Zinger Key Points

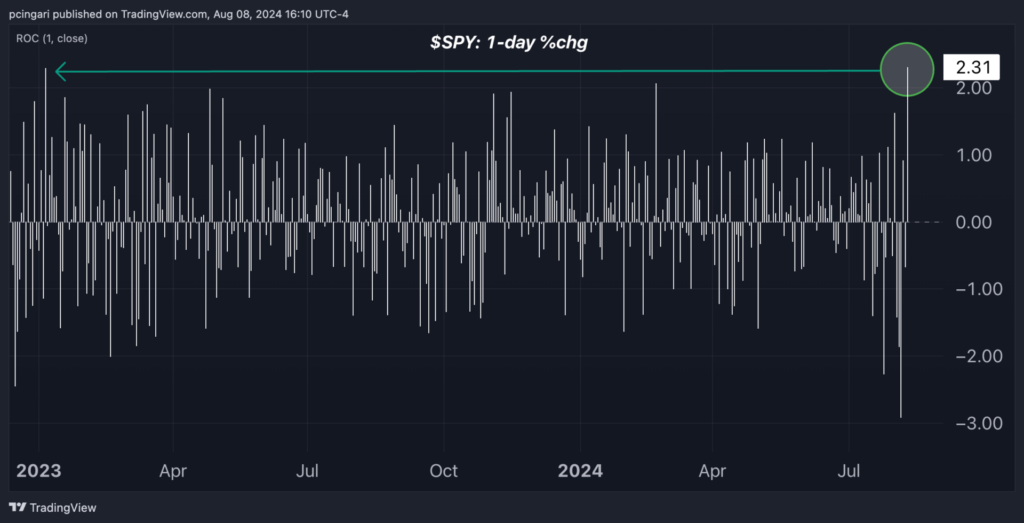

- The S&P 500, tracked by SPDR S&P 500 ETF, gained 2.3%, its best day since January 2023.

- Top tech performers included Arm Holdings up 10.6% and Marvell Technologies up 8.9%.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Wall Street ended Thursday’s session on a positive note, extending midday gains and breaking the recent trend of afternoon declines. Investor sentiment was bolstered by lower-than-expected initial jobless claims last week, alleviating fears of a more structural increase in unemployment potentially leading to a recession.

The S&P 500 index, as tracked by the SPDR S&P 500 ETF Trust SPY, closed Thursday’s session up 2.3%, marking its best daily performance since January 2023.

The tech-heavy Nasdaq 100 index, tracked by the Invesco QQQ Trust QQQ, closed 3.1% higher, marking its best daily performance since February 2023. Despite this rise, the Nasdaq 100 remains 5% below last Thursday’s opening levels but has rallied 5.7% from Monday’s lows.

Within tech stocks, Arm Holdings plc ARM and Marvell Technologies Inc. MRVL were the day’s top performers, up 10.6% and 8.9%, respectively.

Strong gains were also observed in both blue-chip stocks, with the Dow Jones Industrial Average up 1.8%, and small caps, with the iShares Russell 2000 ETF IWM up 2.4%.

Chart: S&P 500 Marks Best Session In 19 Months

Fed’s Barkin Pushes Back Against Labor Market Crisis

Richmond Fed President Tom Barkin, a voting member of the Federal Open Market Committee in 2024, provided key insights during a National Association for Business Economics (NABE) call on Thursday.

Barkin highlighted while companies are slowing their hiring, they are simultaneously not engaging in significant layoffs.

This cautious approach by businesses is reflected in the jobless claims data, which indicate that layoffs are not increasing. Many employers are hesitant to lay off workers remembering the difficulties they faced in hiring two years ago.

Barkin described the economy as “gently moving into a normalizing state,” which he believes will allow for a steady and deliberate normalization of interest rates.

The Richmond Fed President observed that spending patterns are changing. Consumers are still spending but are becoming more selective. Businesses that have raised prices significantly are noticing a more discerning customer base.

“Consumers are still spending, but they’re choosing,” Barkin said, indicating a shift towards more value-based purchasing decisions.

“While inflation is down, prices are still high and I think there are indicators of a choosier customer. And that’s the solution to high prices.”

According to Barkin, inflation is still higher than desired. “The inflation numbers, if you look at those six months of the year, I would categorize them as too disappointing.”

He stressed that while there has been progress, the rate of inflation needs to decline further to align with the Federal Reserve’s targets. Barkin also cautioned about medium-term inflationary pressures. Potential conflicts in the Middle East could impact oil prices, and limited housing supply remains a concern.

Barkin highlighted the importance of monitoring the labor market and inflation data closely in the coming weeks, before making a decision on whether to cut rates in September.

Read Now:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.