Zinger Key Points

- Airbnb website was launched as Airbedandbreakfast.com on Aug. 11, 2008.

- The average analysts' one-year price target for Airbnb is $130.38, suggesting roughly 18% upside from current levels.

- Markets are swinging wildly, but for Matt Maley, it's just another opportunity to trade. His clear, simple trade alerts have helped members lock in gains as high as 100% and 450%. Now, you can get his next trade signal—completely free.

San Francisco, California-headquartered Airbnb, Inc. ABNB has completed 26 years of existence as a company, having launched on Aug. 11, 2008. This community-based vacation rental company is an online platform for listing and renting local homes. Here’s a brief look back at how it came into being and its history as a public company and how investment-worthy the stock has been.

The Beginning: The cliched phrase of humble beginnings applies to Airbnb as Brian Chesky, one of its co-founders, hit upon an ingenious way to finance his home rental in affluent San Francisco. The cash-strapped would-be entrepreneur along with fellow co-founder Joe Gebbia, offered “Air, bed and breakfast” – a package of three airbeds, breakfast, Wi-Fi and a desk to attendees of an Industrial Design Conference, who could not get hotel reservations and needed lodging over the weekend.

The duo were joined by Harvard University graduate Nathan Blecharczyk in February 2008, and the website Airbedandbreakfast.com launched on Aug. 11, 2008. As the business was slack, the co-founders sold cereal boxes to former President Barack Obama and John McCain, who contested against him in the 2008 presidential election.

Subsequently, the company was successful in raising capital from several venture capital firms, including Y Combinator, Youniversity Ventures Partners, Sequoia Capital, Greylock Partners and TPG Capital.

International Foray & Acquisitions: The company launched in Europe in May 2011 through its acquisition of Accoleo and it was quick with its international expansion then on. It had launched in South America, Asia and Australia by the end of 2012.

After the Summer Olympics of 2012, Airbnb acquired London-based rival CrashPadder, which brought 6,000 international listings to its inventory. Among its other acquisitions were NabeWise, a city guide that aggregated curated information for specified locations and Localmind, a location-based question-and-answer platform that allows users to post questions about specific locations online.

See Also: How to Buy Airbnb (ABNB) Stock

Airbnb IPO: In Aug. 2020, Airbnb announced it had confidentially filed for its initial public offering and two months later, it filed a prospectus with the SEC on the S-1 Form. The company offered 51.32 million shares to the public at a price of $68 apiece. The stock opened at $146 on the debut session (Dec. 10, 2020) and closed at $144.71.

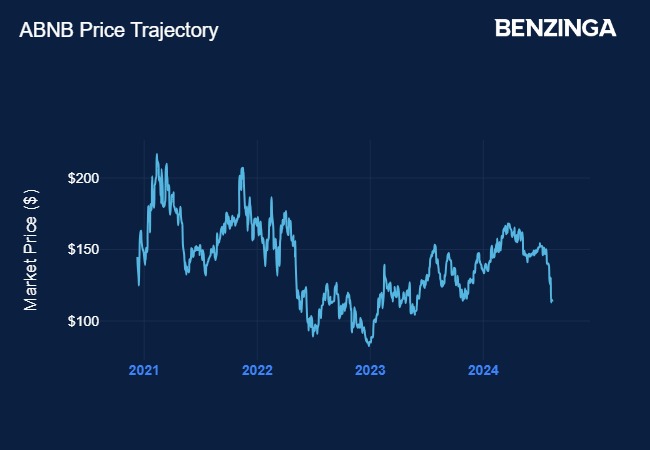

After trading in a broad range through the next year, the stock went down along with the broader market in 2022, falling to an all-time low of under $82 in late 2022. It staged a recovery through March 2024, when it peaked above $170 but has since then seen a downturn.

Source: Benzinga

Airbnb Key Metrics: The financial report for the fourth quarter of 2023 that was released in mid-February showed revenue of $9.9 billion, up 18% year-over-year, and net income of $4.8 million. It reported $3.7 billion in adjusted EBITDA and $3.8 billion in free cash flow.

Among operational metrics, gross booking value climbed 16% in 2023 to $73.3 billion and “nights and experiences booked, climbed 14% to $448.2 million. The company noted accelerating growth in under-penetrated markets.

Returns From Airbnb: If an investor committed a hypothetical sum of $1,000 in Airbnb at the debut session’s closing price of $144.71, he would be in possession of 6.91 shares. These shares would be worth $785.2 now, a negative return of roughly $215 or a negative 22% in percentage terms.

The average analysts’ one-year price target for Airbnb is $130.38, according to TipRanks, suggesting roughly 18% upside from current levels.

Following its second-quarter results released earlier this month, Needham analyst Bernie McTernan reiterated a Hold rating on the share. The quarterly results and guidance, according to the analyst, will keep investors on tenterhook, as key operational metrics saw a moderation in growth in the second quarter. The company hinted at further moderation ahead.

“We expect to hear a greater investor push for ABNB to move beyond its core, although it does not appear to be in the near-term plans,” he said. “The stock is in a difficult position as they comp significant success in TAM and margin expansion over the past 4 years with an undefined catalyst path from here.”

Airbnb stock closed Monday’s session down $1.27 at $113.62, according to Benzinga Pro data.

Read Next:

Image Via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.