosystem scaling.

AI Bandwagon:

Meta features Meta AI, a virtual assistant, AI studio Platform, Emu (an image creation tool), and Llama 2 (an open-source large-language model), among others. Zuckerberg emphasized the importance of making business AIs accessible to more enterprises, a significant focus for the company into 2024.

Anticipating a Federal Reserve pivot in 2024, Meta looks forward to potential support resulting from lower interest rates. Improved ad spending, facilitated by lower rates, could benefit ad-dependent companies like Meta.

The stock’s potential upside is underscored by the average analysts’ price target of $388.43, suggesting an 11% scope for growth in the coming year.

In premarket trading on Thursday, Meta shares rose 0.11% to $349.67, according to Benzinga Pro data.

Image made via photos on Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.