NVIDIA Corp. NVDA reported fourth-quarter revenue of $39.3 billion, representing an extraordinary growth trajectory that has seen quarterly revenue multiply nearly eight times in just five years, according to data shared Wednesday by The Kobeissi Letter.

What Happened: The chipmaker’s daily revenue reached $427 million throughout the fourth quarter, with data center sales—primarily from AI-focused GPUs—surging 93% year-over-year to $35.6 billion, now accounting for over 90% of total revenue.

Despite beating analyst expectations with earnings per share of $0.89 versus $0.84 expected and revenue exceeding forecasts by $1 billion, NVDA shares traded slightly lower after the announcement, continuing a pattern of muted post-earnings reactions.

Analyst John Kicklighter noted that the stock exhibited “lots of volatility, but no clear direction,” with a range of approximately 8% from the spot relative to Nvidia.

RiskReversal Co-Founder Guy Adami expressed concern about potential margin deceleration, telling CNBC, “If margins start to decelerate, that’s when these stories typically get long in the tooth.”

Why It Matters: CEO Jensen Huang highlighted increasing computational demands in AI, saying that next-generation models require “100 times more compute” than earlier versions. He specifically cited DeepSeek’s R1, OpenAI’s GPT-4, and xAI’s Grok 3 as examples of models using intensive reasoning processes.

“DeepSeek was fantastic,” Huang said, praising its open-source reasoning model despite the company’s stock dropping 17% in January over concerns that DeepSeek had found ways to achieve better AI performance with lower infrastructure costs.

Nvidia forecasts first-quarter revenue of $43 billion, topping estimates of $41.75 billion. Huang says Blackwell AI supercomputers saw “billions in sales” in their first quarter as the company ramped up “massive-scale production.”

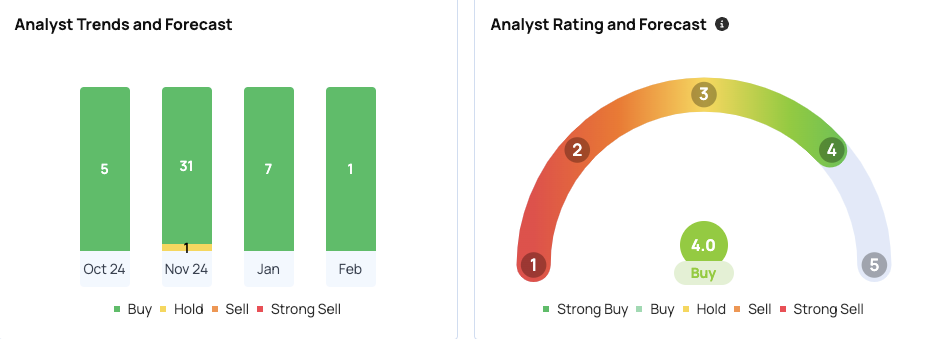

NVDA currently has a consensus price target of $172.28 based on 40 analysts, with recent targets from Rosenblatt, Morgan Stanley, and Tigress Financial implying a potential 52.59% upside.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.