Deep-pocketed investors have adopted a bullish approach towards Nike NKE, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NKE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Nike. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 33% bearish. Among these notable options, 4 are puts, totaling $357,319, and 5 are calls, amounting to $166,781.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $108.0 to $135.0 for Nike over the last 3 months.

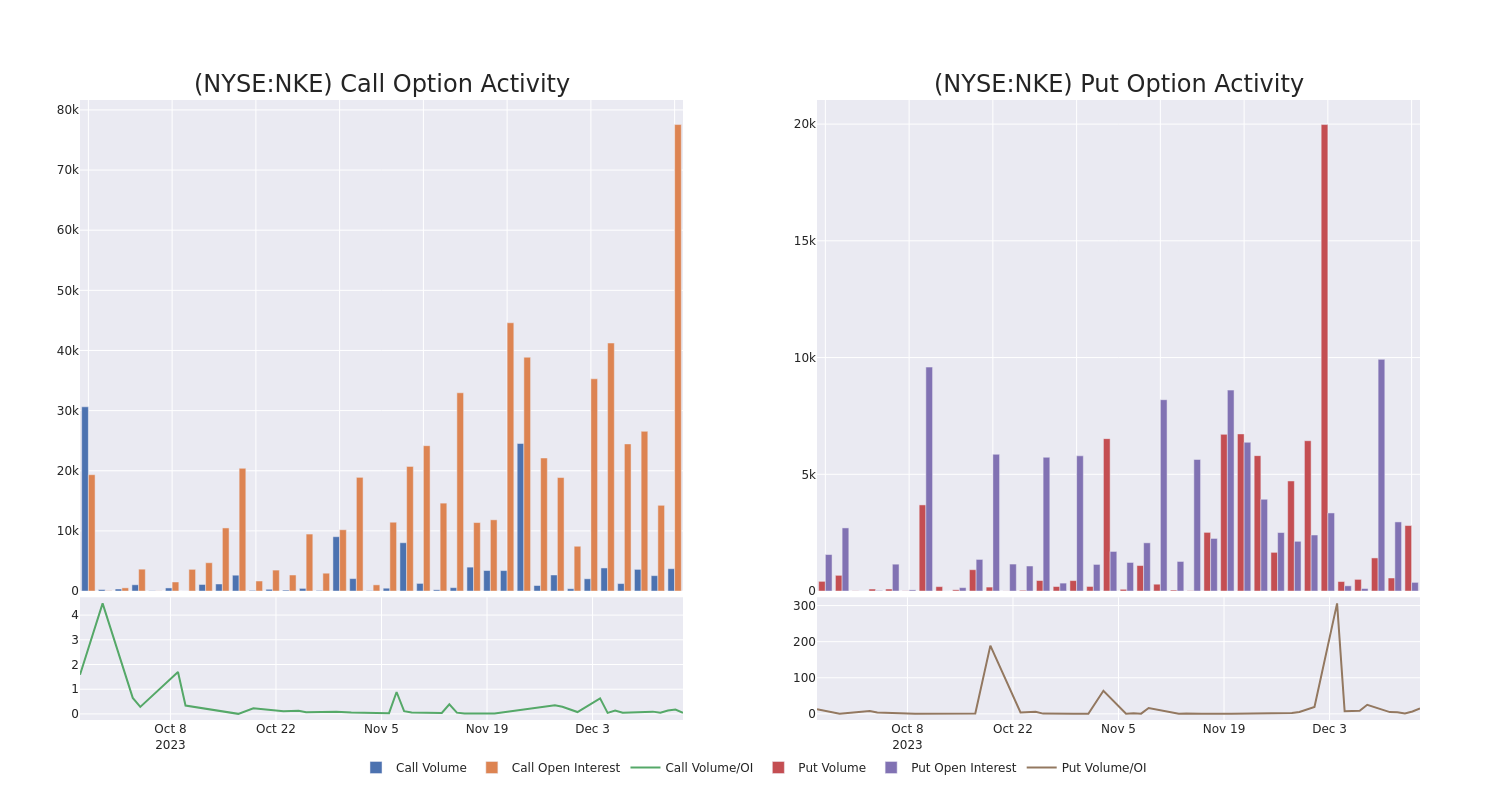

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Nike's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Nike's significant trades, within a strike price range of $108.0 to $135.0, over the past month.

Nike Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| NKE | PUT | SWEEP | BULLISH | 03/15/24 | $125.00 | $250.8K | 308 | 380 |

| NKE | CALL | SWEEP | BULLISH | 01/19/24 | $108.00 | $50.2K | 1 | 32 |

| NKE | PUT | SWEEP | BEARISH | 02/16/24 | $130.00 | $39.9K | 0 | 61 |

| NKE | PUT | TRADE | BULLISH | 12/29/23 | $122.00 | $34.5K | 463 | 152 |

| NKE | PUT | TRADE | BEARISH | 12/22/23 | $122.00 | $32.0K | 542 | 101 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan, and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Present Market Standing of Nike

- Currently trading with a volume of 1,375,435, the NKE's price is up by 1.15%, now at $122.53.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 2 days.

What The Experts Say On Nike

5 market experts have recently issued ratings for this stock, with a consensus target price of $134.8.

- An analyst from Telsey Advisory Group has decided to maintain their Outperform rating on Nike, which currently sits at a price target of $140.

- Reflecting concerns, an analyst from Goldman Sachs lowers its rating to Buy with a new price target of $139.

- Maintaining their stance, an analyst from Raymond James continues to hold a Outperform rating for Nike, targeting a price of $130.

- Showing optimism, an analyst from DZ Bank upgrades its rating to Buy with a revised price target of $130.

- Showing optimism, an analyst from Citigroup upgrades its rating to Buy with a revised price target of $135.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nike options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.