Benzinga recently had a chance to speak with Leav Graves, founder of Option Samurai about option trading and the current state of the stock market. Here’s some of the insight that he shared.

What are your preferred option trading strategies?

There are countless option trading strategies out there with varying degrees of complexity. When Benzinga asked Graves if there are particular option trading strategies he prefers, he listed selling out-of-the money calls on an existing position and/or buying protective puts on an existing position as simple but effective option trading strategies.

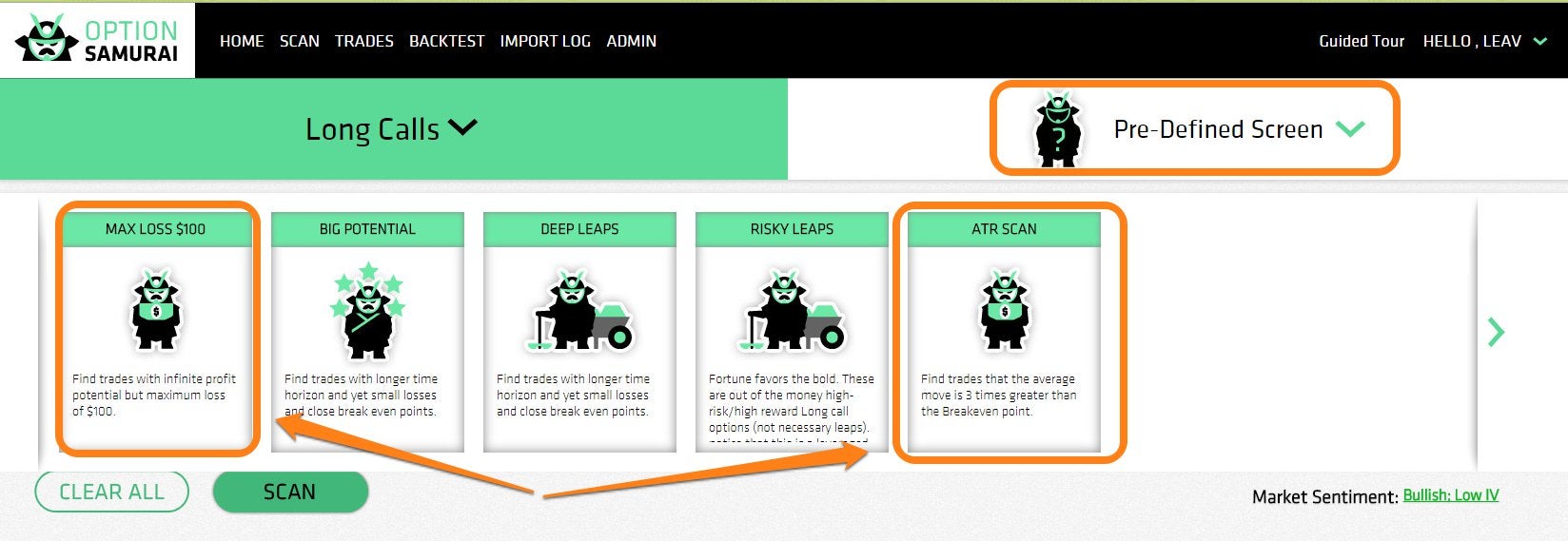

“If you want to initiate new positions, you can try buying a call to replace a stock position or a naked put/covered call to gain income,” Graves added. He suggests the Option Samurai screens pictured below as a good starting point.

What kind of insights can stock traders gain from watching the options

market?

According to Graves, the best things for stock traders to watch for in the options market are market extremes, which may happen only a couple of times per year. Graves says that extreme swings in the options market tend to be counter indicators of things to come in the stock market, and used the VIX Volatility Index as an example.

“The VIX often rises when [stock] markets fall and vice versa. If the VIX is at the lowest value of the year or the highest value of the year, it usually serves as a counter indicator, at least for the short term.”

What stocks do you like?

Graves mentioned JPMorgan Chase & Co JPM and International Business Machines Corp IBM as two stocks that he likes at the moment. Graves’ bullish stance on the two stocks is based mostly on company fundamentals, but he uses the scanners at Option Samurai to select option trading strategies base on what is happening in the options market.

What advice do you have for inexperienced option traders?

According to Graves, the most important thing for new option traders to remember is to start small. “In the beginning, trade in order to learn; profit is the secondary objective.”

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.