Zinger Key Points

- Markets plunged Thursday afternoon after after S&P Global warned about resuming inflationary pressures in May.

- Fed futures are currently pricing in only 34 basis points of rate cuts by year-end, translating to just one rate cut.

- Learn how to trade volatility during Q1 earnings season, live with Matt Maley on Wednesday, April 2 at 6 PM ET. Register for free now.

Markets experienced a sharp downturn Thursday afternoon following an initial surge to historic highs in technology-heavy stock indices, driven by Nvidia Corp.‘s NVDA spectacular AI-driven earnings report.

The CBOE Volatility Index (VIX), also known as the market fear index, surged over 7% after hitting its lowest level since November 2019 earlier in the session.

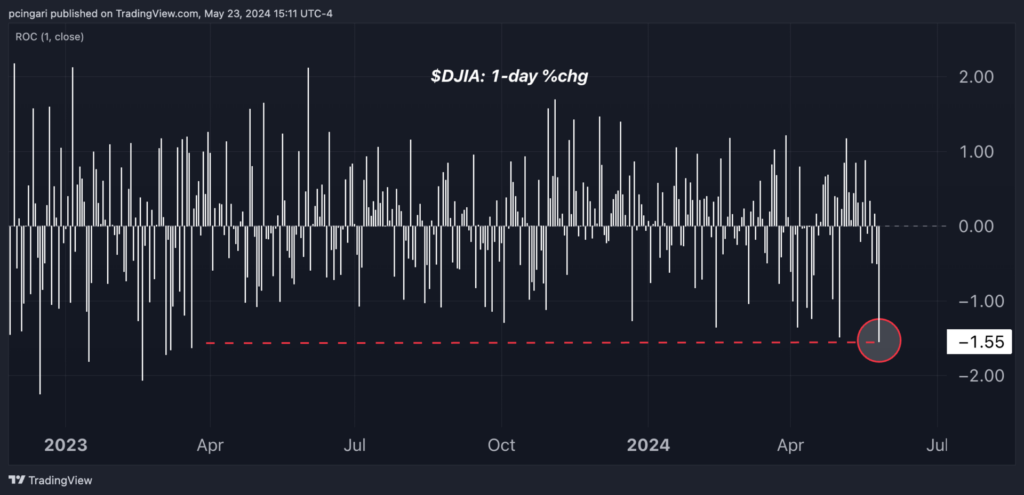

Blue-chip stocks were particularly affected in a broad sector selloff. The Dow Jones Industrial Average, tracked by the SPDR Dow Jones Industrial Average ETF DIA, was down 1.5% at 3:00 p.m. in New York, on track for its worst performance since March 2023.

Both the S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY, and the Nasdaq 100, monitored through the Invesco QQQ Trust QQQ, fell 0.9%.

Chipmakers were the only industry in the green, with the VanEck Semiconductor ETF SMH up 0.8%, thanks to Nvidia’s 8.7% rally.

Chart: Dow Eyes Worst Day In Over A Year

What Happened: Sentiment took a hit after S&P Global released its May private sector activity surveys. The Composite PMI Index, a gauge of overall business health, showed the highest expansion rate in two years.

This might seem like good news, but the devil is in the details.

“Input prices continued to rise sharply in May, with the rate of inflation accelerating to register the second-largest monthly increase seen over the past eight months,” S&P Global reported.

In particular, manufacturers experienced a steep increase, facing the largest cost rise in a year and a half. This was attributed to higher supplier prices for a wide variety of inputs, including metals, chemicals, plastics, and timber-based products, as well as higher energy and labor costs.

Chris Williamson, chief business economist at S&P Global, indicated that selling price inflation has increased, continuing to signal modestly above-target inflation.

He highlighted that the primary inflationary pressure now originates from manufacturing rather than services. This shift has resulted in elevated rates of inflation for both costs and selling prices compared to pre-pandemic standards, implying that reaching the “Fed’s 2% target still seems elusive”

Why It Matters: Stronger-than-expected business sentiment growth and renewed inflationary concerns pushed Treasury yields up across the board, leading investors to reassess the likelihood of Fed interest rate cuts.

Notably, there has been a significant shift in rate cut expectations. Fed futures are currently pricing in only 34 basis points of rate cuts by year-end, translating to just one rate cut.

While investors had anticipated a rate cut by September as of Wednesday, this expectation has now been postponed to November, according to the CME Group Fed Watch Tool.

The rate-sensitive two-year Treasury yield leaped by 6 basis points to 4.93%, eyeing the highest close since May 1.

The dollar was the only gainer among major asset classes, with the Invesco DB USD Bullish Index Fund ETF UUP, up 0.2%.

Now Read: Boeing Stock Falls As CFO Forecasts Negative Cash Flow, Delivery Delays Amid Regulatory Scrutiny

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.