Investors with a lot of money to spend have taken a bearish stance on VMware VMW.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VMW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 15 uncommon options trades for VMware.

This isn't normal.

The overall sentiment of these big-money traders is split between 46% bullish and 53%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $401,320, and 8 are calls, for a total amount of $317,635.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $175.0 for VMware over the recent three months.

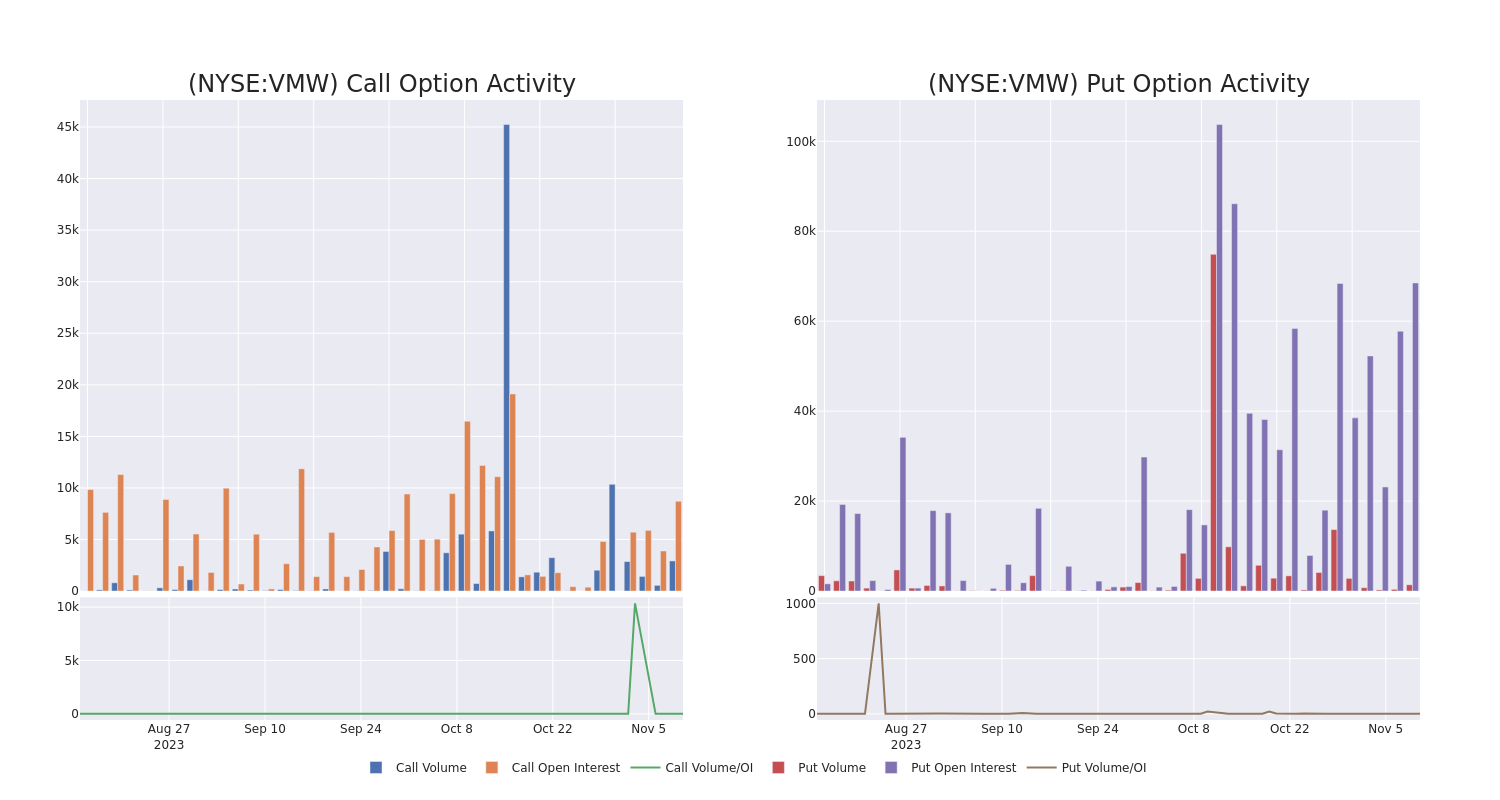

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for VMware's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of VMware's whale activity within a strike price range from $100.0 to $175.0 in the last 30 days.

VMware Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| VMW | PUT | TRADE | BEARISH | 01/19/24 | $175.00 | $102.5K | 334 | 25 |

| VMW | PUT | TRADE | BULLISH | 01/19/24 | $142.60 | $77.0K | 23.3K | 117 |

| VMW | PUT | TRADE | BEARISH | 01/19/24 | $140.00 | $60.0K | 30.3K | 648 |

| VMW | PUT | TRADE | BEARISH | 01/19/24 | $145.00 | $59.4K | 3.1K | 67 |

| VMW | CALL | TRADE | BEARISH | 11/17/23 | $100.00 | $51.2K | 1 | 49 |

About VMware

VMware is an industry titan in virtualizing IT infrastructure and became a stand-alone entity after spinning off from Dell Technologies in November 2021. The software provider operates in three segments: licenses; subscriptions and software as a service; and services. VMware's solutions are used across IT infrastructure, application development, and cybersecurity teams, and the company takes a neutral approach to being the cohesion between cloud environments. The Palo Alto, California, firm operates and sells on a global scale, with about half its revenue from the United States, through direct sales, distributors, and partnerships.

After a thorough review of the options trading surrounding VMware, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is VMware Standing Right Now?

- Currently trading with a volume of 120,883, the VMW's price is up by 0.34%, now at $149.6.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 11 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest VMware options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.