Zinger Key Points

- Technology stocks faced their steepest decline since late 2022, with 75% of Nasdaq 100 constituents in the red.

- The Magnificent Seven ETF fell 5.8%, wiping out $700 billion in market value, with Nvidia losing $180 billion.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Technology stocks endured their steepest decline since late 2022 on Wednesday, with nearly 75% of Nasdaq 100 constituents slipping into the red.

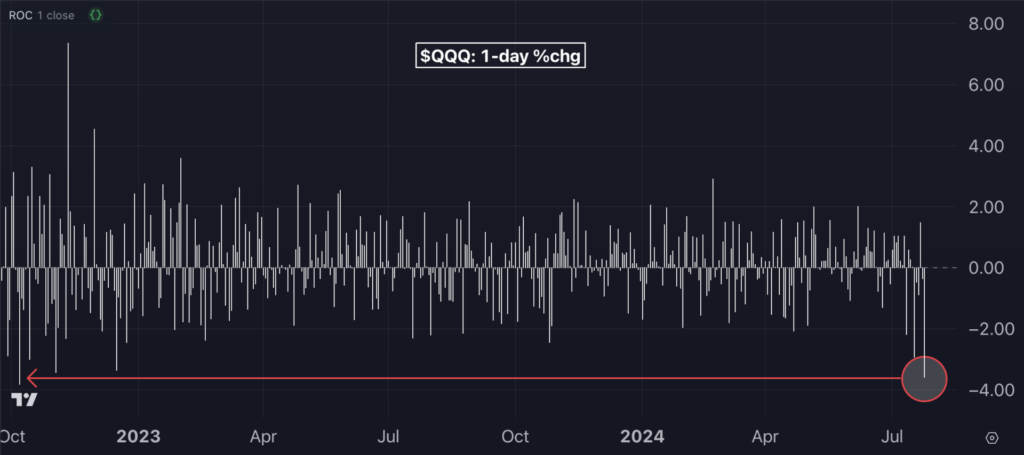

The Nasdaq 100 — tracked by the Invesco QQQ Trust QQQ — dropped 3.6%, marking its fifth decline in six sessions and the sharpest one-day drop since October 2022.

The tech-heavy index fell below its 50-day moving average for the first time since early May. It mostly stayed above this key support level since late October 2023, barring a brief two-week period between April and May.

See Also: GDP Q2 Preview – 5 ETFs To Monitor Thursday As Economic Data Unfolds

Shares of Alphabet Inc GOOG, the parent company of Google, plummeted 4.9% due to higher-than-expected AI spending and disappointing YouTube ad revenue.

Tesla Inc. TSLA shares tumbled 12% following a 7% drop in auto revenue, a profit miss, and delays in the Robotaxi project.

Chip stocks also suffered, with Nvidia falling 6.2%, Broadcom Inc. AVGO losing 7.6%, and Arm Holdings plc ARM sinking 8.2%.

The Magnificent Seven, tracked by the Roundhill Magnificent Seven ETF MAGS, plunged 5.8%. This marks the worst daily performance since the fund’s inception. Collectively, the seven tech giants wiped out nearly $700 billion in market value in a single session, with Nvidia Corp. NVDA alone shedding $180 billion.

Chart: Nasdaq 100 Falls Below 50-Day Moving Average, QQQ Marks Worst Day Since October 2022

The key question now is whether the tech-led bull market is over or the AI bubble is bursting. Investors have also been rotating out of tech since July 11, according to veteran Wall Street investor Ed Yardeni.

The lower-than-expected CPI in June prompted investors to pile into interest-rate-sensitive stocks.

“We agree with that expectation,” Yardeni said, “but we also think it could be a one-and-done rate cut for 2024 because the economy remains resilient.”

“For now, we believe that the stock market was overbought and is experiencing a minor selloff,” he added.

On July 16, the S&P 500 was 15% above its 200-day moving average. Historically, such levels have often preceded 10%-20% corrections or more significant declines during recessions.

This time, the selloff doesn’t seem linked to widespread recession fears, Yardeni says. After all, the Fed is poised to potentially lower interest rates in September.

Now Read:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.