CNBC’s Jim Cramer suggested on Tuesday that NVIDIA Corp. NVDA may have reached a key turning point after the stock touched $127, potentially signaling a bottom for the semiconductor giant’s recent pullback.

What Happened: “We may have hit a possible crescendo for Nvidia’s stock when it hit the $127 mark. Could be a moment where everyone who wanted to sell did so,” Cramer wrote on X, formerly Twitter. This marks a shift from his Monday warning when he predicted a “vicious” and “fast” reversal for the chipmaker.

Nvidia shares closed Tuesday at $130.39, down 1.22%, before gaining 0.53% in after-hours trading. Despite recent volatility, the stock has maintained an impressive 170.69% gain year-to-date, largely fueled by artificial intelligence demand.

See Also: Nissan Stock Soar Over 20% On Merger Talks With Honda, Mitsubishi Spikes

Why It Matters: The company’s fundamental strength remains evident in its recent financial performance, with third-quarter revenue surging 94% year-over-year to $35.1 billion. Nvidia’s market capitalization stands at $3.21 trillion, with a price-to-earnings ratio of 53.

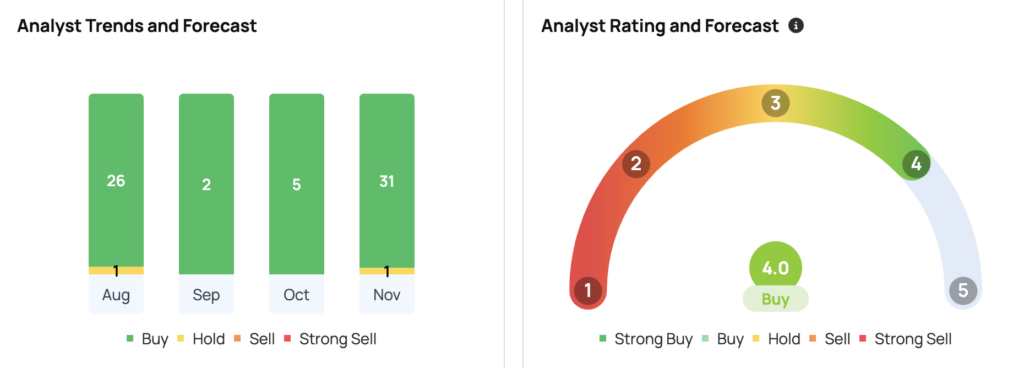

Wall Street maintains an optimistic outlook, with 40 analysts setting an average price target of $170.56. Rosenblatt Securities leads with the most bullish target of $220, while New Street Research sets a more conservative target of $120, according to Benzinga Pro data.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.