Zinger Key Points

- Mortgage applications surge 16.8% for the week ending Aug. 9, the largest weekly increase since January 2023.

- Refinance Index soars 35%, marking its highest weekly gain since May 2022, and it's up 118% year-over-year.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get Matt’s next trade alert free.

Mortgage applications skyrocketed by 16.8% in the week ending Aug. 9, according to data released Wednesday by the Mortgage Bankers Association.

This impressive increase follows a 6.9% rise in the previous week and represents the largest one-week jump since January 2023.

The surge comes despite the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) remaining relatively stable at 6.54%, compared to 6.55% the week before.

Refinance Activity Hits Highest Level Since May 2022

The Refinance Index, which is highly sensitive to interest rate changes, surged by 35% from the previous week, marking a 118% increase compared to the same week last year.

This sharp rise is the highest weekly gain for the Refinance Index since May 2022.

Consequently, the refinance share of mortgage activity grew to 48.6% of total applications, up from 41.7% the previous week. Additionally, the share of adjustable-rate mortgage (ARM) applications increased to 7.3% of total applications.

Read Now: ‘True’ US Debt Is $175 Trillion: Former Coinbase CTO On ‘Unpayable’ Crisis

Joel Kan, MBA's vice president and deputy chief economist, commented on the data, stating, “Rates on both 30- and 15-year fixed-rate mortgages decreased for the second consecutive week, and combined with the previous week's rate moves, spurred another strong week for application activity as borrowers with higher rates took the opportunity to refinance.”

Kan also highlighted that purchase applications increased by 3%, with modest gains across various loan types, suggesting that prospective homebuyers are gradually returning to the market.

Mortgage-Linked Stocks Soar To September 2022 Levels

The recent surge in mortgage activity has positively impacted mortgage-linked stocks, pushing them to their highest levels since September 2022.

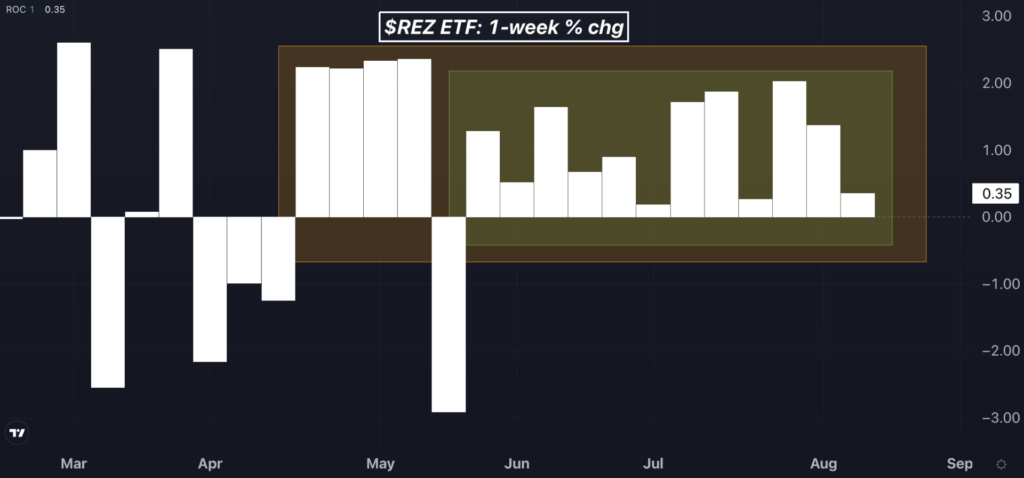

The iShares Residential and Multisector Real Estate ETF REZ rose 0.3% on Wednesday, putting it on track to close the session at its highest point since September 2022.

Notably, the ETF has posted gains for 12 straight weeks, achieving its longest winning streak since the fund’s launch in 2007. Additionally, the fund has closed in the green 16 out of the last 17 weeks.

Below are the top-performing stocks in the REZ ETF year-to-date:

| Name | Ytd Return (%) |

| Diversified Healthcare Trust DHC | 310.64 |

| National Health Investors, Inc. NHI | 37.44 |

| Welltower Inc. WELL | 33.37 |

| UMH Properties, Inc. UMH | 31.73 |

| Independence Realty Trust, Inc. IRT | 31.51 |

Read Next:

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.