Zinger Key Points

- U.S. labor market growth slowed, with 818,000 nonfarm payrolls revised downward from April 2023 to March 2024.

- Fed rate-cut expectations rose, pushing down the U.S. dollar and boosting utilities; gold reacted positively, while oil prices fell.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

The U.S. labor market’s seemingly gravity-defying growth has been tempered by revisions to employment gains from April 2023 to March 2024.

The American economy has seen 818,000 nonfarm payrolls, previously reported in official government statistics, vanish into thin air.

This downward revision reduces the average monthly job gains to around 175,000, down from the originally reported 242,000.

The most significant declines occurred in professional and business services (-358,000 for the year), leisure and hospitality (-150,000), retail trade (-129,000), and manufacturing (-115,000).

On the other hand, there were upward revisions in private education and health services (+87,000) and transportation and warehousing (+56,400).

The immediate takeaway from this data is that the U.S. labor market was not as hot as initially perceived, although job gains have still been solid, amounting to approximately 2.1 million annually through March 2024.

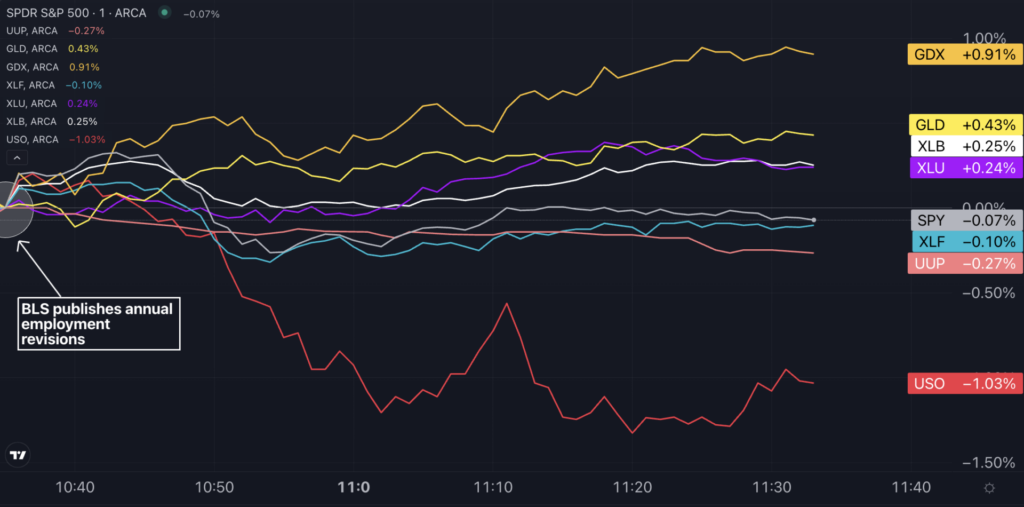

Market Reactions: Dollar Falls As Rate-Cut Bets Increase, While Utilities, Gold Miners Rally

The downward revision to annual payroll data has heightened expectations for aggressive Fed rate cuts, with speculators increasingly betting on a 50-basis-point cut in September. According to the CME Group Fed Watch tool, the probability of this outcome has risen to 34.5%, up from 29% the previous day.

Traders are now fully pricing in that the federal funds rate will approach 4.25%-4.5% by the end of the year, implying a full percentage point cut from current levels.

This shift in interest rate expectations triggered a negative reaction in the U.S. dollar, with the Invesco DB USD Index Bullish Fund ETF UUP erasing earlier gains.

In contrast, gold prices reacted positively following the release, although the SPDR Gold Trust GLD remained in negative territory at 11:20 a.m. ET, down 0.2%.

Growth-sensitive commodities like oil declined, with the United States Oil Fund USO falling more than 1% after the data release, and down 0.3% for the day.

While the S&P 500 remained largely unchanged, notable sector movements emerged. The Financial Select Sector SPDR Fund XLF dropped sharply following the data release, while the Materials Select Sector SPDR Fund XLB and Utilities Select Sector SPDR Fund XLU saw gains.

Within industries, gold miners experienced a turnaround, with the VanEck Gold Miners ETF GDX flipping from session losses to gains.

Chart: 7 ETFs React To The Downward Revision In Employment Statistics

Read Next:

Image created using artificial intelligence via Midjourney.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.