Zinger Key Points

- U.S. consumer confidence in January reaches a two-and-a-half-year high, exceeding expectations.

- Existing home sales in December dip, hitting the lowest level since August 2010.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

U.S. consumer confidence in January continues to exceed even the most optimistic expectations among analysts, reaching its highest levels in two and a half years, a testament to the robust resilience of household demand.

Meanwhile, existing home sales for December fell slightly below expectations, underscoring the ongoing cooling of the real estate market.

Friday’s Economic Highlights

University of Michigan Consumer Sentiment Booms In January

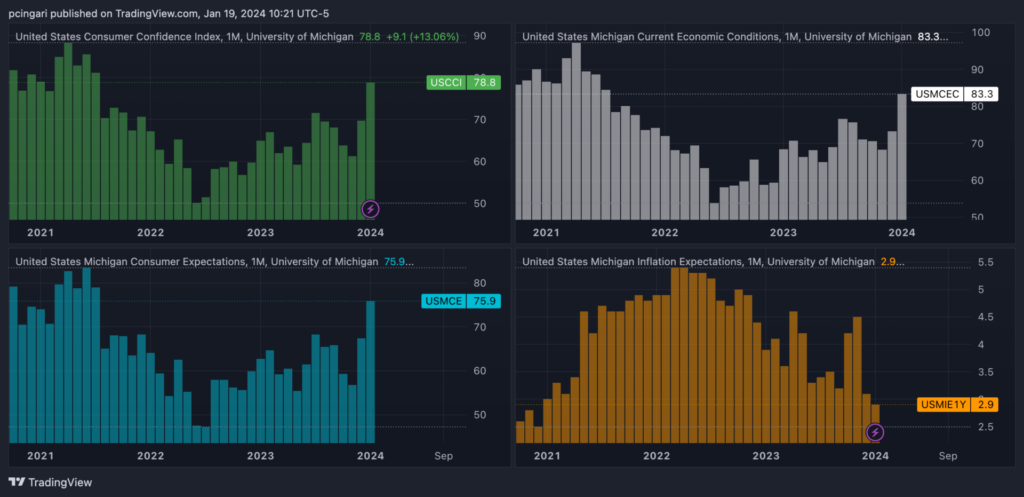

- In January 2024, the University of Michigan’s consumer sentiment surged to 78.8, a significant jump from December’s 69.7 and surpassing the anticipated 70, as indicated by preliminary estimates. This marks the highest level for U.S. consumer sentiment since July 2021.

- The subindex for current conditions also experienced a notable increase, rising from 73.3 to 83.3, reaching its highest point since July 2021.

- Similarly, the subindex for consumer expectations saw a substantial rise, climbing from 67.4 to 75.9, also reaching its highest level since July 2021.

- Conversely, consumer inflation expectations decreased on both short and medium-term horizons. The year-ahead gauge dropped from 3.1% to 2.9% in January, while the 5-year-ahead measure edged down from 2.9% to 2.8%.

Chart: Optimism Among US Consumers Hits Highest Level In Two Years And A Half

Housing Market Continues To Struggle

- Existing-home sales fell by 1.0% in December 2023, reaching an annualized rate of 3.78 million units, the lowest level since August 2010, and falling short of the expected 3.82 million units.

- Single-family home sales declined by 0.3% to 3.40 million, while condominium and co-op sales plummeted by 7.3% to 0.38 million. Among the four major U.S. regions, the Midwest and South saw sales declines, while the West experienced an increase, and the Northeast remained unchanged. Year-on-year, sales dropped by 6.2%.

- For the full year of 2023, existing-home sales reached their lowest point in nearly three decades. However, Lawrence Yun, chief economist at National Association of Realtors, remains optimistic, anticipating a rebound in the new year due to lower mortgage rates and an expected increase in inventory.

Market reactions: Stocks, Treasury Yields Rise

Major U.S. stock averages edged higher in the first hour of trading on Friday, with the SPDR S&P 500 ETF Trust SPY rising 0.3%.

Tech continued to lead with the Nasdaq 100, as tracked by the Invesco QQQ Trust QQQ, up by 0.7%. Blue chips inched higher by 0.2%, while small caps fell 0.3%.

Meanwhile, U.S. Treasury yields soared further, as markets continue to dial back expectations on Fed rate cuts in the first quarter of 2024.

Yields on a 10-year Treasury Note inched to 4.18%, while yields on the policy-sensitive 2-year Note rose to 4.41%, up 25 basis points for the week.

Bond-related assets fell, with the popular iShares 20+ Year Treasury Bond ETF TLT easing 0.3% during Friday’s morning trading.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.