Zinger Key Points

- EVs set to account for 16.2% of all global passenger vehicle sales in 2024, relative to 12% in 2023.

- Forward multiples for 5 EV players including Tesla, and China-based BYD, Li, BYD, and XPeng, reveals where value lies.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

A KPMG and Global Semiconductor Alliance survey revealed ‘automotive’ as the most important revenue driver for the semiconductor industry in 2024. The position is likely attributable to the continuing computerization and electrification of vehicles.

Accordingly, EVs are set to outrank AI within the semiconductor space, revenue wise. The S&P Global Mobility 2024 global sales forecast projects BEVs to post 13.3 million units in sales globally for 2024 (vs. 9.6 million in 2023)- approximately 16.2% of all global passenger vehicle sales (EVs + non-EVs), up from 12% in 2023. As the EV sector is expected to grow in 2024, potentially lifting EV manufacturers, investors may be interested in discerning which EV companies to focus their investments on.

Also Read: EVs Outrank AI Among Top Revenue Drivers For Semiconductor Industry In 2024: Survey

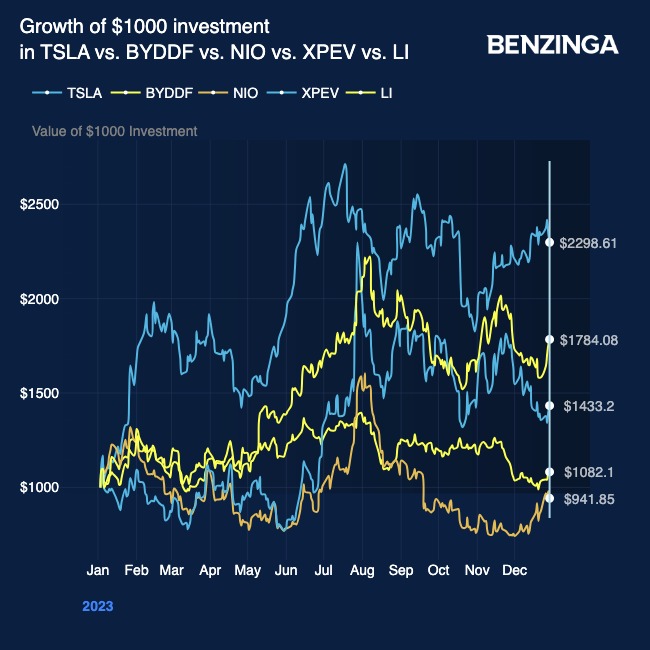

We took a look at some top EV players and their performance in 2023. A $1,000 investment in U.S.-based Tesla Inc TSLA stock at the beginning of 2023, would have grown to $2,298 by the end of 2023. That’s a whopping 130% return on your investment.

A similar amount invested in any of the Chinese EV players who stand in competition to Tesla, especially in China, would have resulted in varied amounts. An investment in Li Auto Inc LI stock would have returned about 78%, in XPeng Inc XPEV stock would have returned 78%, and in BYD Co Ltd BYDDF BYDDY stock would have returned about 8%.

A $1,000 invested in NIO Inc NIO stock would have resulted in a loss of about 6%.

To compare value, we’ll use the EV/Sales (FWD) ratio, as at least 2 of these companies have negative earnings (Nio and XPeng). Comparing these companies on sales multiples, we get:

| Valuation | TSLA | BYDDF | LI | NIO | XPEV |

| Price/Sales (TTM) | 8.21 | 1.01 | 2.69 | 2.03 | 4.03 |

| EV/Sales (FWD) | 7.96 | 0.9 | 1.58 | 2.05 | 2.71 |

| EV/Sales (TTM) | 8.06 | 0.97 | 1.99 | 2.12 | 3.84 |

Looking at the Enterprise Value to Forward Sales ratio for the stocks under comparison, BYD appears to offer the better value. The company’s valuation is currently pegged at about 0.9 EV/Sales (FWD). The Warren Buffett-backed Chinese EV player, finished 2023 reporting record quarterly battery EV deliveries of 526,409.

With profitability and scale up its sleeve, the company appears on track to stand tall against current global EV leader Tesla.

Tesla, at 7.96 EV/Sales (FWD) appears pricey on the valuation front. Although growth in services and new products should continue to drive Tesla’s stock, the company is facing pricing pressure due to EV overproduction in China.

Tesla faces a tough situation as it needs to adjust its pricing to stay competitive against more cost-effective rivals in China, leading to declining profit margins. The extent to which regulatory tailwinds, such as the Inflation Reduction Act and the CHIPS Act in the U.S. can help Tesla’s business, remains to be seen.

Li, another formidable competitor, is trading at a favorable EV/Sales (FWD) ratio of 1.58. Li continues to report quarter-on-quarter of profitable growth, with growing automotive profit margins despite the lower average selling price of its vehicles.

In a nutshell, the company sports improved manufacturing/ operating scale. Li’s stock presents a potentially strong option for those looking to gain exposure in the plug-in hybrid electric vehicle (PHEV) market.

While it remains to be seen how 2024 pans out for each of these EV players, investors who believe in the growth of the EV sector this year should consider the stocks and their valuations above before making an investment decision.

Now Read: Exploring The Competitive Space: Tesla Versus Industry Peers In Automobiles

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.