Someone with a lot of money to spend has taken a bearish stance on Freeport-McMoRan FCX.

And retail traders should know.

We noticed this today when the big position showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with FCX, it often means somebody knows something is about to happen.

So how do we know what this whale just did?

Today, Benzinga's options scanner spotted 39 uncommon options trades for Freeport-McMoRan.

This isn't normal.

The overall sentiment of these big-money traders is split between 38% bullish and 61%, bearish.

Out of all of the special options we uncovered, 8 are puts, for a total amount of $472,799, and 31 are calls, for a total amount of $3,521,237.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $65.0 for Freeport-McMoRan over the last 3 months.

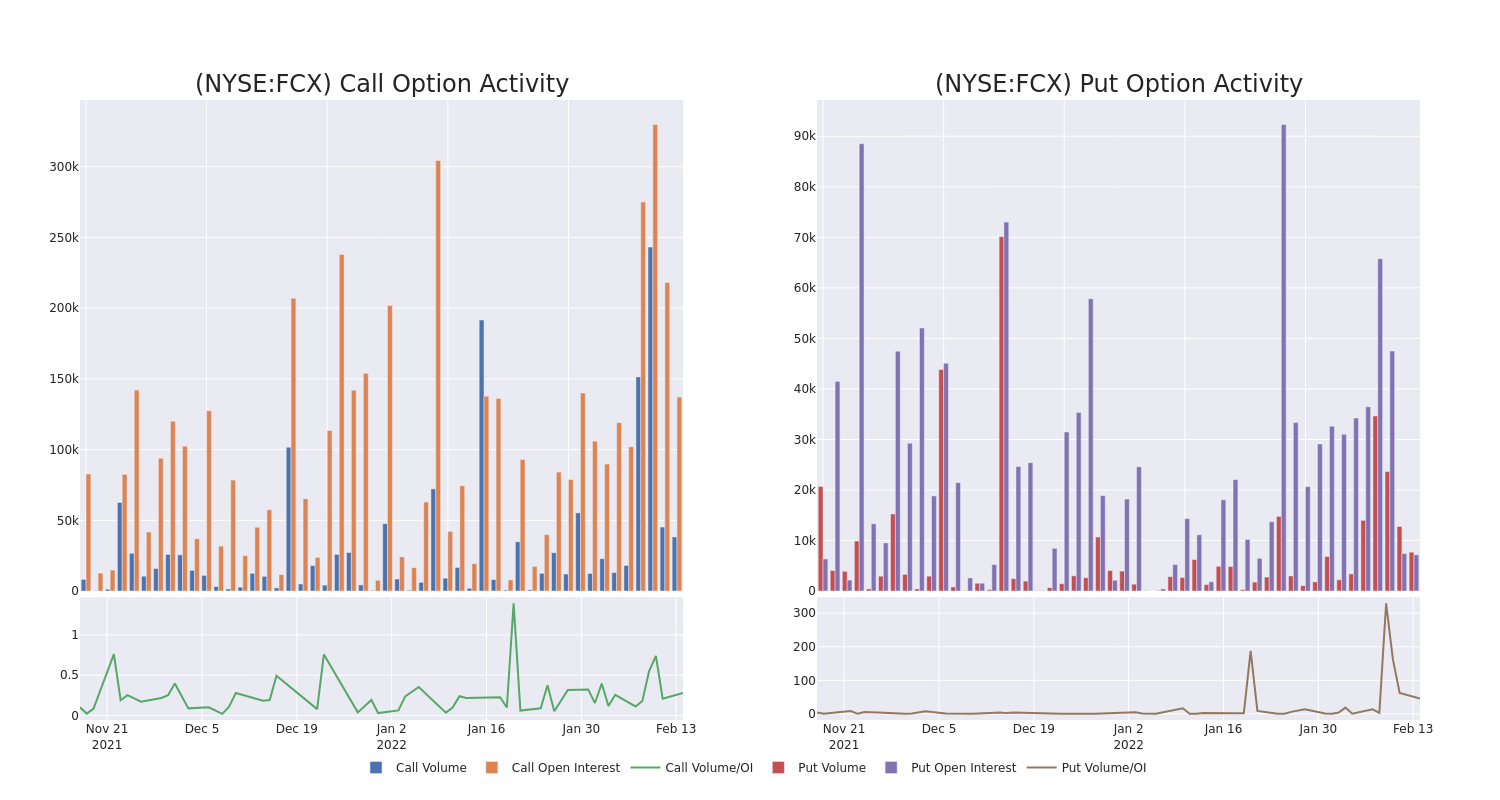

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Freeport-McMoRan's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Freeport-McMoRan's whale trades within a strike price range from $3.0 to $65.0 in the last 30 days.

Freeport-McMoRan Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| FCX | CALL | TRADE | BULLISH | 04/14/22 | $45.00 | $1.0M | 2.9K | 5.0K |

| FCX | CALL | TRADE | NEUTRAL | 03/18/22 | $37.00 | $725.0K | 21.3K | 1.2K |

| FCX | CALL | SWEEP | BULLISH | 02/25/22 | $34.00 | $161.0K | 401 | 200 |

| FCX | PUT | TRADE | BEARISH | 08/19/22 | $42.00 | $140.0K | 112 | 250 |

| FCX | CALL | TRADE | BEARISH | 06/17/22 | $30.00 | $128.0K | 2.5K | 0 |

Where Is Freeport-McMoRan Standing Right Now?

- With a volume of 7,801,290, the price of FCX is down -0.48% at $42.59.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 66 days.

What The Experts Say On Freeport-McMoRan:

- Raymond James has decided to maintain their Outperform rating on Freeport-McMoRan, which currently sits at a price target of $49.

- Deutsche Bank has decided to maintain their Hold rating on Freeport-McMoRan, which currently sits at a price target of $40.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you are already an options trader or would like to get started, head on over to Benzinga Pro. Benzinga Pro gives you up-to-date news and analytics to empower your investing and trading strategy.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.