Zinger Key Points

- These AI-influenced stocks sitting outside the Mega Techs are performing well.

- Cybersecurity is likely to be among the early adopters for AI use cases.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Nvidia Inc NVDA and Meta Platforms Inc META, top artificial intelligence (AI) plays and elite members of the Magnificent 7 club, are topping the S&P 500 leaderboard so far this year.

These two stocks were among the best performers of 2023 — indeed, Nvidia was the year’s winner by a country mile with a gain of 239% — and also led the powerful fourth-quarter surge that has resumed in the opening weeks of 2024.

Much of this momentum is based on the anticipation that AI will become a significant revenue stream, despite it not yet making a substantial impact on the earnings of either company.

Some fear that these AI expectations have become overplayed and the risk of disappointment could burst this AI “baby bubble”, as analysts at Bank of America call it.

Also Read: Is Tesla Still A Magnificent 7 Stock? Berkshire Hathaway, Broadcom, Eli Lilly Line Up As Contenders

AI Plays Outside Magnificent 7

If, however, investors believe that AI will come to dominate tech growth, there are a number of stocks sitting outside the Magnificent 7 that are also right up there on the S&P 500 leaderboard — but at less lofty valuations.

Among the likely most important use cases for AI will be cybersecurity. As cyber criminals become more sophisticated, those safeguarding corporate networks and data are expected to deploy AI models to maintain a lead in security measures.

Palo Alto Networks PANW says: “AI is a critical piece of our history of solutions that prevent successful cyber-attacks.”

“Cortex is Palo Alto Network's AI-based continuous-security platform, which continually evolves to help

the security operations center stop the most sophisticated threats.”

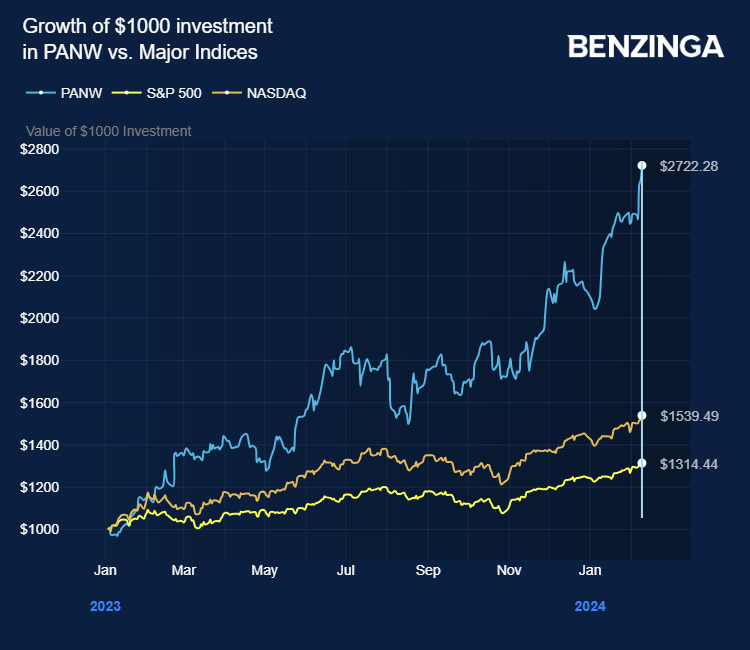

Palo Alto shares are up 28% so far in 2024, having gained 111% in 2023.

The company’s last quarterly earnings report was impressive, reporting earning of $1.36 per share, comfortably beating consensus expectations of $1.16.

Fortinet FTNT plays out a similar theme. The company says: “Our experts develop and utilize leading-edge machine learning (ML) and AI technologies to provide timely and consistently top-rated protection and actionable threat intelligence.”

Its shares are up 20% so far in 2024, and gained 20% during 2023 — despite a sharp drop in August 2023.

Nevertheless, its fourth-quarter earnings report last Wednesday beat market expectations and analysts like the stock, with Goldman Sachs on Thursday raising its price target to $85. The shares currently stand at $70.44.

Juniper Networks JNPR calls itself a leader in AI and cloud networking. The company says of its product: “[Our] highly performant and adaptive network infrastructures are optimized for the connectivity, data volume, and speed requirements of mission-critical AI workloads.”

Year to date, Juniper’s shares are up 26%, following a 6% loss in 2023. However, the shares surged around 20% alone on Jan. 8 after it was reported that Hewlett Packard HPE was in advanced talks to take over the company.

Arista Networks ANET has also developed AI networking systems, and says: “Arista's open, interoperable solutions and emphasis on operational efficiency, automation, and streamlined management workflows contribute to lower operational costs and overall total cost of ownership for AI networking deployments.”

So far in 2024 Arista’s shares have gained 20%, after rising 94% over 2023.

The company reports its fourth-quarter earnings on Thursday, and is expected to post earnings per share of $1.70, up from $1.41 in the same quarter a year ago.

Now Read: AI Titans Meta, Microsoft, Nvidia Join Biden On Safety Initiative

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.