Zinger Key Points

- AI-powered stock picker has beaten benchmark exchange traded funds

- The model has yet to be tested by volatile, declining market conditions.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Artificial intelligence is increasingly used by asset managers to help assess risk and make portfolio choices. And there’s at least one institutional investor who believes he’s hit on a model that can routinely beat benchmark indices.

Doug Clinton, managing partner at Deepwater Asset Management, is embracing what the late Charlie Munger called “sit on your ass investing.”

Minneapolis-based Deepwater launched Intelligent Alpha in 2022 using generative AI (GenAI) models to seek long-term investments fueled only by fundamental business performance.

Clinton says this new approach uses a “committee” of generative AI systems. They include ChatGPT, Bard and Claude. Each system avoids “emotional mania buying and panic selling.”

Essentially, the model cuts out all the noise that might drive short-term equity performance, Clinton explains. And, just like Warren Buffett and Munger, it selects good companies and sits on them.

“Instead of trying to harness AI's superpower to process massive amounts of data, Intelligent Alpha uses a different AI superpower: the lack of human emotion and bias that corrupts mere mortals from exercising the discipline of Buffett and Munger,” Clinton wrote on his Substack page, The Deload.

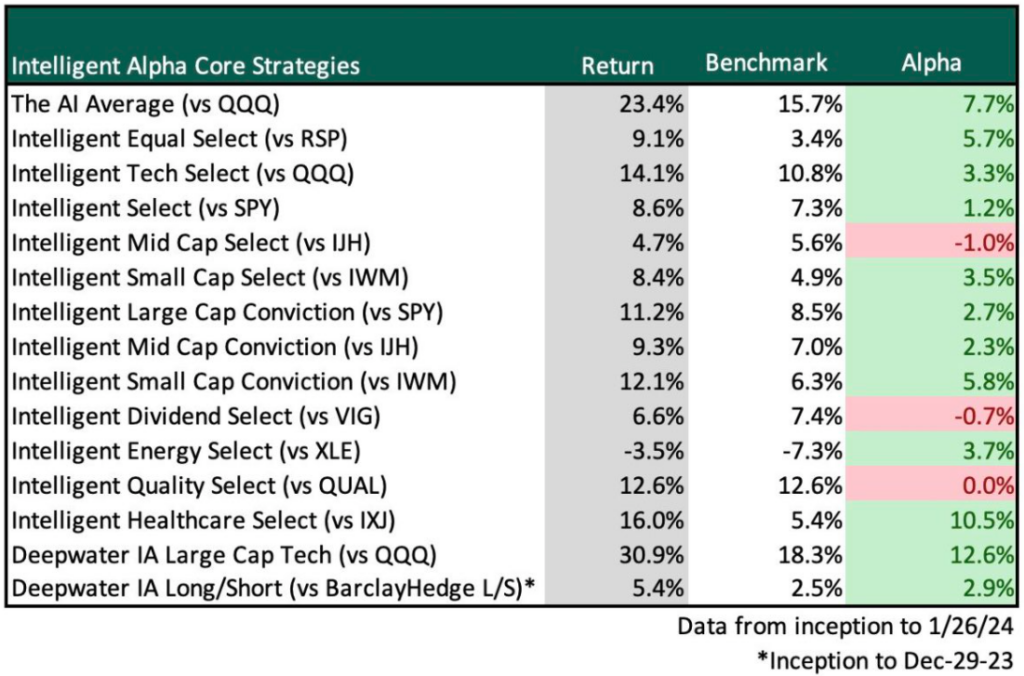

Clinton’s results appear to be impressive over all the core strategies. Clinton’s portfolios compete with exchange-traded fund benchmarks such as the SPDR S&P 500 SPY, which itself is benchmarked against the S&P 500 index, and the NASDAQ-based Invesco QQQ Trust QQQ.

His results, which were posted on X this week, are below:

Also Read: AI Growth, Lower Interest Rates Foil Recession Threats In 2024, Says IMF

Caveats To Consider

It remains to be seen how Clinton’s portfolios perform under more stressful circumstances. Markets moved broadly higher during 2023. Although his Intelligent Large Cap Conviction portfolio outperformed its benchmark during the downturn in the third quarter, a longer period of deeper losses could test it.

Clinton hasn’t divulged the contents of all the portfolios for the above strategies. The Intelligent Large Cap Conviction includes just 30 stocks compared with SPY’s 504. This makes the S&P 500 easier to beat, as it has a higher ratio of underperforming stocks to drag it down.

Clinton’s portfolio also includes all the Magnificent 7 tech mega caps. Those stocks comprise about one-third of the S&P 500’s market weighting. Buffett’s approach was to choose the best companies and hang on to them; Clinton insists his way works, too.

Clinton sums it up as “the contrarian approach of avoiding the temptation to pump AI with excess data combined with the beautiful simplicity of looking for great companies yields a novel approach to AI-powered investing.”

Now Read: ‘Magnificent 7’ Widens Gap With Rest Of S&P 500, But That May Change In 2024

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.