Key Points:

- The optimism seen at the begging of the week faded with coronavirus-related headlines.

- Focus this Wednesday on the EU Commission Economic Growth Forecasts.

- EUR/USD retains a mildly positive technical stance in the short-term.

The EUR/USD pair is finishing Tuesday a handful of pips below the 1.1300 level, down for the day but off its daily low of 1.1258. The American currency appreciated intraday on the back of a downbeat market mood throughout the first half of the day, with Asian and European indexes closing in the red. In the US, the Nasdaq reached a fresh all-time high, but the DJIA and the S&P posted substantial losses. Coronavirus-related headlines drove the sentiment down, as the number of new cases not only in the US continues to increase.

The macroeconomic calendar had little to offer, as Germany published May Industrial Production, which missed the market’s expectations, up by 7.8% in the month and down by 19.3% when compared to a year earlier. The US, on the other hand, released the IBD/TIPP Economic Optimism, which resulted in 44 in July, down from the previous 47, and the May JOLTS Job Opening report, which improved to 5.397M in the month. This Wednesday, the EU will publish the EU Commission Economic Growth Forecasts, relevant in the current pandemic context. The US won’t publish relevant macroeconomic data.

EUR/USD Short-Term Technical Outlook

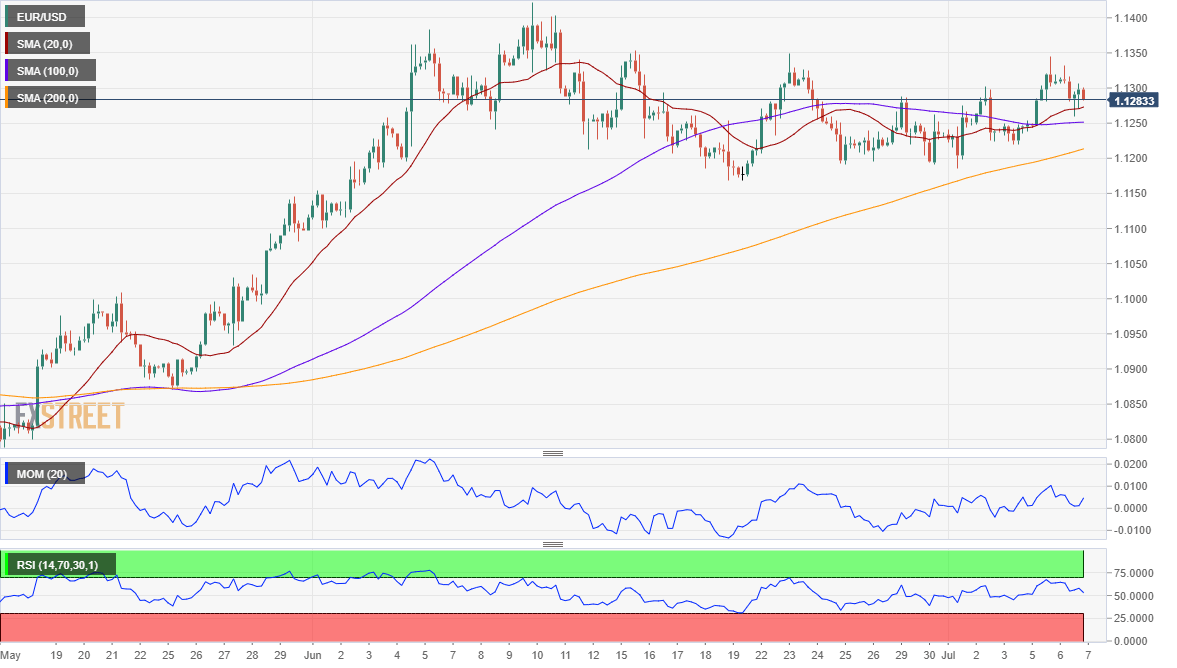

The EUR/USD pair is trading around 1.1280 ahead of the Asian opening, maintaining a positive tone in the short-term but lacking bullish momentum. The 4-hour chart shows that the pair is comfortable above a Fibonacci level at 1.1270 and above all of its moving averages, while technical indicators are directionless within positive levels. The pair has an immediate resistance at 1.1310 but would need to break above the weekly high at 1.1345 to gain bullish potential.

Support levels: 1.1270 1.1220 1.1170

Resistance levels: 1.310 1.1345 1.1390

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.