Zinger Key Points

- Enphase Energy stock has dropped 31.1% year-to-date, with bearish technical indicators signaling further downside.

- Analysts remain cautious, lowering price targets ahead of Enphase's Q3 earnings report due after market close.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-Day free trial now.

Enphase Energy Inc. ENPH is gearing up to report its third-quarter earnings after the market closes on Tuesday. Wall Street expects 77 cents per share and revenue of $391.98 million.

Investors, however, may be less optimistic. The solar energy stock has been under a cloud, dropping 31.10% year-to-date and slipping 6.10% over the past year. Most notably, the stock has taken a sharp dive of 22.72% in the past month as market sentiment soured ahead of the earnings report.

The Charts Show A Shadow Over Enphase Stock

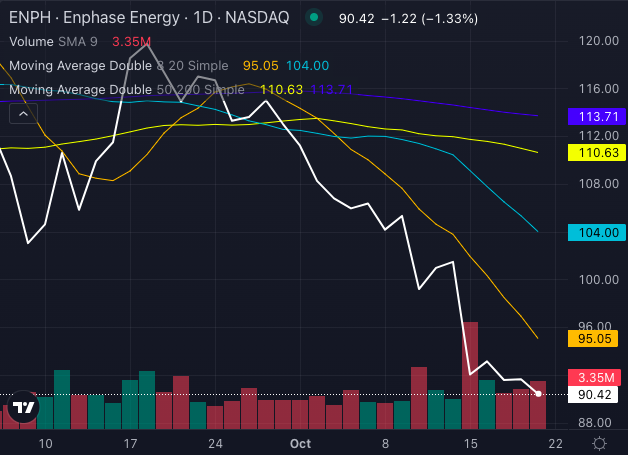

As the company heads into its quarterly results, the technical charts don't paint a sunny picture for Enphase Energy's stock.

Chart created using Benzinga Pro

Enphase's technical setup shows the stock trading well below key moving averages, suggesting more downside pressure. The share price of $90.42 is sitting beneath the eight-day, 20-day and 50-day simple moving averages, all of which indicate a bearish trend.

The stock is also well below its 200-day moving average of $113.71, underscoring the extent of the stock’s current slump. Despite some signs of buying pressure, the trend remains firmly downward.

Momentum Indicators Leave Enphase Feeling The Heat

Chart created using Benzinga Pro

Momentum indicators are also adding to the gloom. The Moving Average Convergence Divergence (MACD) is at a negative 5.67, which suggests further selling pressure.

The Relative Strength Index (RSI) is hovering at 28.06, signaling that the stock is oversold, which could hint at a short-term bounce.

However, this oversold condition alone might not be enough to reverse the larger negative trend. Enphase is trading close to the lower end of its Bollinger Bands, which range from $88.09 to $125.32, indicating the stock is under significant pressure as earnings loom.

Read Also: Goldman Sachs Highlights 20 Top Short-Squeeze Opportunities For Q3 Earnings Season

Analysts Are Cooling Off On Enphase

Analysts have been lowering their price targets for Enphase Energy stock as well.

Citi recently trimmed its target from $114 to $99, maintaining a Neutral rating, while Piper Sandler lowered its target from $115 to $105. Royal Bank of Canada followed suit, downgrading the stock from outperform to sector perform, with a revised target of $100, down from $125.

The consensus rating on the stock remains neutral, reflecting a wait-and-see attitude as the company prepares to release its earnings.

Will Earnings Be The Sunshine Enphase Needs?

At the time of publication, Enphase Energy is trading at $90.20, well below its recent highs and far from its key technical levels.

With bearish signals from the charts and lower expectations from analysts, investors are hoping that Enphase Energy's third-quarter results can turn things around.

Until then, the outlook remains dim.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.