Zinger Key Points

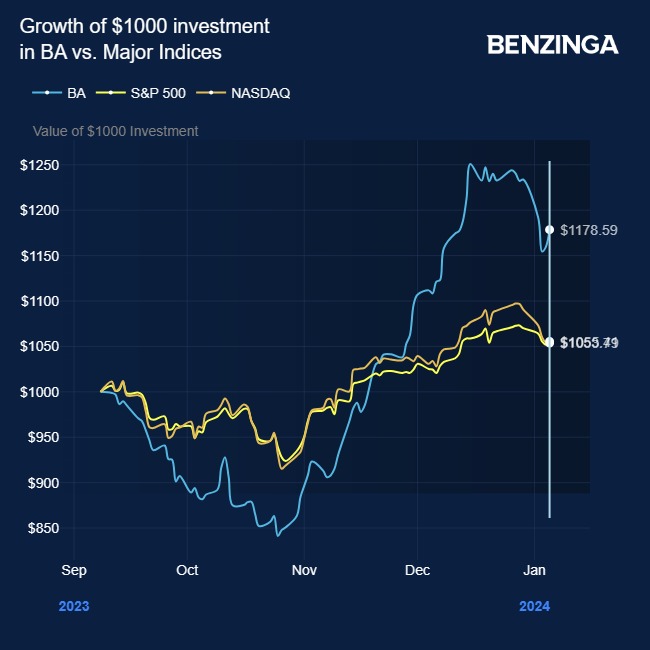

- Boeing shares fall 8% in early trade as reputational damage sparks sell-off

- Airlines with grounded 737 Max 9 jets see share prices fall as flights cancelled

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Share prices of airlines that operate Boeing Co‘s BA 737 Max 9 fell on Monday as air safety regulators ordered inspections of the global fleet after a section of fuselage on an Alaska Airlines ALK flight blew out shortly after take off on Friday.

The incident forced the jet to make an emergency landing in Portland 20 minutes after take-off, having already reached an altitude of 16,000 feet. Nobody was seriously injured.

The repercussions for Boeing’s reputation and share price might extend further, especially since this isn’t the first incident with the Max-family of jets. Five years ago, the entire global fleet was grounded following two fatal crashes.

Indeed, at the time of publication on Monday, Boeing’s shares were down 6.7%. By contrast, shares in Boeing’s arch-rival Airbus Group were up 2.4% in Paris, while Airbus American depository receipts EADSY were up 2.9%.

Goldman Sachs maintained its Buy rating and $280 price target on Boeing, saying: “Any quality control issues introduce risk to the production and delivery cadence; but there is also a scenario where this is isolated and has limited impact beyond the near-term.”

Bank of America also maintained a Buy rating and $275 price target, but warned: “This latest incident erodes the fragile confidence that has been built around the 737 MAX franchise. In our view, Boeing needs to tread carefully and cautiously through this potential reputational minefield.”

Global Regulators Order Safety Inspections

Responses from global air safety regulators were swift. In the U.S., the Federal Aviation Administration (FAA) ordered temporary grounding of 171 Max 9 jets until safety inspections could be carried out on the fleet, while the National Transportation Safety Board (NTSB) opened an investigation.

The FAA said in a statement: “The FAA is requiring immediate inspections of certain Boeing 737 MAX 9 planes before they can return to flight. Safety will continue to drive our decision-making as we assist the NTSB's investigation into Alaska Airlines Flight 1282.”

Other aviation regulators around the world whose carriers operate the 737 Max 9 series with the same configurations as the Alaska Airline jet followed the FAA’s directive.

The European Union’s Aviation Safety Agency said that it did not operate any 737 Max 9 aircraft with the same configuration that has the section that blew out and, therefore, could continue to operate normally.

Similarly the U.K.’s Civil Aviation Authority said no registered planes were affected, although it would require any 737 Max 9 operators entering its airspace to comply with the FAA directive.

Airlines That Operate Grounded Jets

Alaska Airlines, which operates 65 of the Max 9 jets, said in a statement on its website: “The 737-9 MAX grounding has significantly impacted our operation. We have cancelled 170 Sunday flights and 60 cancellations for Monday, with more expected. Cancellations will continue through the first half of the week.”

Shares in ALK were down nearly 5% in early trading on Monday, but were recovering and trading flight at the time of publication.

United Airlines Holdings Inc UAL, which operates 79 of the jets, said it had cancelled 230 flights, and issued a statement: “Following the incident on an Alaska Airlines flight on Friday, we have temporarily suspended service on select Boeing 737 Max 9 aircraft to conduct an inspection.”

Shares in UAL, having been down 1.6% in pre-market trade, turned around to gain 2.2% at the time of publication Monday.

Copa Holdings CPA, the parent company of Panamanian operator Copa Airlines, which operates 21 Max 9 jets, said: “Copa Airlines deeply regrets this situation beyond the control of the Airline and wishes to inform you that the entire team of the Company is focused on mitigating the effects of the situation in the best possible way.”

Copa shares were down 1.2% in early trade, but were up 0.4% at the time of publication Monday.

Other operators to use Max 9 aircraft include Aeromexico, Turkish Airlines and Icelandair.

Now Read: Oil Prices Fall As Demand Concerns Driven By Massive US Gasoline Stockpile Increase

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.