Zinger Key Points

- More than 15% of Americans are expected to participate in Dry January this year

- Key reasons are for better health and saving money - but where to invest?

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

Around 15% of Americans said they were planning to participate this year in Dry January — a month of abstinence from alcohol — according to a survey by Morning Consult.

Most cite the health benefits from taking a break from the bottle, but it has its financial benefits too. Bloomberg reports that alcohol-tracking app “I Am Sober” found that more than half its users saved more than $15 a day by abandoning drink last year.

But what do you do with those savings? Treat yourself to a new TV? Take a holiday? Or invest the money to keep it growing?

The last time I gave up drinking was during the first U.K. Covid lockdown in spring 2020. I was in denial about my favorite watering hole, The Blue Pig, being closed and stayed alcohol-free for three months. This changed my drinking habits totally.

Before Covid, I could spend anywhere between $75-$120 a week in the pub. Now, I spend only around $50. But during those three sober months in spring 2020, I saved around $1,200, and chose to put this money into a dividend yield equity individual savings account (ISA), a type of U.K. tax-free savings plan, which generally yields around 5% per year.

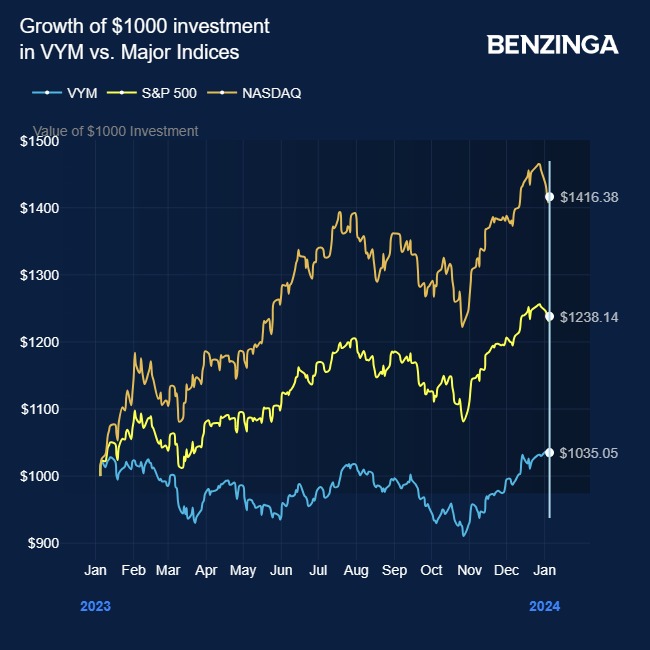

For context, a comparable type of investment in the U.S. might be something like the Vanguard High Dividend Yield ETF VYM. This ETF tracks U.S. companies known for high dividend yields and reinvests these dividends, aligning with long-term investment approaches. It has experienced significant growth since its low point in March 2020.

Also Read: New Year Resolution Stocks: Can Getting Fitter Be A Winner On The Stock Market?

New Year Resolution Trades

So, what other interesting investments could be made using the money saved during an investor’s Dry January?

New Year’s resolutions could provide some ideas. Most resolutions involve getting healthier, as gym memberships tend to flourish in January.

But be advised — according to a Forbes survey, these health commitments often don’t endure. Typically, they last only one to two months, as disappointment from limited progress and the lure of less healthy activities lead most people to abandon their gym memberships. This suggests that investing in fitness clubs might not be the best strategy.

Healthcare Stocks Starting The Year Well

Healthcare stocks could be a good route. The pharmaceutical industry is actively competing in the development of weight-loss medications. Stocks such as Eli Lilly And Co LLY have already made blockbuster gains in 2023 related to sales of their weight-loss treatments.

But Pfizer PFE, unliked by investors in 2023, is close to releasing its diabetes/weight-loss treatment. Marc Chaikin, CEO of Chaikin Analytics, told Benzinga‘s Pre-Market Prep this week that he’d turned bullish on the stock — it’s up 1% this week.

And the best performing stocks during a week when investors might well have sought solace in a drink, were Moderna MRNA up 9% this week, after Oppenheimer upgraded the stock on optimism about its vaccines, and Merck & Company MRK, up 7.4%.

Investing In Alcohol Stocks Amid Sobriety

How could alcohol company stocks respond if people choose to abstain from drinking in January?

It remains unclear, but so far in the first week of January it’s not looking too bad. Molson Coors Beverage Company TAP is up 1.1%, and Constellation Brands STZ is 3.5% higher.

Now Read: EXCLUSIVE: Buy The Dip — There’s A Lot More Upside To Come, Says Marc Chaikin

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.