Zinger Key Points

- Inflation slowed to 3.3% annually in May, below the expected 3.4%. Monthly CPI remained flat, below the anticipated 0.1%.

- Small caps, tracked by iShares Russell 2000 ETF, surged 2.9%, outperforming large-cap indices. Real estate and materials sectors led gains.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

A cooler-than-expected U.S. inflation report fueled a rally on Wall Street, ahead of the highly anticipated Federal Open Market Committee (FOMC) meeting at 2:00 p.m. Wednesday.

What happened: Inflation slowed to 3.3% annually in May, below both the expected and previous rate of 3.4%. On a monthly basis, the Consumer Price Index (CPI) remained flat, below the anticipated 0.1% increase and a significant drop from April’s 0.3% rise.

Additionally, the core measure of inflation, which excludes energy and food, weakened more than predicted. Annually, core inflation slowed from 3.6% to 3.4%, falling short of the 3.5% expectation.

Why it matters: Lower-than-expected inflation data is bolstering hopes for a steady return to the Federal Reserve’s 2% target and raising expectations for interest rate cuts later this year.

Markets are now assigning a probability of over 70% for a September rate cut, up from 54% before the inflation report. Notably, Fed futures now indicate 55 basis points of rate cuts priced in by the end of the year, implying two rate cuts.

Prospects of a declining cost of borrowing are aiding interest-rate sensitive sectors and stocks, which had lagged in recent weeks due to fears of prolonged higher rates.

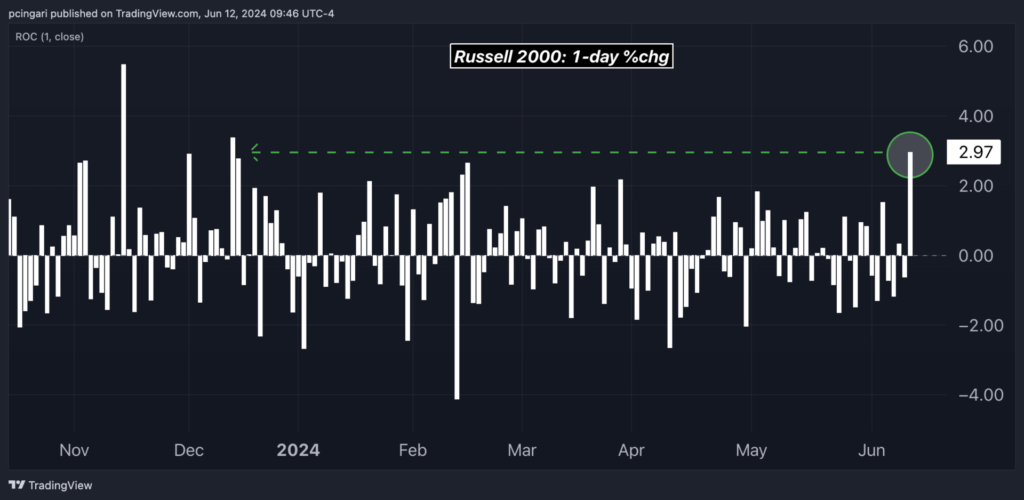

Market reactions: Small caps, as tracked by the iShares Russell 2000 ETF IWM, were the brightest spot in the market, opening 2.9% higher and on track for the best-performing day year to date.

Chart: Small Caps Eye Best Day Since Mid-December 2023

In comparison, large-cap indices such as the S&P 500, the Nasdaq 100, and the Dow Jones Industrial Average were all about 0.9% higher.

Sector-wise, real estate and materials were the best performers, with the Vanguard Real Estate ETF VNQ and the Materials Select Sector SPDR Fund XLB up 2.2% and 1.6%, respectively.

Industry-wise, homebuilders, regional banks, solar, and biotech stocks were the top performers, showing notable increases.

- SPDR S&P Homebuilders ETF XHB up 4%

- Invesco Solar ETF TAN 3.9%

- SPDR S&P Regional Banking ETF KRE up 3.3%

- SPDR S&P Biotech ETF XBI up 2.3%

According to Benzinga pro data the top-performing stocks (with at least $1 billion of market cap) in the hour following the U.S. inflation report were:

- Sunrun Inc. RUN: 7.87%

- Array Technologies Inc. ARRY: 7.65%

- Opendoor Technologies Inc. OPEN: 7.44%

- Element Solutions Inc. ESI: 6.78%

- TeraWulf Inc. WULF: 6.68%

- Iamgold Corporation IAG: 6.55%

- Globus Medical Inc. GMED: 6.04%

- Dyne Therapeutics Inc. DYN: 5.99%

- Enphase Energy Inc. ENPH: 5.93%

- Upstart Holdings Inc. UPST: 5.75%

Looking ahead, traders are now eagerly anticipating the Federal Open Market Committee (FOMC) meeting. The statement and new macroeconomic projections will be released at 2:00 p.m. ET, followed by Fed Chair Powell's press conference at 2:30 p.m. ET.

Read now: Fed Meeting Preview: Economists Predict Steady Rates In June, Fewer Cuts Ahead

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.