Keith Patrick Gill, popularly known as “Roaring Kitty” on social media, is facing a new class action lawsuit over allegations of a pump-and-dump scheme involving GameStop Corp. GME securities.

What Happened: A court document filed on June 28, in the Eastern District of New York, reveals that plaintiff Martin Radev accuses Gill of manipulating GameStop’s stock price through his social media influence. Known for his significant role in the “meme stock” movement, Gill is a former financial analyst.

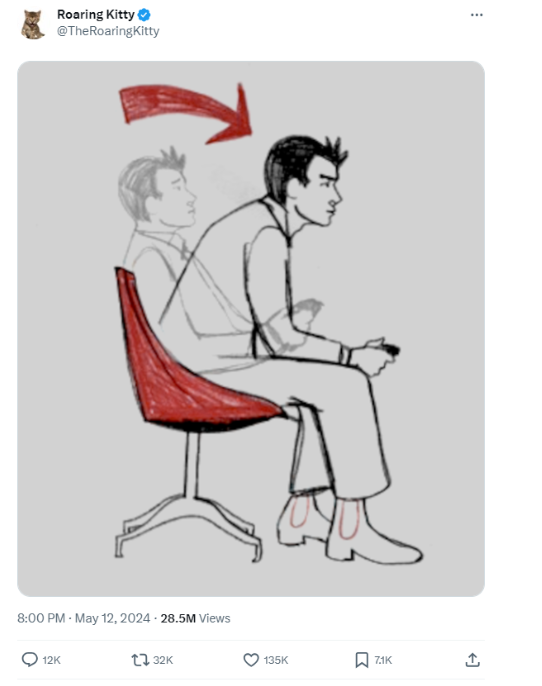

The lawsuit alleges that Gill discreetly bought a large number of GameStop call options before making a social media post on May 12, 2024, which sparked renewed interest in the company’s stock. The stock price soared over 74% the following day. Gill is then alleged to have disclosed his large stake in the company on June 2, leading to another surge in the stock price.

On June 3, The Wall Street Journal reported that Gill had bought a large volume of GameStop options just before his May 12 post. This news led to a 5.36% drop in GameStop’s stock price, according to the filing.

On June 13, Gill posted a screenshot of his GameStop portfolio, revealing that he no longer held the call options but had increased his position in GameStop stock. The lawsuit alleges that Gill profited from these transactions, describing his actions as a pump-and-dump scheme.

The lawsuit aims to recover damages resulting from Gill’s alleged violations of federal securities laws.

“As a result of Defendant's wrongful acts and omissions, and the precipitous decline in the market value of the Company's securities, Plaintiff and other Class members have suffered significant losses and damages,” said the lawsuit.

Why It Matters: Roaring Kitty’s influence among Redditors, especially users of r/WallStreetBets, is significant. Interestingly the latest lawsuit was peppered with memes posted by Gill on social media. The filing noted that one post on May 12 garnered nearly 28.5 million views, 12,000 comments and 135,000 reactions.

Screenshot from the lawsuit filed on June 28, 2024 by Martin Radev.

Following this, on June 4, 2024, Massachusetts’ top securities regulator began investigating Gill’s recent trading activity over potential manipulation.

By June 16, 2024, Gill had accumulated a stake of $262 million in GameStop, leading to discussions about market manipulation in the meme-stock era.

Price Action: On Friday, GameStop shares closed 1.6% lower at $24.69, according to data from Benzinga Pro.

Image Generated With Midjourney

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.