Zinger Key Points

- Smith & Nephew is the second-largest company in the sports management and advanced wound management.

- Smith & Nephew reported that an activist investor, Cevian Capital, had taken a 5% stake.

- How to Spot the Market Bottom: Matt Maley has navigated every major market turn in the last 35 years, and on Wednesday, March 26, at 6 PM ET, he’s revealing how to recognize when the worst is over, the trades to make before the next bull market takes off, and the stocks and sectors that will lead the recovery.

Shares of Smith & Nephew Plc SNN are trading higher on Friday. Smith+Nephew offers a medical technology portfolio across orthopedics, sports medicine, ENT, and advanced wound management.

In an SEC filing, Smith & Nephew reported that an activist investor, Cevian Capital, had taken a 5% stake.

Citing a partner at the Swedish fund, Bloomberg noted that Smith & Nephew has not generated shareholder value for many years. “Cevian sees the potential to create significant long-term value by improving the operating performance of the company’s businesses.”

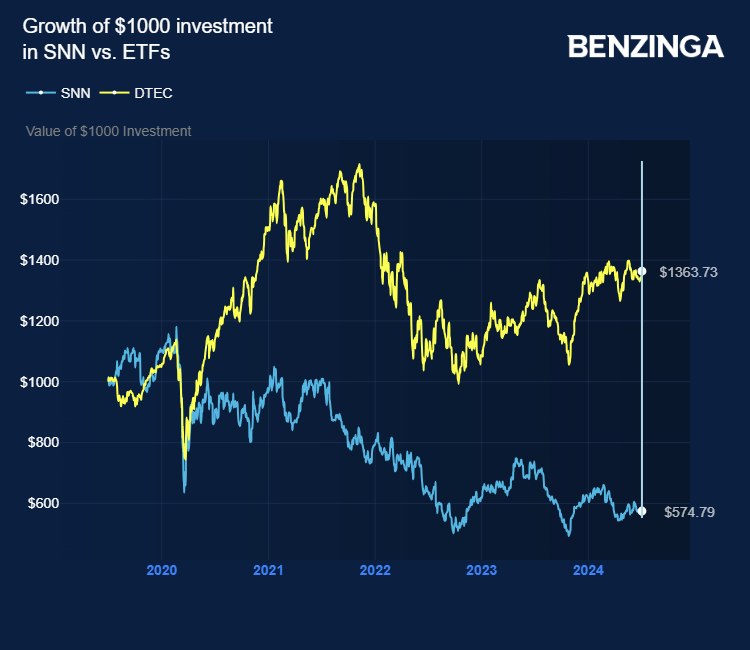

Medical technology firm’s share price performance in the past five years has been lacklustre.

Its market capitalization has fallen from 17 billion pounds in 2019 to 8.6 billion pounds (around $11 billion), with supply chain issues and changes at the top hitting the company’s performance.

Financial Times notes that Smith & Nephew is the second-largest company in the sports management and advanced wound management sectors, while it is the fourth-largest maker of hip and knee implants.

“Cevian sees the potential to create significant long-term value by improving the operating performance of the company’s businesses,” Friederike Helfer, a partner in the fund, told the Financial Times.

In a statement, Smith & Nephew said it had “an open dialogue with our shareholders and will continue to engage with Cevian, as we do with all of our shareholders.”

In the first quarter 2024 trading update, the company said, "Revenue growth in the first quarter was driven by solid performance in our Orthopaedics and Sports Medicine & ENT businesses, partially offset by some anticipated softness in Advanced Wound management.”

Underlying revenue growth is expected between 5.0%-6.0% (4.3% to 5.3% reported), and the trading profit margin is expected to be at least 18.0%.

Price Action: SNN shares are up 8.04% at $27.15 at last check Friday.

Image from Shutterstock

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.