Zinger Key Points

- Gold reaches record $2,530 per ounce as Powell hints at the start of interest rate cuts.

- Interest-sensitive sectors soar; small-caps and real estate in the lead.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Jerome Powell's interest rate remarks Friday ignited a rally in stocks, bonds, and commodities, while the U.S. dollar plunged as traders solidified their bets on rate cuts.

Financial markets responded positively to Fed chair Powell’s remarks at the Jackson Hole symposium, where he said the ‘”time has come for policy to adjust.”

The Fed chair said he is more confident the economy is on a sustainable path back to the 2% inflation target, allowing the Fed to finally shift its focus to labor market conditions.

“We do not seek or welcome further cooling in labor market conditions,” he said, adding the Fed has “ample room to respond” by adjusting its policy should further weakening in labor market conditions occur.

7 Key ETFs React To Powell’s Jackson Hole Speech

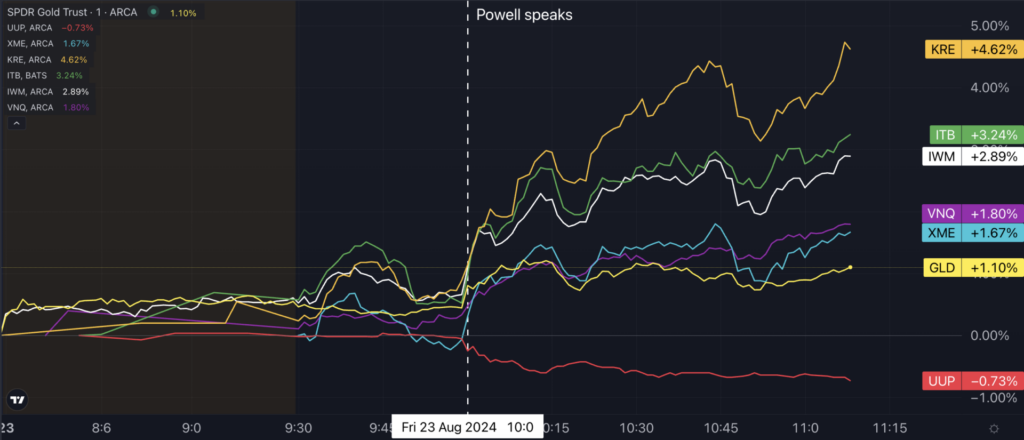

A greenback gauge, as tracked by the Invesco DB USD Index Bullish Fund ETF UUP, tumbled by 0.7% at 11 a.m. ET., extending its weekly decline to 1.4% — the worst performance it has recorded this year.

Driven by expectations of lower interest rates and a weakening dollar, gold prices surged to a new all-time high of $2,530 per ounce following the speech, with the SPDR Gold Trust GLD climbing by 1.1%.

Wall Street initially rallied before paring back some gains as traders assess the economic outlook.

Small caps, instead, substantially outperformed large-cap indices. The iShares Russell 2000 ETF IWM soared 2.9%, on track for its strongest session since July 16.

Within sectors, real estate stocks rallied, with the Vanguard Real Estate ETF VNQ up 1.8%, hitting the highest levels since September 2022.

Interest-rate sensitive industries saw significant gains following Powell’s remarks, with homebuilders, regional banks and miners leading the market.

The SPDR S&P Regional Banking ETF KRE jumped 4.6%, while the iShares U.S. Home Construction ETF ITB climbed 3.2%, and the SPDR S&P Metals & Mining ETF XME advanced 1.7%.

Don't miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference Oct. 9-10 at the Chicago Marriott Downtown Magnificent Mile.

Read Next:

Jerome Powell and Wall Street illustration. Photo: Federalreserve/Flickr Photo: Bylolo/Unsplash

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.