Zinger Key Points

- Most stocks Ark's funds own do not belong to the Magnificent Six and they have corrected tremendously, says Cathie Wood.

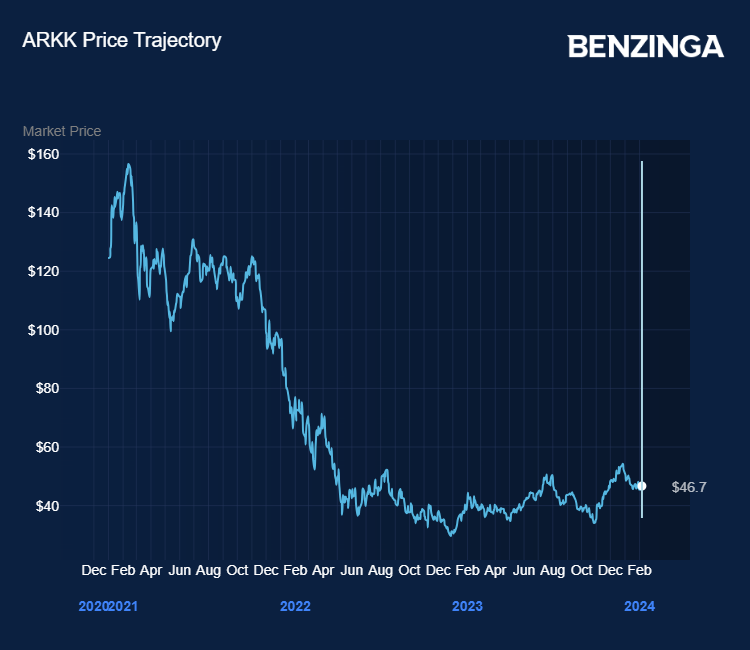

- ARKK topped out at $159.70 on Feb. 16, 2021 and pulled all the way down to $29.43 in late-December 2022.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

Cathie Wood-owned Ark Invest’s flagship exchange-traded fund, the Ark Innovation ETF ARKK is currently trading well off its peak reached in early 2021. The fund manager said on Wednesday a recovery may be in the offing.

What Happened: Most of the S&P 500 returns in 2023 were from the Magnificent Seven companies and some of their valuations may be stretched now, Wood said in a CNBC interview. With Tesla underperforming, people are now calling the mega-cap, high-flying tech stocks as the “Magnificent Six,” she said.

“Most of the market did not rally last year,” Wood said, adding that the rest was up only 7%.

Most stocks Ark’s funds own do not belong to the Magnificent Six and they have “corrected tremendously,” the Ark Invest founder said.

“They’re now starting to show earnings momentum and surprises on the upside, not just from revenue but also earnings. And we think they have a long way to catch up,” Wood said.

She noted that ARKK is now way below its peak. “We think interest rates clobbered our style,” she said.

“And we’ve paid our dues and now earnings will and revenue growth will speak loudly.”

See Also: Best Technology Stocks Right Now

Why It’s Important: As noted by Wood, ARKK topped out at $159.70 on Feb. 16, 2021, and pulled all the way down to $29.43 in late December 2022. The ETF has come off the level and is yet locked in a range around its depressed levels.

Source: Benzinga

ARKK’s top six holdings are as follows:

- Coinbase Global Holdings, Inc. COIN

- Tesla, Inc. TSLA

- Roku, Inc. ROKU

- UiPath, Inc. UI

- Block, Inc. SQ

- Zoom Video Communications, Inc. ZOOM

Each of these stocks accounts for over 5% weighting in the ETF. Given the still-unclear interest-rate trajectory and company-specific risks some of these companies are facing, it remains to be seen if ARKK can acquit itself creditably and retest its peak.

ARKK ended Wednesday’s session up 1.01% at $47.1, according to Benzinga Pro data.

Photo via WEF on Flickr

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.