Zinger Key Points

- Enbridge stock is set to report Q4 earnings on Feb. 9 and investor sentiment appears to be optimistic.

- The stock just formed a Golden Cross signaling upward momentum and potential future price appreciation.

- Discover Fast-Growing Stocks Every Month

As Enbridge Inc ENB moves closer to reporting its fourth-quarter results Friday, its stock is signaling renewed investor confidence. While Enbridge stock is down 13% over the last year, a technical signal indicates the investor pessimism over the stock may now be fading. Enbridge is reporting premarket Feb. 9.

Ninety-eight percent of Enbridge’s EBITDA is derived from long-term contracts or regulated utilities, ensuring stable cash flows.

The Mainline pipeline system, a key asset facilitating Canadian oil exports to U.S. markets, solidifies the company’s position in the energy infrastructure sector. The September 2023 strategic acquisition of natural gas utilities from Dominion Energy Inc D further diversified Enbridge’s revenue streams and enhances its exposure to regulated utility assets.

"Adding natural gas utilities of this scale and quality, at a historically attractive multiple, is a once-in-a-generation opportunity," Greg Ebel, Enbridge's president and CEO, said at the time the acquisition was announced.

Enbridge’s business mix, post-acquisition, allocates 50% to liquids pipelines, 25% to gas transmission, 22% to gas distribution and 3% to renewables.

With one of the best credit ratings in the midstream sector (BBB+), a well-laddered debt structure and low debt ratios, Enbridge maintains financial stability. Trading at a discount to historical average valuations, the stock could present a favorable buying opportunity, especially given its improved defensive and growth profiles post-acquisition.

The stock boasts a high forward dividend yield of 7.62% The five-year average annualized dividend growth rate of Enbridge is 4.39%

Related: 3 Top High-Yield Dividend Stocks: Maximize Returns In 2024

Golden Cross Validates Investor Confidence

Enbridge looks fundamentally well-positioned to record gains in 2024. Technicals are hailing optimism as well.

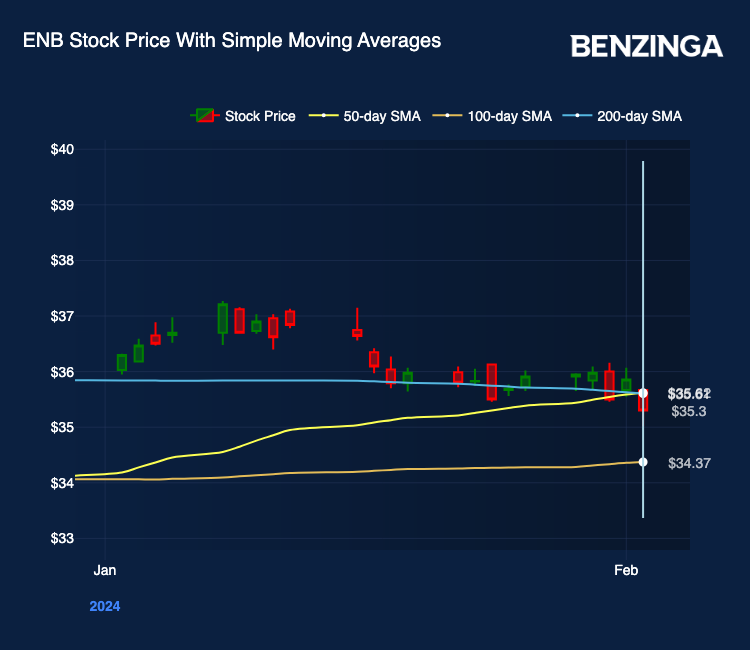

Enbridge stock has made a Golden Cross, as can be seen in the chart above. The 50-day SMA has crossed over the 200-day SMA from below. This event is considered a positive signal for a stock or an index.

The Golden Cross is often interpreted as a sign of upward momentum and potential future price appreciation. Traders and investors use this crossover as a bullish indication, suggesting the stock's recent upward trend is gaining strength, and it may continue to rise in the near term.

Read Next: Top 5 Industrials Stocks That May Fall Off A Cliff This Month

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.