Financial giants have made a conspicuous bearish move on Seagen. Our analysis of options history for Seagen SGEN revealed 19 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 68% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $153,750, and 15 were calls, valued at $950,993.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $205.0 and $225.0 for Seagen, spanning the last three months.

Analyzing Volume & Open Interest

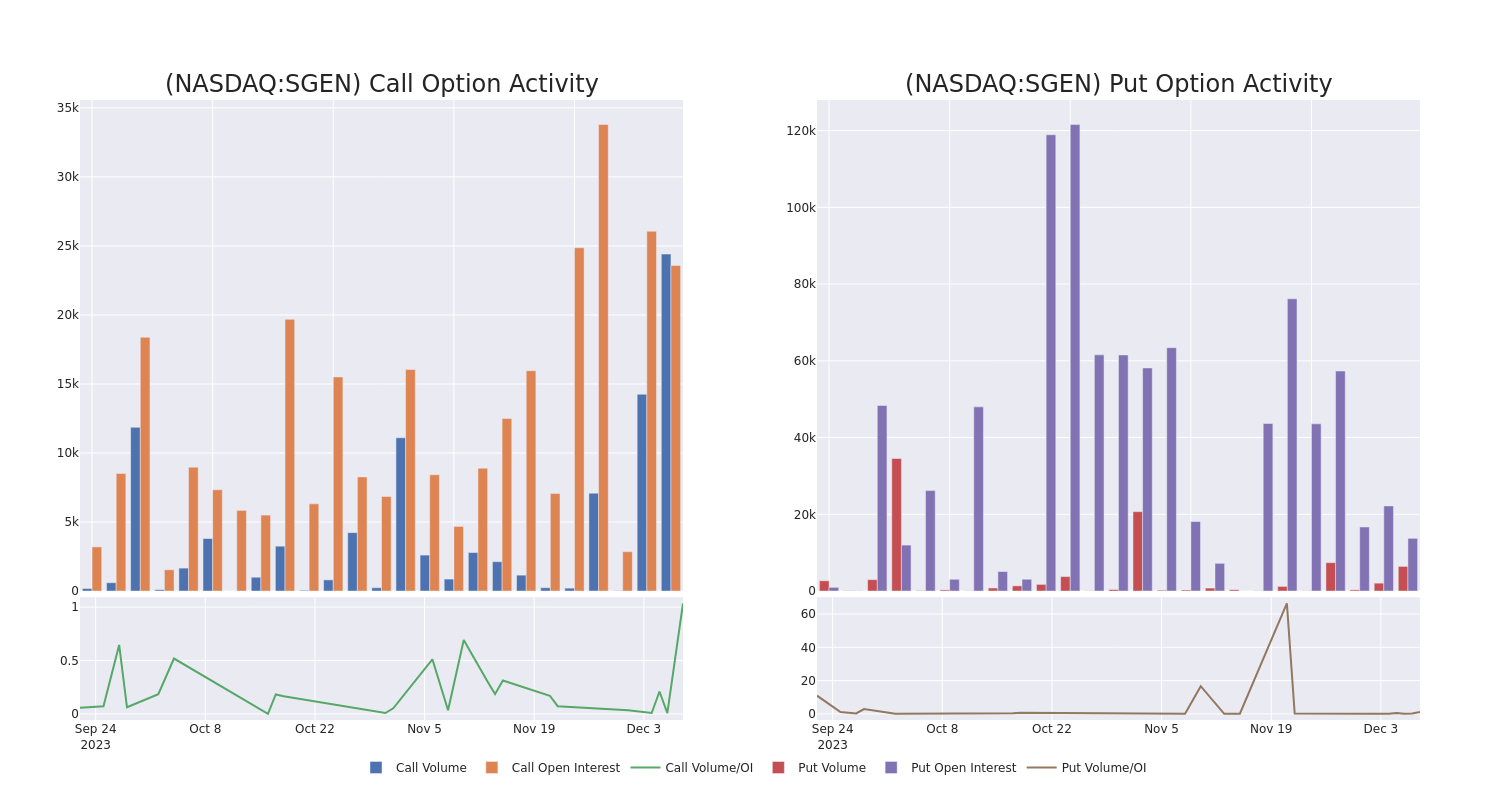

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Seagen's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Seagen's significant trades, within a strike price range of $205.0 to $225.0, over the past month.

Seagen 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| SGEN | CALL | TRADE | BEARISH | 12/15/23 | $220.00 | $270.0K | 13.4K | 0 |

| SGEN | CALL | TRADE | BULLISH | 12/15/23 | $220.00 | $165.0K | 13.4K | 1.3K |

| SGEN | CALL | SWEEP | BEARISH | 02/16/24 | $215.00 | $81.2K | 313 | 327 |

| SGEN | CALL | TRADE | BEARISH | 01/19/24 | $210.00 | $76.0K | 4.7K | 10 |

| SGEN | PUT | TRADE | BULLISH | 03/15/24 | $205.00 | $42.5K | 0 | 202 |

About Seagen

Seagen (formerly known as Seattle Genetics) is a biotech firm that develops and commercializes therapies to treat cancers. Seagen's therapies are based on antibody-drug conjugate technology that utilizes the targeting ability of monoclonal antibodies to deliver cell-killing agents directly to cancer cells. The company's lead product, Adcetris, has received approval for six indications to treat Hodgkin lymphoma and T-cell lymphoma. Other approved products include Padcev for bladder cancer, Tukysa for breast cancer, and Tivdak for cervical cancer. The company has several other oncology programs in pivotal trials. Seagen also licenses its antibody-drug conjugate technology to several leading biotechnology and pharmaceutical companies.

Following our analysis of the options activities associated with Seagen, we pivot to a closer look at the company's own performance.

Where Is Seagen Standing Right Now?

- With a volume of 1,305,607, the price of SGEN is up 0.88% at $220.91.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 65 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Seagen, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.