Coffee chain Dutch Bros Inc. BROS saw its shares soar nearly 25% in after-hours trading Wednesday following stronger-than-expected fourth-quarter results and an optimistic 2025 outlook, drawing praise from CNBC’s Jim Cramer.

What Happened: “Cramer-fave Dutch Bros crushes it. As watchers know, these guys are the real deal,” Cramer wrote on X, formerly Twitter, after the earnings release.

The drive-through beverage company reported earnings of 7 cents per share, exceeding analyst estimates of 2 cents. Revenue jumped to $342.8 million, beating expectations of $317.8 million and marking a significant increase from $254.12 million in the same quarter last year.

CEO Christine Barone highlighted the company’s impressive performance, noting a 35% revenue growth and system same-shop sales growth of 6.9%. “We believe our brand is resonating with customers, as we delivered 2.3% system same-shop transaction growth, the largest year-over-year increase in over two years,” Barone said.

Why It Matters: The company’s expansion continues to accelerate, with 32 new shops opened in the fourth quarter, including 25 company-operated locations. Company-operated shop revenues increased 38.2% to $314.2 million compared to the previous year.

Looking ahead, Dutch Bros projects fiscal 2025 revenue between $1.55 billion and $1.57 billion, with plans to open at least 160 new system shops.

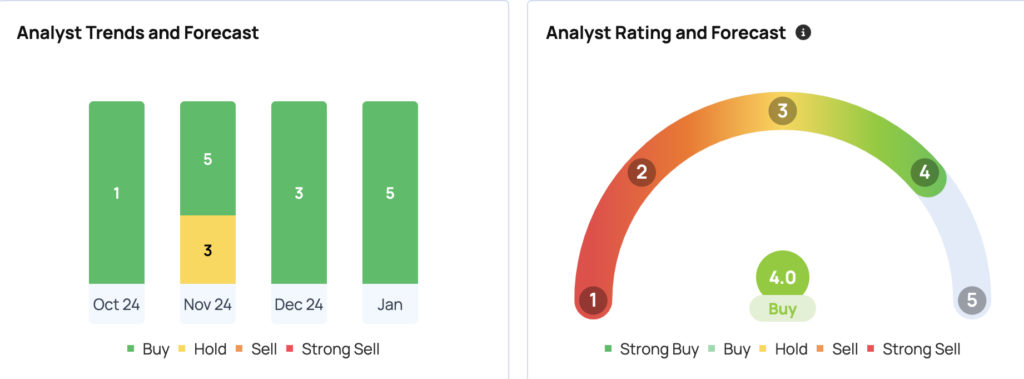

While the stock has gained over 130% in the past year, recent analyst consensus shows a mixed outlook. The latest ratings from B of A Securities, Jefferies, and Stifel in January 2025 suggest an average price target of $67.67, indicating a potential downside from current after-hours trading levels.

Price Action: The stock closed at $64.71 on Wednesday before surging to $80.79 in after-hours trading, pushing its market capitalization above $9 billion, according to data from Benzinga Pro.

Read Next:

- Trump-Putin ‘Highly Productive’ Call Sparks Oil Sell-Off As Investors Eye Geopolitical De-Escalation

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.